The trading world is supposed to be black and white. No gray areas. Your trade either triggers or it doesn’t. It either continues or you get stopped out. You never stretch for an entry. But that is not the case in the world of exercise. One company has made a very big name for itself making tight-fitting, stretchy clothes. Lululemon Athletica (NASDAQ:LULU) -- maker of those athletic pants every woman seems to wear -- has become a household name. And its stock looks good, possibly ready for a trade. Just don’t stretch to enter it.

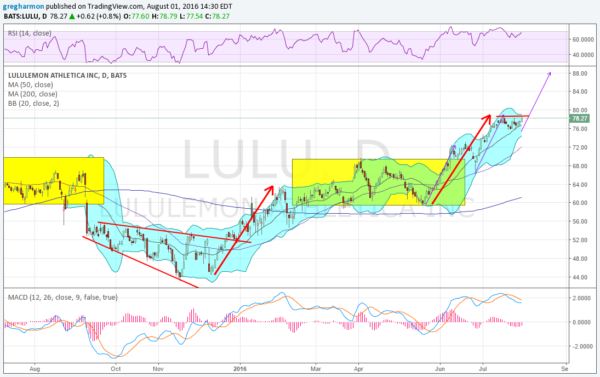

The chart below shows LULU's price history over the past year. After falling from a consolidation box in September, it built an expanding wedge during the next 4 months as it worked through a rounded bottom. The price sprung higher out of the wedge at the end of December -- right back to that prior consolidation box. It stayed there for another 4 months before the move that started in May broke the box to the upside. That gave a target of about 79, where it sits now.

Going forward, the stock is consolidating under resistance, with Bollinger Bands® that are squeezing in -- often a precursor to a big move. The momentum indicators are bullish. The RSI is in the bullish zone and rising. The MACD is leveling after a pullback, holding in positive territory. A look at the leg moving higher shows it was actually two steps of equal length with a slight pullback and consolidation in between before rising again. This is the first 2 legs of 3 Drives pattern. The third leg gives an upside target to 88. This triggers on a break above resistance. Wait until then. Don’t stretch for it.