Dear Traders,

We welcome you to the trading month of November.

Before addressing this week's upcoming events and reports, let us briefly focus on what does the current situation look like. The Federal Reserve bolstered speculation that it may raise interest rates before the end of the year. The U.S. dollar advanced in response to the more hawkish than anticipated FOMC statement last week. The European Central Bank, however, signaled the possibility of more ECB asset purchases and will reexamine the scope of their quantitative easing plan in December. The diverging outlook weighs on the euro and prompted the EUR/USD for a test of 1.09. With the Fed appearing to be moving closer to a liftoff in monetary policy, investors speculate that the Bank of England will be the next central bank which plans to raise rates rather sooner than later. The British pound climbed toward 1.5470 as a result.

What will be important this week?

The week starts off with the release of the U.S. ISM Manufacturing Index at 15:00 GMT today. Both ISM indices, ISM Manufacturing and ISM Non-Manufacturing, due for release on Wednesday, are leading indicators for the Non-Farm Payrolls report. Traders should therefore pay close attention to these releases before the highly anticipated U.S. employment report on Friday. An upside surprise in payrolls growth could revive the dollar's strength, whereas disappointments are likely to diminish Fed rate hike speculations in December.

Thursday will be a big day for the British pound. The Bank of England is due to publish its Inflation report alongside with new forecasts and its monetary policy decision.

Moreover, market participants will listen to ECB and Fed commentary this week. ECB president Mario Draghi is scheduled to speak on Tuesday, Wednesday and Thursday, whereas Fed Chair Janet Yellen testifies on Wednesday.

Important data for today (timezone GMT):

8:55 EUR German Manufacturing PMI

9:30 UK Manufacturing PMI

15:00 USA Manufacturing PMI

It should be an interesting week for traders and we wish everyone many profits.

Let's have a brief look at the technical side:

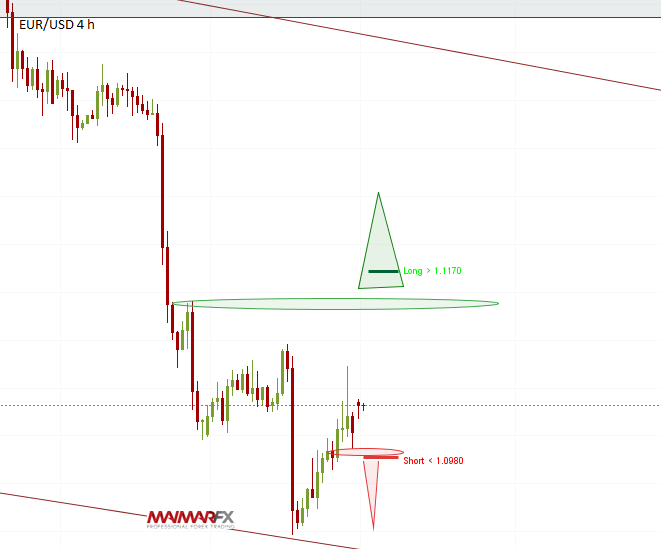

EUR/USD

The euro tended downwards but found a current support area around the 1.09-level. If the primary downtrend remains intact, we see chances that a break below 1.0980 may revive fresh bearish momentum. Lower supports are seen at 1.0880 and 1.0810. On the upper side, we see a current resistance at 1.1080/1.11. If the euro is able to break significantly above 1.11, we will focus on the 1.1150-area. A break of 1.1170 could drive the pair towards 1.13.

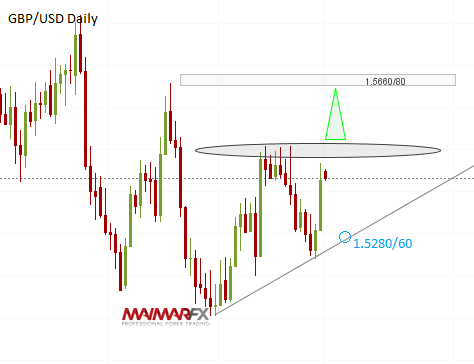

GBP/USD

Sterling advanced on BoE rate hike speculation. A key resistance still persists at 1.55. Above 1.5510, the pound could head towards 1.5660. On the bottom side, the support line could limit bearish engagements. Lower supports are seen at 1.5170 and 1.51.

Here are our daily signal alerts:

Daily Forex Signals:

EUR/USD

Long at 1.1060 SL 25 TP 20, 60

Short at 1.0985 SL 25 TP 30-40

GBP/USD

Long at 1.5470 SL 25 TP 30, 70

Short at 1.5425 SL 25 TP 40

Daily Signal- performance in pips:

October 2015: EUR/USD: +257 pips, GBP/USD: -107 pips

September 2015: EUR/USD: -79 pips, GBP/USD: +236 pips

August 2015: EUR/USD: +319 pips, GBP/USD: +61 pips

July 2015 (01.07. – 16.07.): EUR: +106 pips, GBP: -123 pips

June 2015: EUR/USD: -169 pips, GBP/USD: +134 pips

May 2015: EUR/USD: -16 pips, GBP/USD: -99 pips

April 2015: EUR/USD: +153 pips, GBP/USD: +392 pips

March 2015: EUR/USD: +510 pips, GBP/USD: +275 pips

February 2015: EUR/USD: +360 pips, GBP/USD: +155 pips

January 2015: EUR/USD: +240 pips, GBP/USD: +200 pips

December 2014: EUR/USD: +405 pips, GBP/USD: +230 pips

November 2014: EUR/USD: + 135 pips, GBP/USD: + 190 pips

October 2014: EUR/USD: + 255 pips, GBP/USD: +390 pips

September 2014: EUR/USD: + 336 pips, GBP/USD: + 424 pips

Signal success rate: EUR/USD: 63 %, GBP/USD: 54 %

We wish you good trades and many pips!

Any and all liability of the author is excluded.