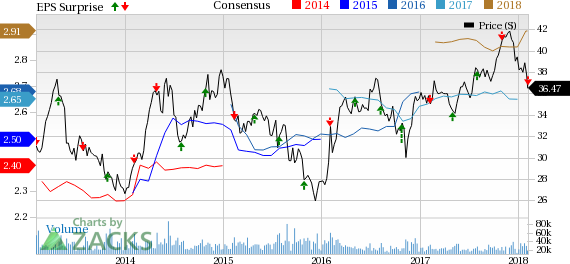

Exelon Corporation’s (NYSE:EXC) fourth-quarter 2017 operating earnings of 55 cents per share lagged the Zacks Consensus Estimate of 62 cents by 11.3%. However, quarterly earnings were 25% higher than the year-ago figure of 44 cents.

On a GAAP basis, quarterly earnings were $1.94 per share compared with 22 cents in the year-ago quarter. The difference between GAAP and Operating earnings in the reported quarter was due to some one-time gains and losses.

Total Revenues

Exelon's operating revenues of $8,381 million surpassed the Zacks Consensus Estimate of $7,596 million by 10.3%.

Quarterly revenues also improved 6.4% from $7,895 million reported in the year-ago quarter.

Quarterly Highlights

Exelon's total operating expenses increased 3.7% year over year to $7,336 million. The rise was primarily due to higher purchasing power and fuel expenses, and operating and maintenance expenses.

Interest expenses were $365 million compared with $356 million in the year-ago quarter.

Hedges

Exelon's hedging program involves hedging of commodity risks for expected generation, typically on a ratable basis, over a three-year period. The proportion of expected generation hedged as of Dec 31, 2017, was 85-88% for 2018, 55-58% for 2019, and 26-29% for 2020.

Guidance

Exelon provided 2018 earnings guidance per share in the range of $2.90-$3.20. The guidance takes into consideration the benefits of U.S. tax reform and strong utility growth among others.

The company plans to invest a total of $21 billion to strengthen its existing infrastructure in the next few years. The capital expenditure and tax reforms are expected to drive annual rate base growth of 7.4% through 2021, exceeding growth expectations of 6.5% for 2017-2020 projected a year ago.

Zacks Rank

Exelon has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

American Electric Power Co., Inc. (NYSE:AEP) reported fourth-quarter 2017 operating earnings per share of 85 cents, beating the Zacks Consensus Estimate of 81 cents by 4.9%.

NextEra Energy, Inc. (NYSE:NEE) reported fourth-quarter 2017 adjusted earnings of $1.25 per share, lagging the Zacks Consensus Estimate of $1.31 by 4.6%.

Dominion Energy Inc. (NYSE:D) reported fourth-quarter 2017 operating earnings of 91 cents per share, beating the Zacks Consensus Estimate of 88 cents by 3.4%.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

American Electric Power Company, Inc. (AEP): Free Stock Analysis Report

Exelon Corporation (EXC): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

Original post