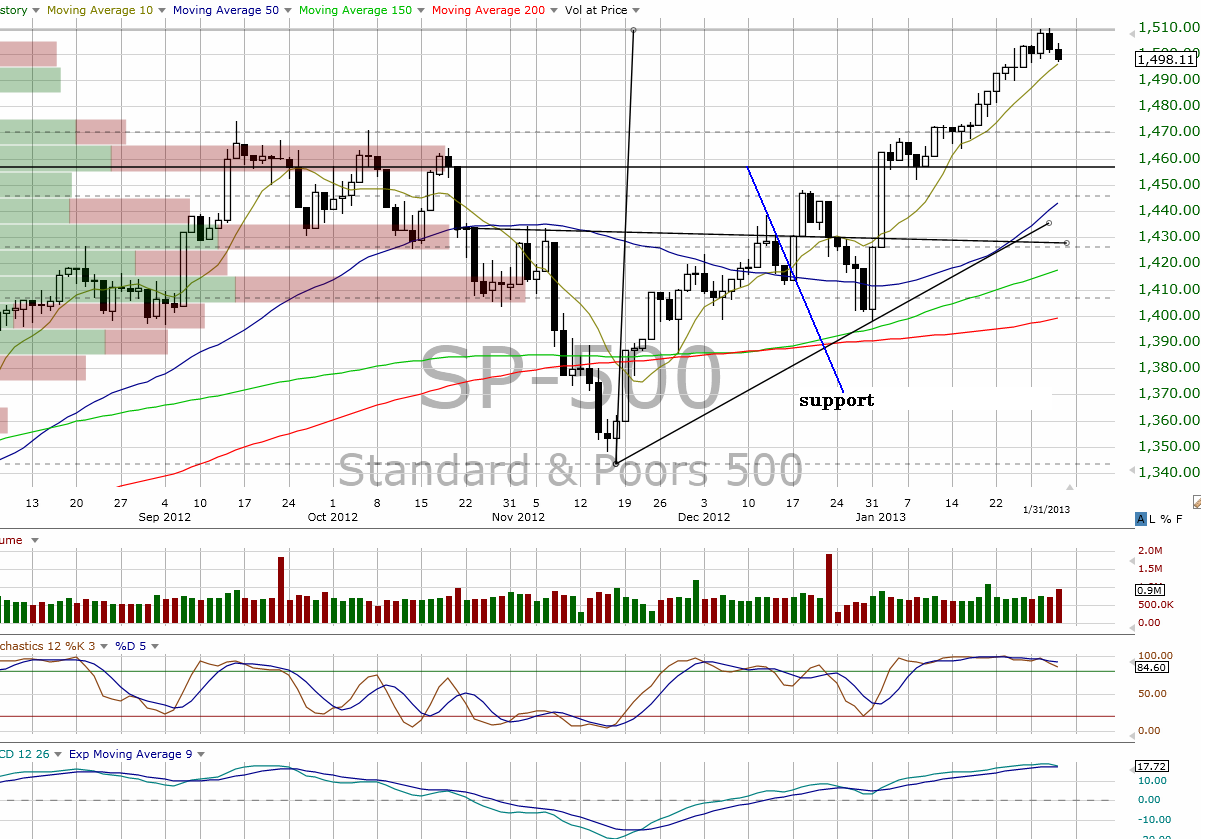

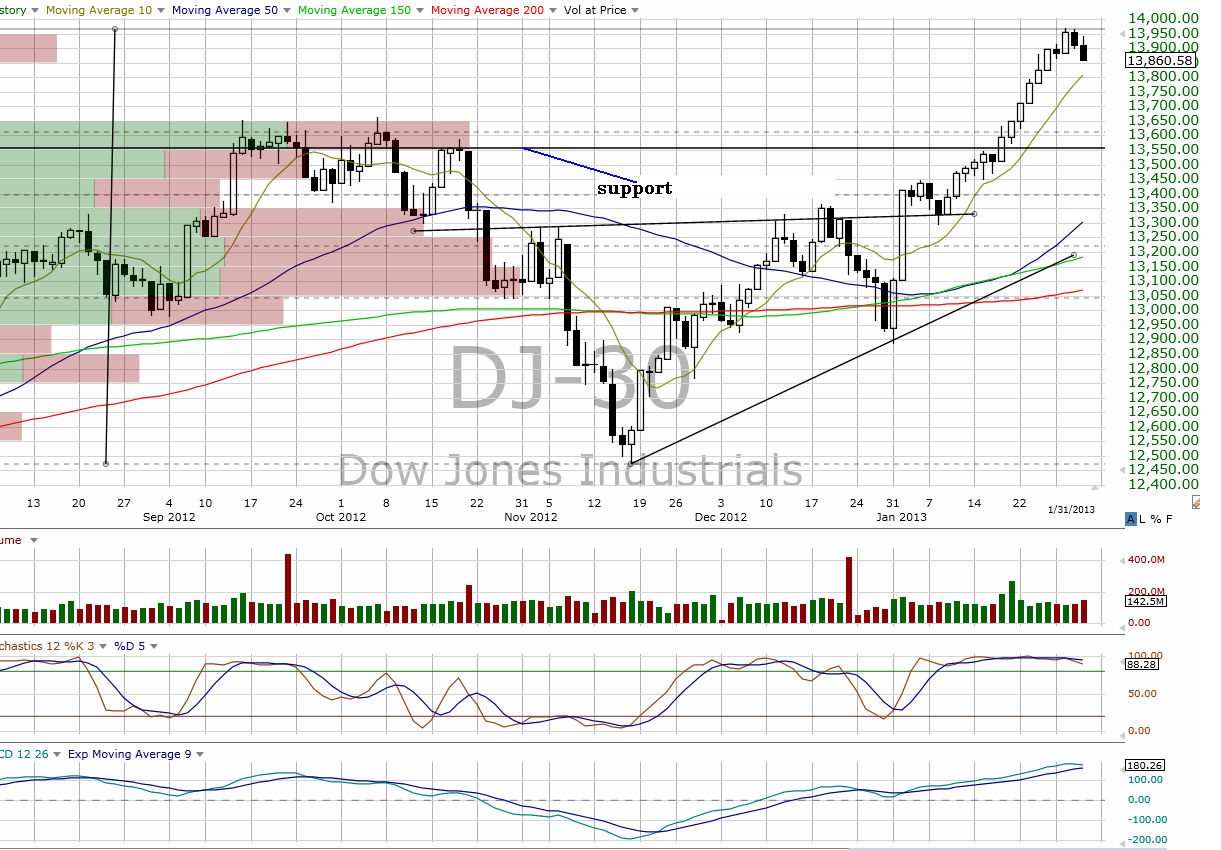

: Short term caution remains out theme based on the current state of the sentiment data while a few hairline cracks have shown up in the charts. As such, the message we are receiving is that of risk outweighing reward for the major equity indexes over the near term.

On the data side, sentiment, which tends to have a good deal of influence over the markets from a short term perspective, continues to be at extremes historically seen near short term market tops. They have been highly reliable signals in the past and, as such, we continue to view them with respect.

The “crowd” (contrary indicators) has gone over the top bullish as the recent AAII Bear/Bull Ratio shows bulls double the amount of bears at 24/48. Investors Intelligence is even more extreme at 22.3/54.3. The Rydex Ratio is 41.5 describing the leveraged ETF traders as highly bullish as well.

Meanwhile, as noted earlier this week, the Rydex Money Market levels have shrunk down to one of the lowest levels seen over the past three years as the crowd has piled into stocks. They’ve spent their money and made their bet. So the question becomes “Who will be the next buyer?”.

In very sharp contrast, the smart money either wants nothing to do with buying or is outright bearish. The Gambill Insider Buy/Sell Ratio remains at a very low 5% as of 1/30 as insiders are loathe to participate on the buy side while the professional traders are betting heavily on some forthcoming weakness with the OEX Put/Call Ratio at very bearish levels on the 1 and 15 day readings of 3.26 and 1.93 respectively. So as the title of today’s report states, everyone’s a bull except the smart money.

On the charts, there have been no formal price breaks. However, both the OTC (page3) and RUT (page 4) have just seen bearish MACD crossovers while the OTC is also on a bearish stochastic crossover below the 80 signal line. Internally, breadth continues to narrow as Net New Highs for the NYSE and OTC have both made recent lower lows. The 10 Year Treasury Yield (page 4) also saw a “doji” formation recently suggesting the recent downdraft in Treasury prices may have peaked for the near term. All in all, we will continue to let others take the risk on the long side for the short term.

For the longer term, the outlook remains bullish for equities as the IBES Valuation Model suggests equities are quite undervalued with the forward 12 month earnings yield for the SPX versus the 10 year Treasury yield standing at 7.5% versus 1.97%.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Everyone’s A Bull

Opinion

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.