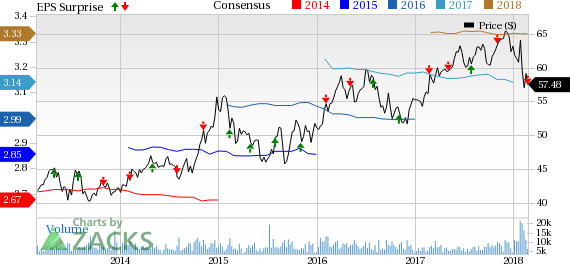

Eversource Energy (NYSE:ES) reported fourth-quarter 2017 operating earnings of 75 cents per share, missing the Zacks Consensus Estimate of 76 cents by 1.3%. Earnings improved 4.2% year over year.

Total Revenues

Eversource’s fourth-quarter revenues of $1,895.5 million surpassed the Zacks Consensus Estimate of $1,826 million by 3.8% and improved 6.7% from the year-ago figure of $1,776.6 million.

Highlights of the Release

In the reported quarter, total electric distribution improved 1.1% year over year to 12,815 gigawatt hours and natural gas distribution increased 4.7% to 31,340 million cubic feet of gas.

Operating expenses increased nearly 7.9% from the prior-year quarter to $1,444.7 million, primarily owing to higher expenses incurred for purchased power, fuel and transmission.

Operating income was up 2.9% to $450.8 million and interest expenses were in line year over year at $102.3 million.

Net income in the reported quarter was $237.4 million, up 3.6% from the year-ago quarter.

Segmental Performance

Electric Distribution and Generation: The segment’s earnings were up 27.6% to $104 million primarily due to a lower effective tax rate in 2017, and lower non-tracked operations and maintenance expenses in 2017.

Electric Transmission: This segment’s earnings declined 1.8% year over year to $102.3 million. Results in 2016 benefited from a settlement related to the recovery of $27.5 million of pre-tax merger-related costs through electric transmission rates.

Natural Gas Distribution: The segment’s earnings declined 1.2% to $102.3 million. The year-over-year decline was primarily due to higher depreciation, operation and maintenance, and property tax expense.

Eversource Parent & Other Companies: The segment earned $5.6 million, lower than the year-ago quarter’s earnings of $17.7 million.

Guidance

Eversource Energy issued 2018 guided earnings per share in the range of $3.20-$3.30. Long-term earnings growth is projected in the range of 5-7% annually through 2021, using 2017 earnings of $3.11 per share as the base.

Zacks Rank

Eversource carries a Zacks Rank #3 (Hold).

You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

WEC Energy Group (NYSE:WEC) reported fourth-quarter 2017 operating earnings of 71 cents per share, beating the Zacks Consensus Estimate of 67 cents by 5.97%.

NextEra Energy (NYSE:NEE) reported fourth-quarter 2017 adjusted earnings of $1.25 per share, missing the Zacks Consensus Estimate of $1.31 by 4.58%.

FirstEnergy Corp. (NYSE:FE) reported fourth-quarter 2017 operating earnings of 71 cents per share, beating the Zacks Consensus Estimate of 69 cents by 2.9%.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

Eversource Energy (ES): Free Stock Analysis Report

Original post

Zacks Investment Research