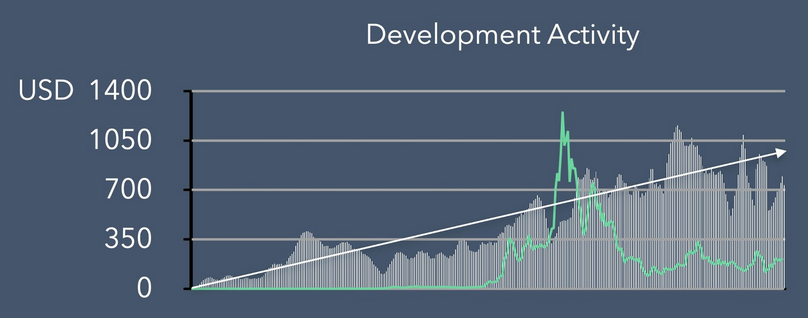

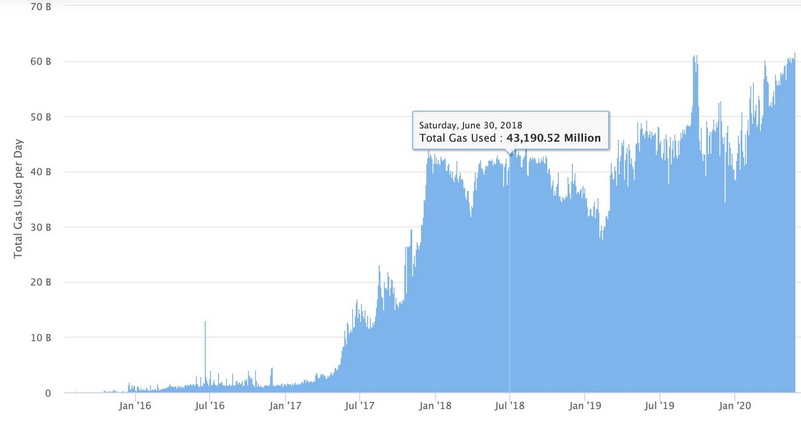

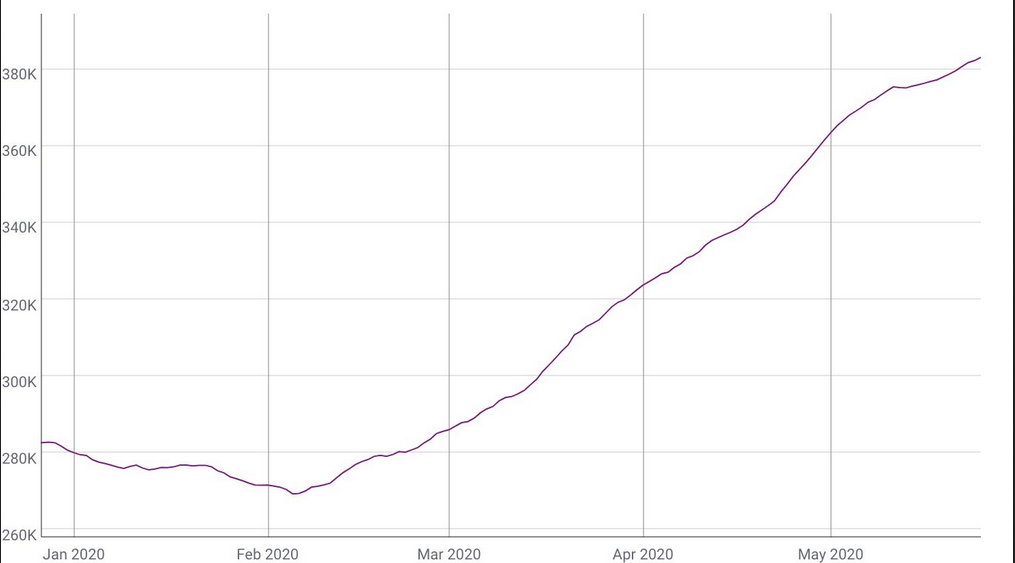

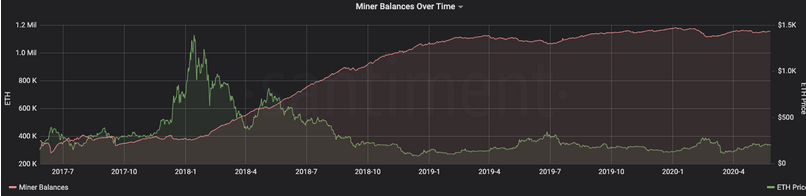

On-chain data all indicate that Ethereum is posed for a major bull run. What's holding it back? New insights from crypto analysts highlight that ETH is undervalued, indicating the crypto asset is primed for significant price appreciation soon. As the native asset of the Ethereum blockchain, ETH stands to gain the most from an escalation of on-chain activity. Several data points, when put together, make a clear-cut case for ETH’s low valuation. Blockfyre, a cryptocurrency research firm, notes that Ethereum has seen active development since the network’s inception in 2014. Ethereum’s edge over rivals is its thriving developer community. Other networks that boast greater scalability and other technical advantages have failed to attract the same demographic. Despite criticism for tardy protocol upgrades, Ethereum developers have steadily progressed irrespective of price movements. This progress is in part thanks to coherent treasury management by the Ethereum Foundation Gas consumed over the network hit an all-time high this week, and daily consumption has continuously been more than 60 billion gas. This data indicates actual usage. Unfortunately, four out of the top six consumers of gas are confirmed Ponzi schemes. Further signaling usage is the number of active addresses on Ethereum, highlighted by Spencer Noon, founder of DTCC Capital. The 90-day moving average for addresses using Ethereum is currently near 380,000 – a threshold not seen since 2018. Ethereum’s DeFi ecosystem has likely fueled this growth in active addresses, with the number of users doubling over the last five months. Last but not least is the rise of stablecoins. During the previous three months, over $4 billion of stablecoins were issued on Ethereum alone. These assets have quickly become one of Ethereum’s moat, overpowering ETH as the primary medium of exchange in DeFi. The final barrier for Ethereum is achieving higher throughput and efficiently serving an even larger batch of users. Miners, who are an integral part of any blockchain network, have displayed their bullish outlook by hoarding coins like never before. Since Jan. 1, 2018, ETH held by miners has risen 3x from 384,000 to 1.16 million ETH. Miners’ confidence has been strengthened by the network’s ability to provide them with adequate incentives. Ethereum’s daily security budget of $426,000 (block rewards + transaction fees) is second only to Bitcoin’s $828,000. The nearest competitor is Ripple, with a meager $1,800 paid to miners daily. Institutions bear a similar aura. Grayscale’s ETH Trust has seen roughly a million dollars of inflow per day for the last three weeks. More so, the market price for a share in the trust is $105 at the time of press. With each share only representing a claim on 0.09 ETH, one ETH of exposure costs $1,170 through Grayscale while the market price for ETH is just $204 per unit. With developers, users, and investors all aligned, Ethereum is well-positioned to lead the smart contracts market for the foreseeable future.Key Takeaways

Fundamentals Shine as Network Activity Surges

Investors Are Confident in Ethereum

Institutional investors are effectively buying ETH at a 570% premium to avoid using a native crypto exchange and being held responsible for asset custody.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Everything But Ethereum’s Price Is Booming

Published 05/27/2020, 07:21 AM

Everything But Ethereum’s Price Is Booming

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.