Evotec has raised €30m in new equity to accelerate its CureX/TargetX strategy, which is focused on discovery alliances with academia. The additional capital will allow Evotec to build more alliances more rapidly, thereby enhancing its long-term growth prospects. There are now three CureX and two TargetX initiatives, one of which (CureBeta) has already resulted in a major alliance with Janssen. We expect further collaborations and/or deals in H213. Our valuation increases from €451m to €480m.

€30m raised from Biotechnology Value Fund...

BVF is now a major strategic shareholder in Evotec (9.1%) following its €30m investment in 11.8m new shares at €2.55/share. With this transaction BVF becomes the third largest institutional shareholder behind TVM Capital (9.4%) and ROI/Oetker (c 14%). BVF also has an option to buy an additional 11.8m shares from TVM at €4.00/share within the next 30 months; full exercise of this option would result in Evotec having a cornerstone investor holding c 18% of the shares.

…to accelerate CureX and TargetX strategy

While Evotec was already well capitalised (liquid funds of €56.1m at end-Q213), the extra funds provide it with the flexibility to invest in more CureX/TargetX research collaborations with academia. Evotec is targeting eight alliances by end-2013 and, encouragingly, has just announced its fifth deal (CureMotorNeuron). The CureMN partnership (the fourth with Harvard) aims to identify novel therapies to treat amyotrophic lateral sclerosis (ALS). We anticipate further collaborations in Q413.

Enhancing growth prospects

We view the CureX/TargetX initiatives as a key component of Evotec’s long-term growth prospects. Their potential has been indicated by the CureBeta (diabetes) alliance with Harvard, which resulted in a major alliance with Janssen. Evotec received €8m upfront and is eligible for milestones of €200-250m per product plus royalties. Further partnering deals (eg CureNephron) are possible in H213.

Valuation: Revised DCF valuation of €480m

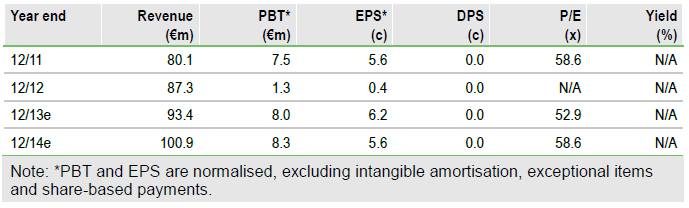

The increase in our valuation by €29m to €480m reflects the greater long-term growth prospects associated with the fund-raising and planned CureX/TargetX expansion. Our FY13 forecasts are materially unchanged. For FY14, we have increased R&D and SG&A expenditure to reflect additional spending on new projects; we now expect operating profit (pre-goodwill and exceptionals) to remain close to flat year-on-year at €9.1m.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Evotec Fast Forward

Fast forward with fresh funds

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.