The European Central Bank (ECB) did not really surprise anyone with its well-telegraphed rate cuts on 6/5/2014. Yet risk assets of all shapes, sizes and geographic origins rallied a bit more than most had anticipated. The reason? Not only did the ECB slash its overnight lending rate — not only will they charge banks for depositing cash in ECB coffers (i.e. negative deposit rate) — European authorities opened the door to unconventional asset purchases in the future.

Unconventional measures. Emergency stimulus. Quantitative easing (QE). Whatever one chooses to call it, the European Central Bank (ECB) may eventually take pages from the scripts of Japan and the United States; that is, they may print money electronically and purchase market-based securities to stimulate economic activity.

Back in April, I suggested that the ECB would ultimately agree to create euro-dollars electronically for the purpose of purchasing bonds and depreciating the eurozone currency. (See here.) Many commented that Germany would never agree to such actions. Six weeks later, however, the probability of a QE-type intervention is increasing.

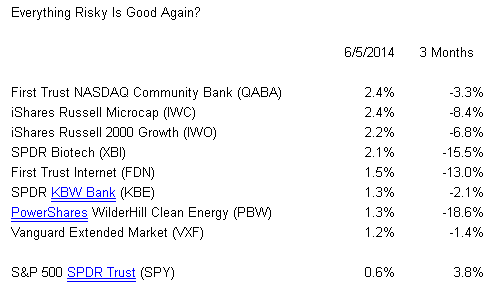

What does that mean for risk-taking in general? At least for one trading session, it meant that investors would return to the riskiest areas of all. Micro-caps, small-cap growth, banks, biotech, alt energy and the Internet. High-flying momentum shares that had lost their luster over the last three months had recaptured the public imagination. After all, money from abroad can pour into U.S. assets just as easily as it can pour into European assets or emerging market assets.

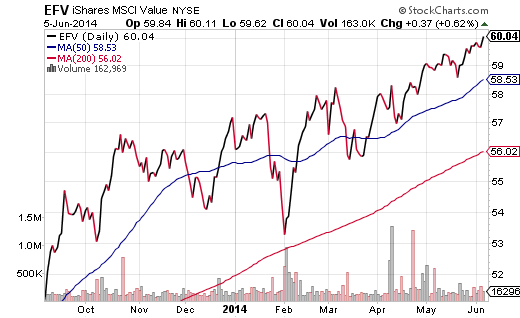

In spite of former high-flyers regaining some of their momentum from 2013, I would rather add foreign equity exposure to client portfolios here in 2014. The trailing 12-month P/E ratio for iShares MSCI EAFE Value (NYSE:EFV) hovers near 13 and for the S&P 500 SPDR Trust (ARCA:SPY) near 18. What’s more, EFV serves up an approximate yield of 3.1% versus 1.8% for SPY.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.