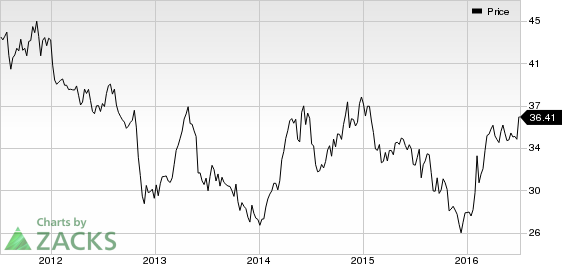

Shares of Exelon Corporation (NYSE:EXC) rallied to a new 52-week high of $36.46 during Friday’s trading session, before closing a tad lower at $36.41. Chicago, IL-based Exelon, together with its subsidiaries, is engaged in the production, purchase, transmission, distribution and sale of electricity as well as distribution and sale of natural gas. The stock has delivered a one-year return of about 19.3%.

Over the past 52 weeks, Exelon Corporation’s shares have ranged from a low of $25.09 on Dec 14, 2015 to a high of $36.46 on Jul 1, 2016. The average volume of shares traded over the last three months is approximately 5.2 million.

What’s Driving the Stock?

Systematic investments in distribution automation or digital smart switches increased the reliability of Exelon’s services. The company is also planning to implement a long-term cost-reduction strategy worth $350 million to improve its financial flexibility. Notably, Exelon has beaten estimates in three out of the last four quarters, averaging a positive surprise of 8.27%.

EXELON CORP Price

We remind investors that Exelon invests substantially to strengthen its infrastructure projects. Post the completion of its Pepco Holdings acquisition, the company raised its capital investment plans to $23 billion from $18.9 billion for the 2016–2018 time frame. Backed by its long-term investments plans, the company expects earnings to grow 7% to 9% annually over the same period.

In addition, the Pepco Holdings buyout is expected to boost cash flow by $700 million to $850 million in the 2017–2019 time period, besides providing various socio-economic advantages and benefits to customers.

Meanwhile, Exelon’s ongoing investments in renewables and natural gas construction indicate its diversification initiatives. Its unit, Exelon Generation has recently purchased the 198 megawatt (MW) Bluestem wind farm in Beaver County, OK from Renewable Energy Systems (RES). The project is slated to be completed by 2016 end. Moreover, in 2016, Exelon intends to install 350MW of contracted renewable projects including the Michigan Wind 3 and the Bluestem Wind projects. These initiatives will reduce its dependence on nuclear plants, going forward.

Zacks Rank & Key Picks

Exelon Corporation currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the same space include Black Hills Corporation (NYSE:BKH) , Korea Electric Power Corporation (NYSE:KEP) and Spark Energy, Inc. (NASDAQ:SPKE) , each sporting a Zacks Rank #1 (Strong Buy).

EXELON CORP (EXC): Free Stock Analysis Report

KOREA ELEC PWR (KEP): Free Stock Analysis Report

BLACK HILLS COR (BKH): Free Stock Analysis Report

SPARK ENERGY (SPKE): Free Stock Analysis Report

Original post

Zacks Investment Research