EXCO Resources, Inc.(EXCO) is an independent oil and natural gas company engaged in the exploration, exploitation, development and production of onshore North American oil and natural gas properties.

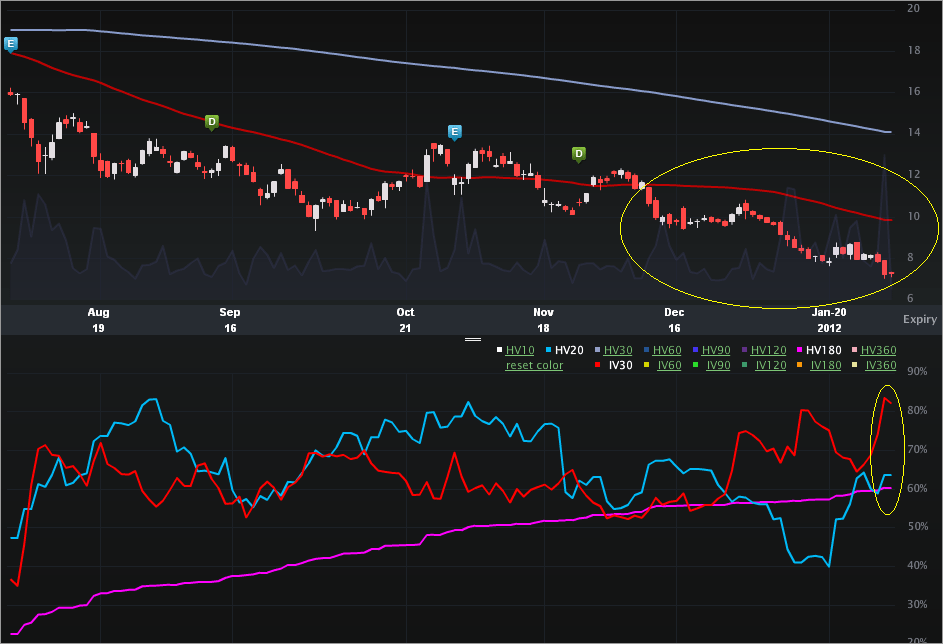

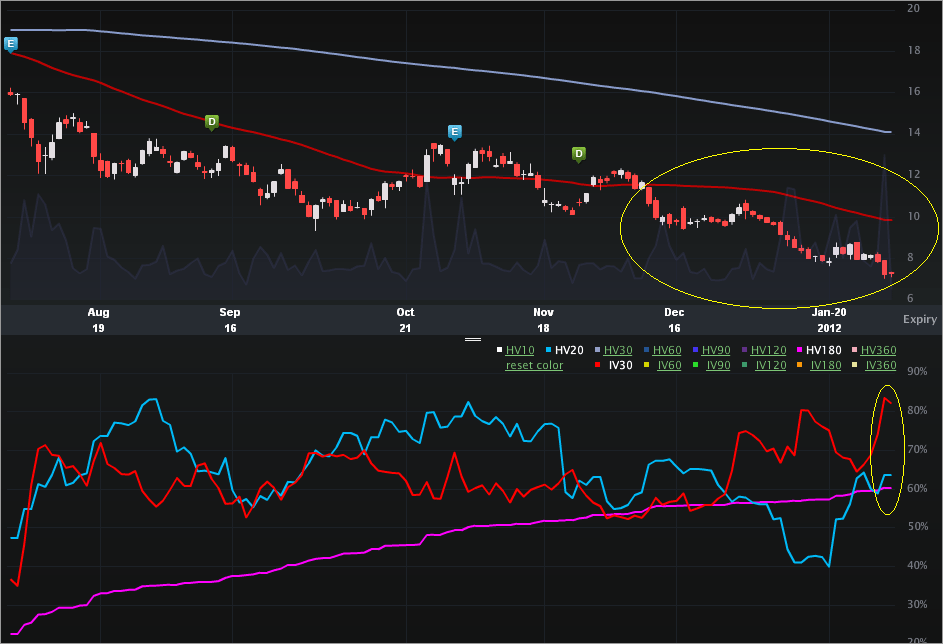

I found XCO because of its elevated vol. In fact, as of early trading, the IV30™ had breached a new annual high. Let’s look to the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

Starting with the stock portion, we can see how the underlying has been dipping for the last six months. On 8-2-2012 the stock closed at $15.94. As of this writing, that’s a 54.2% drop. In the vol portion we can see that the implied has been rising to new highs, then dropping a touch only to make another new high in the near future. The 52 wk range in IV30™ is [17.70%, 83.60%], putting the current level in the 95th percentile (and over the annual high intra-day).

I actually wrote about XCO in late Dec of last year when the stock was trading $10.56, noting the elevated vol at the time (IV30™ was 72.16%). Obviously, the stock is a lot lower and vol is higher in a month’s time. You can read that post here:

EXCO Resources (XCO) - Elevated Implied, Elevated Historical, More Insider Buying Than... Everyone

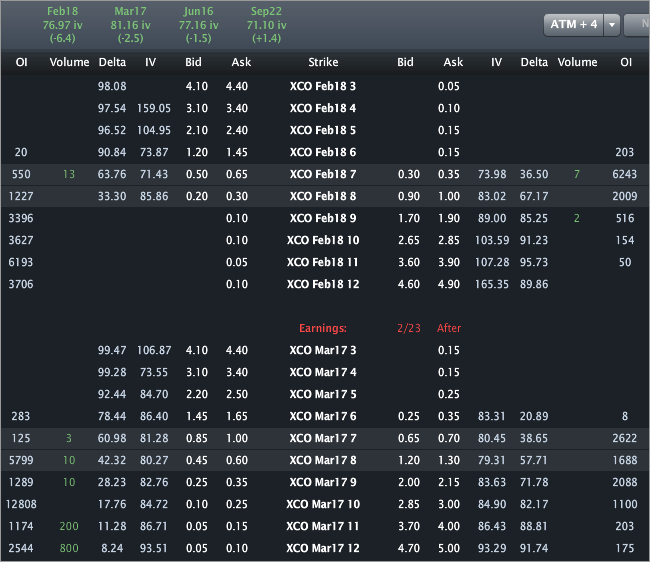

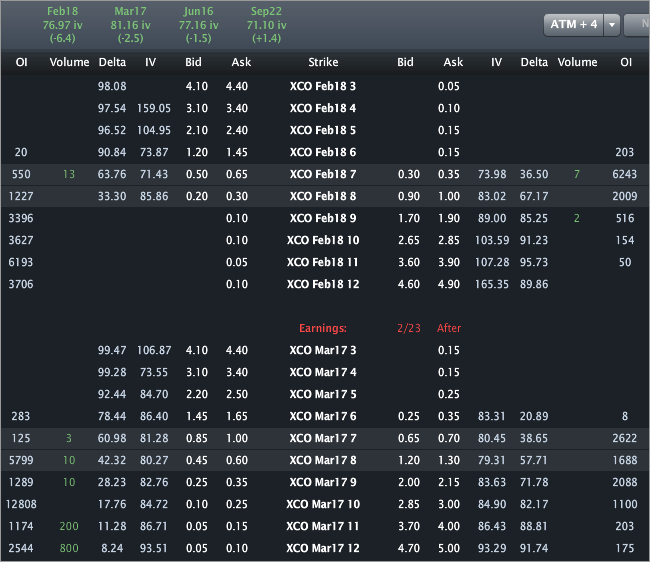

Let’s turn to the Options Tab before the Skew Tab for some month to month comps.

Two things to note here:

1. The next earnings release for XCO is due out on 2-23-2012 per Livevol® Pro (and the company’s investor relations website). That means the Mar options have a vol event that the Feb expiry does not.

2. Mar vol is priced above Feb – which makes sense given #1 above.

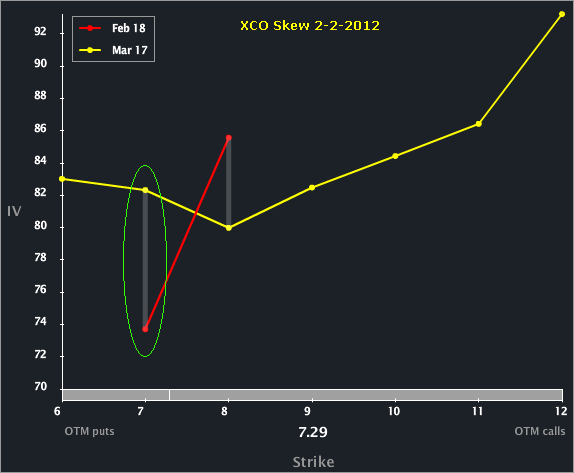

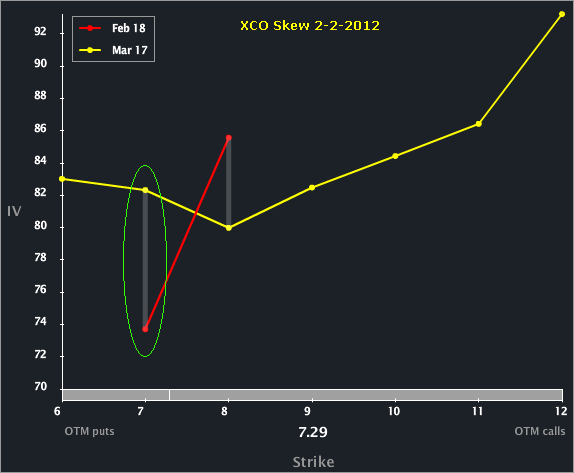

So far, nothing weird – until the Skew Tab, below.

I wrote about this one for TheStreet (OptionsProfits), so no specific trade analysis here. I will say that both Feb and Mar exhibit an upside skew – that is, the OTM calls increase in vol by line moving further OTM. But, Mar also exhibits a rising downside skew – a normal phenomenon. Feb, however, does not.

For a stock nearing an annual high in implied vols and down more than 50% in six months with no real sign of letting up, that depressed vol in the Feb 7 puts (relative to the Feb 8 calls) is pretty weird. Doing a little more analysis:

The Feb 7 puts are priced to almost 13 vol points lower than the Feb 8 calls. But, if the Feb 7 puts were priced to the same vol as the Feb 8 calls (like Mar is set up) – say 86 vol – those Feb 7 puts would be worth $0.08 more. Further, it wouldn’t be unusual to see "sticky" prices in the Feb puts given how close expiry is -- and therefore a vol above 90%. That would push the Feb 7 puts up by ~$0.10. Of course, that's not the case... Oddly, though the options reflect elevated risk in general, the downside in Feb doesn't reflect the same risk as the upside.

This is trade analysis, not a recommendation.

I found XCO because of its elevated vol. In fact, as of early trading, the IV30™ had breached a new annual high. Let’s look to the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

Starting with the stock portion, we can see how the underlying has been dipping for the last six months. On 8-2-2012 the stock closed at $15.94. As of this writing, that’s a 54.2% drop. In the vol portion we can see that the implied has been rising to new highs, then dropping a touch only to make another new high in the near future. The 52 wk range in IV30™ is [17.70%, 83.60%], putting the current level in the 95th percentile (and over the annual high intra-day).

I actually wrote about XCO in late Dec of last year when the stock was trading $10.56, noting the elevated vol at the time (IV30™ was 72.16%). Obviously, the stock is a lot lower and vol is higher in a month’s time. You can read that post here:

EXCO Resources (XCO) - Elevated Implied, Elevated Historical, More Insider Buying Than... Everyone

Let’s turn to the Options Tab before the Skew Tab for some month to month comps.

Two things to note here:

1. The next earnings release for XCO is due out on 2-23-2012 per Livevol® Pro (and the company’s investor relations website). That means the Mar options have a vol event that the Feb expiry does not.

2. Mar vol is priced above Feb – which makes sense given #1 above.

So far, nothing weird – until the Skew Tab, below.

I wrote about this one for TheStreet (OptionsProfits), so no specific trade analysis here. I will say that both Feb and Mar exhibit an upside skew – that is, the OTM calls increase in vol by line moving further OTM. But, Mar also exhibits a rising downside skew – a normal phenomenon. Feb, however, does not.

For a stock nearing an annual high in implied vols and down more than 50% in six months with no real sign of letting up, that depressed vol in the Feb 7 puts (relative to the Feb 8 calls) is pretty weird. Doing a little more analysis:

The Feb 7 puts are priced to almost 13 vol points lower than the Feb 8 calls. But, if the Feb 7 puts were priced to the same vol as the Feb 8 calls (like Mar is set up) – say 86 vol – those Feb 7 puts would be worth $0.08 more. Further, it wouldn’t be unusual to see "sticky" prices in the Feb puts given how close expiry is -- and therefore a vol above 90%. That would push the Feb 7 puts up by ~$0.10. Of course, that's not the case... Oddly, though the options reflect elevated risk in general, the downside in Feb doesn't reflect the same risk as the upside.

This is trade analysis, not a recommendation.