The US Federal Reserve, widely known as simply ‘the Fed,’ is conducting a comprehensive review of its monetary policy framework. First announced in November 2018, the review intends to engage US Fed officials and other stakeholders in a discussion about monetary policy strategy, tools, and communication practices. While the review is expected to be wide-ranging, the scope is limited by the Fed’s statutory mandate of maximum employment and price stability. Importantly, a long-term inflation objective of 2.0% is stated as a given, ruling out any discussions about changes in the inflation target level.

The format of the Fed’s framework review involves a series of town-hall-style meetings in “Fed Listens” events around the US. This includes the conference hosted by the Chicago Fed on June 4-5, when Fed officials met with top experts and community leaders to openly discuss monetary policy issues. The review is expected to be finalized in one year with the publication of a report in the first half of 2020. Potential changes are of paramount importance and the bar is high for any meaningful innovation, as the existing framework is the result of decades of learning and fine-tuning.

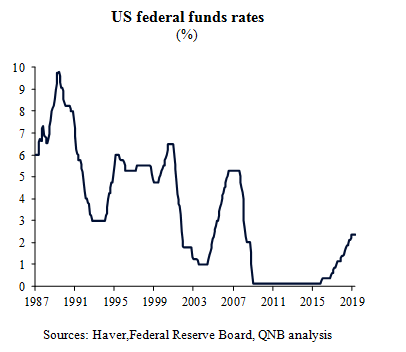

The existing framework is a “flexible inflation target” strategy in which inflation should not deviate from 2.0% and employment should hover around its maximum level, which is currently estimated to take place when unemployment is below 4.3%. The main monetary policy tool is the target range of the federal funds rate. Under this framework, the inflation target is forward-looking and the key objective is to anchor inflation expectations. The Fed responds to significant deviations in inflation or employment with changes in policy rates. Periods of deflation, lower growth or higher unemployment call for rate cuts while periods of expansion and high inflation call for rate hikes. Despite the success of such a set up during the decades preceding the Lehman Brothers collapse in 2008, three motivations are currently underpinning the ongoing review of the US monetary policy framework.

First, secular or long-run structural changes (aging population, more risk averse behaviour, and slower productivity growth) are creating a capital glut that pushes neutral interest rates down. This threatens the effectiveness of the current monetary policy framework, raising concerns about the possibility of a deflationary trap, i.e., a feedback loop of persistently low interest rates, limited monetary policy space, deeper and longer recessions, and persistently low inflation. In fact, a lower neutral interest rate reduces the room for rate cuts in future recessions. Given that nominal rates cannot move much below the zero lower bound (ZLB), lower interest rates cap “policy ammunition,” constraining the Fed’s ability to counter a future downturn. While monetary authorities have historically resorted to rate cuts of around 500 basis points (bps) during US recessions, the current “ammunition” stands at around 225 bps.

US federal funds rates (%)

Sources: Haver,Federal Reserve Board, QNB analysis

Second, the need to formally review and evaluate the use of unconventional monetary policy tools, especially the extraordinary ones deployed in response to the Global Financial Crisis and the Great Recession. This includes both quantitative easing (QE or large-scale asset purchases) and forward guidance (central bank communication about the likely future path of policy rates). As US monetary policy started to “normalize” after 2015, the roles of unconventional tools in future policymaking became more uncertain.

Third, the timing is favourable for a comprehensive review, as the Fed is close to delivering the two objectives of maximum employment and price stability, despite the recent bout of risk-off sentiment as US trade disputes with key partners intensify. Different measures of unemployment are close to multi-decade lows, while inflation and inflation expectations are now close to the 2.0% mark. This creates the ideal backdrop for an open discussion about the monetary policy framework.

It is still too early to grasp the likely conclusion of the Fed’s framework review. However, current debates and the commentary of Fed officials suggest that the review will produce “evolution rather than revolution” in US monetary policymaking. In terms of strategy, the most likely scenario will be the substitution of the “flexible inflation target” to a “makeup approach.” The main difference between the two strategies is whether the past will be an indicator for the future or not. The “flexible inflation target” is forward looking and therefore does not consider the past as a reference for the future, i.e., bygones are bygones. The “makeup approach” does consider the past as a reference for the future and therefore requires past deviations from the target to be compensated in the future, i.e., a period of lower inflation requires another period of higher inflation and vice versa. In other words, the “makeup approach” requires the inflation target to be achieved over a multiyear period. Additionally, the review will likely consolidate unconventional measures, such asQE and forward guidance, into the Fed’s permanent toolkit.

All in all, the Fed’s framework review is a positive development. Should a form of “makeup approach” be adopted, inflation will likely be required to run above target for some time during economic expansions, preventing early rate hikes. Further down the cycle, however, a higher policy rate would be needed to stabilize prices back towards the 2.0% target. This would be combined with a broader permanent toolkit to increase monetary policy space and thus provide a more adequate buffer against negative shocks or deeper downturns.