This month, WidomTree launched a new South-Korea focused ETF, the WisdomTree Korea Hedged Equity Fund (DXKW). This goes head-to-head against a well-entrenched competitor, the iShares MSCI South Korea ETF (EWY), which trades about 2.5 million shares per day and has assets of about $4.4 billion.

It also brings up two questions: For one, does WisdomTree’s new offering stack up against the competition? But more broadly, should you invest in South Korea stocks at all?

Buying South Korea

As I wrote last month, South Korea is a little hard to define. Although it tends to get a high weighting in emerging-market funds and ETFs, it’s not an “emerging market.” Its GDP per capita, at around $32,000 by IMF estimates, is slightly above the European Union average and is higher than Spain and Italy. As a point of reference, it’s also more than double the level of rising emerging markets such as Mexico and Turkey and nearly triple that of Brazil.

With living standards comparable to Western Europe, South Korea should be considered a developed market, and fund managers are belatedly starting to accept this. The EG Shares Beyond BRICs ETF (BBRC) — a new entrant in the emerging-market space, specifically excludes South Korea — as well as Taiwan and the four “BRIC” economies of Brazil, Russia, India and China.

South Korea stocks include several world-class multinationals — among them Samsung (SSNLF), Posco (PKX), and Hyundai Motor Company (HYMTF) — and its students rank higher than most of their developed-world peers.

Demographically, South Korea will eventually hit a brick wall. Its fertility rate, at 1.24 children per mother, is even lower than that of China and Japan — but that is a long-term problem that won’t be an issue for another couple decades.

So, yes, you should buy South Korea stocks … at least at the right price. And hey, by Financial Times estimates, the country is reasonably priced at about 15 times trailing earnings.

With all of that as an introduction …

Which ETF Is Best for South Korea Stocks?

Based on fees and trading expenses, it’s close to a wash. EWP and DXKW have expense ratios of 0.61% and 0.58%, respectively. EWP has a much larger trading volume — 2.5 million shares per day vs. 4,900 — but DXKW is still a new fund, and its trading volume might be comparable given time.

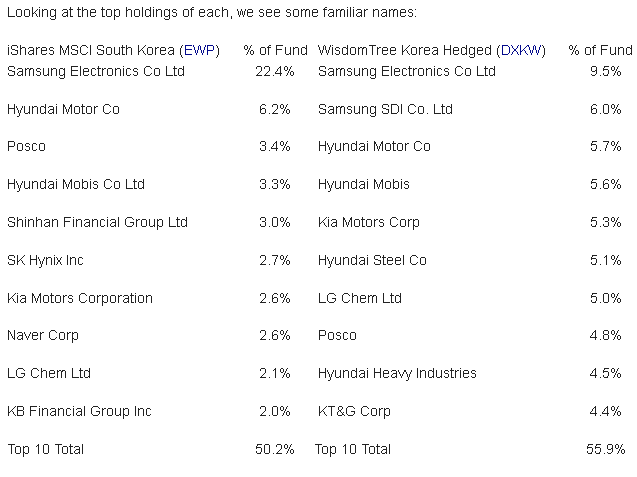

Although both ETFs essentially hold the same names, DXKW is better diversified. For example, both funds are very heavily weighted toward Samsung Electronics (SSNLF), but the overweighting is more pronounced in EWY, where fully 22% of the ETF is invested in Samsung Electronics. DXKW has 9.5% invested in Samsung Electronics and another 6% invested in Samsung SDI, a related company that makes lithium batteries.

And finally, there is currency exposure. EWY is not hedged against movements in the value of the South Korean won, whereas DXKW is. In fact, that is the ETF’s entire reason for existing. Per the fund literature:

“The WisdomTree Korea Hedged Equity Fund can offer you a way to capitalize on the growth potential of South Korea’s exporters while hedging exposure to the Korean won.”

Of course, this hedging comes at a cost. If the value of the won rises relative to the dollar, you will not profit from this upside.

The won has added volatility to the Korean market for U.S. and other foreign investors. The currency lost 54% of its value during the Asian financial crisis of 1998, and it lost 41% during the 2008 global crisis. By WisdomTree’s calculations, currency movements increased volatility by 8.1% per year over the past decade while only adding 0.8% to returns.

So, unless you’re particularly bearish on the dollar (or bullish on the won), there is a case to be made for hedging.

Bottom Line

Assuming its trading volume improves, I’m giving the nod to DXKW. At its current trading volume, I can’t recommend it in good faith. It’s just too thinly traded. But once it reaches an acceptable volume of 50,000 to 100,000 shares per day, I would recommend that it be your default option for South Korea stocks. It’s better diversified and offers a measure of protection against currency plunges.

Disclosure: Charles Lewis Sizemore, CFA, is the chief investment officer of the investment firm Sizemore Capital Management. As of this writing, he did not hold a position in any of the aforementioned securities. Click here to receive his FREE 8-part investing series that will not only show you which sectors will soar, but also which stocks will deliver the highest returns. This series starts Nov. 5 and includes a FREE copy of his 2014 Macro Trend Profit Report.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EWY Vs. DXKW: Which Is The Best South Korean ETF?

Published 11/12/2013, 12:42 AM

Updated 07/09/2023, 06:31 AM

EWY Vs. DXKW: Which Is The Best South Korean ETF?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.