The bullish EUR/USD may have a serious move to the downside rapidly approaching as the sickly USD begins to gather its strength. The formation of a pin candle at the top of the latest rally is signalling that the market is rejecting the bull’s latest attempt to push the pair higher. When combined with other indicators, this could be heralding an end to the euro’s relatively steady gains.

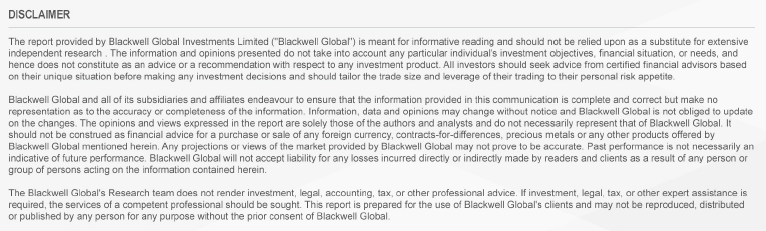

Firstly, looking at the daily chart shows the formation of a bearish pin candle at the end of the recent rally. After being steamrolled last week, the bears finally fought back and smashed the Euro lower which showed up on the chart as a bearish pin candle. Consequently, the probability of a strong reversal to the downside of the channel is increasing significantly. Moreover, the pair has already begun the journey lower and could accelerate its descent later in the session when liquidity is less scant.

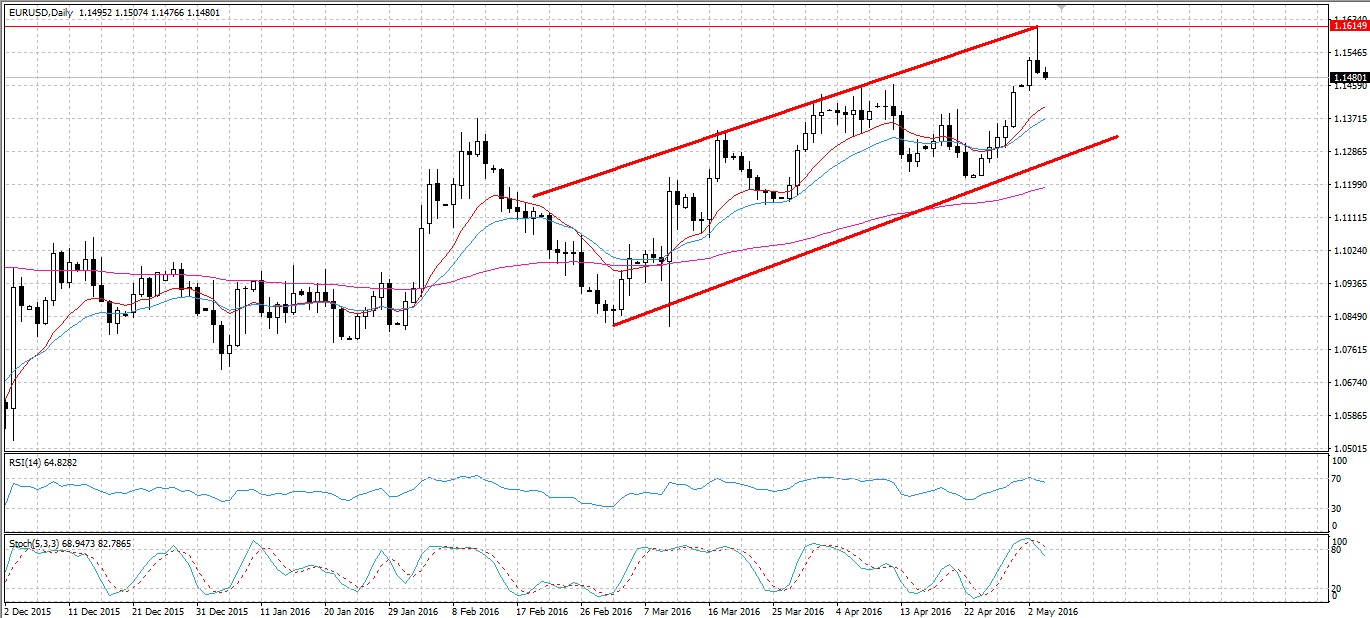

Furthermore, the attempt to close the pair above 1.1614 represents another failure to overcome the robust zone of resistance found here. Additionally, when this level was last tested there was a significant slip for the pair which resulted in the EUR plunging to 1.1172 before support was found. Consequently, many bulls will be nervously watching the euro after their most recent attempt at breaking the 1.1614 level.

What’s more, much of the market began to fear the eventual bearish reversal even before the recent euro rally took off. Specifically, the CFTC commitment of traders report showed a net short position for the EUR prevailing in its latest release. Now that buyers have ostensibly run out of momentum, it might be worth bracing for what could be a rough return to support.

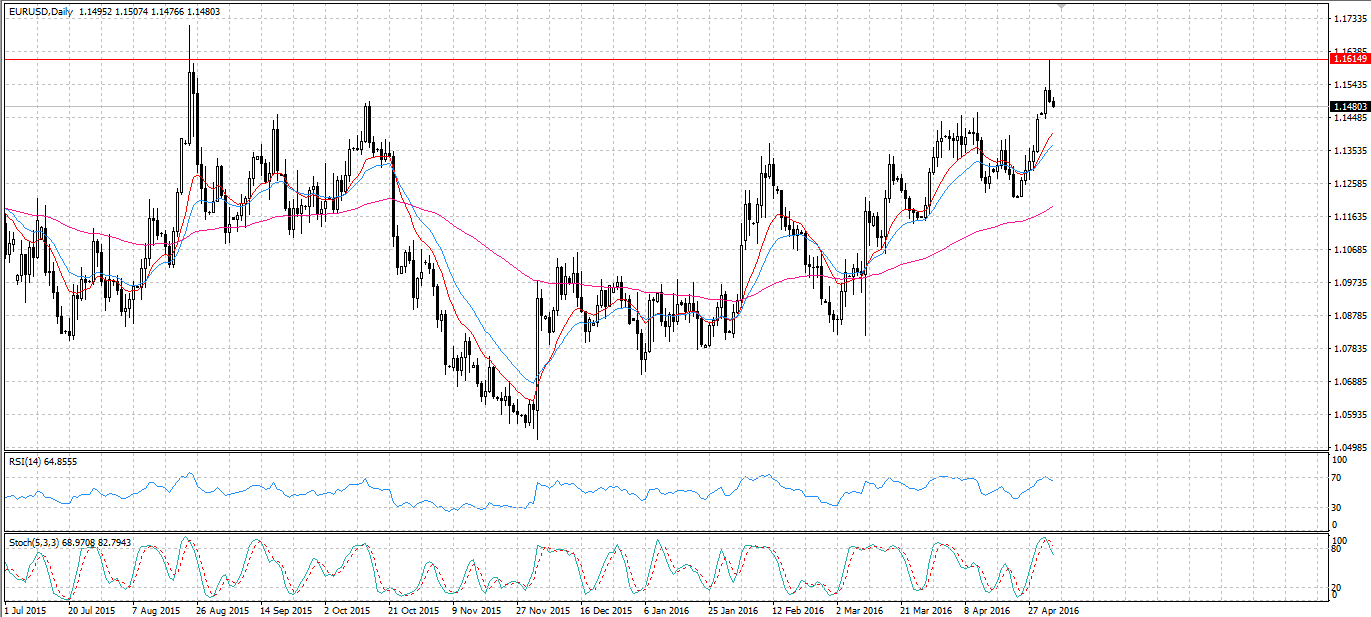

Additionally, the hourly EMA’s and the daily RSI are signalling that the EUR/USD is ready to drop. Specifically, the 12 and 20 period EMA’s have crossed over whilst the 100 hour Moving Average is levelling out. If the two shorter EMA’s cross the 100 hour EMA the tumble could begin in earnest. Furthermore, both the daily RSI and stochastic oscillators are signalling that the pair is overbought which will be causing selling pressure to mount significantly.

Ultimately, if the EU continues to post decent indicator results such as the recent 0.3% m/m PPI figure, the EUR could remain buoyant. However, with a bevy of US results due in the coming week, the greenback may continue to make back recent losses and see the EUR/USD collapse once again. As a result, the second half of this week might have some significant movement instore for the euro should the US actually manage to scrape together some solid results.