Copper mining companies’ fortunes have been a pretty dismal story of late and, in truth, hold little potential for an improvement in the short term.

China’s slowing industrial production and lack of any form of a long-awaited stimulus package have sapped any incentive for investors to buy copper and, hence, support the price. A recent rally in prices on the release of a raft of bullish news has caused an upturn but few are betting this will result in a return to an upward bull trend.

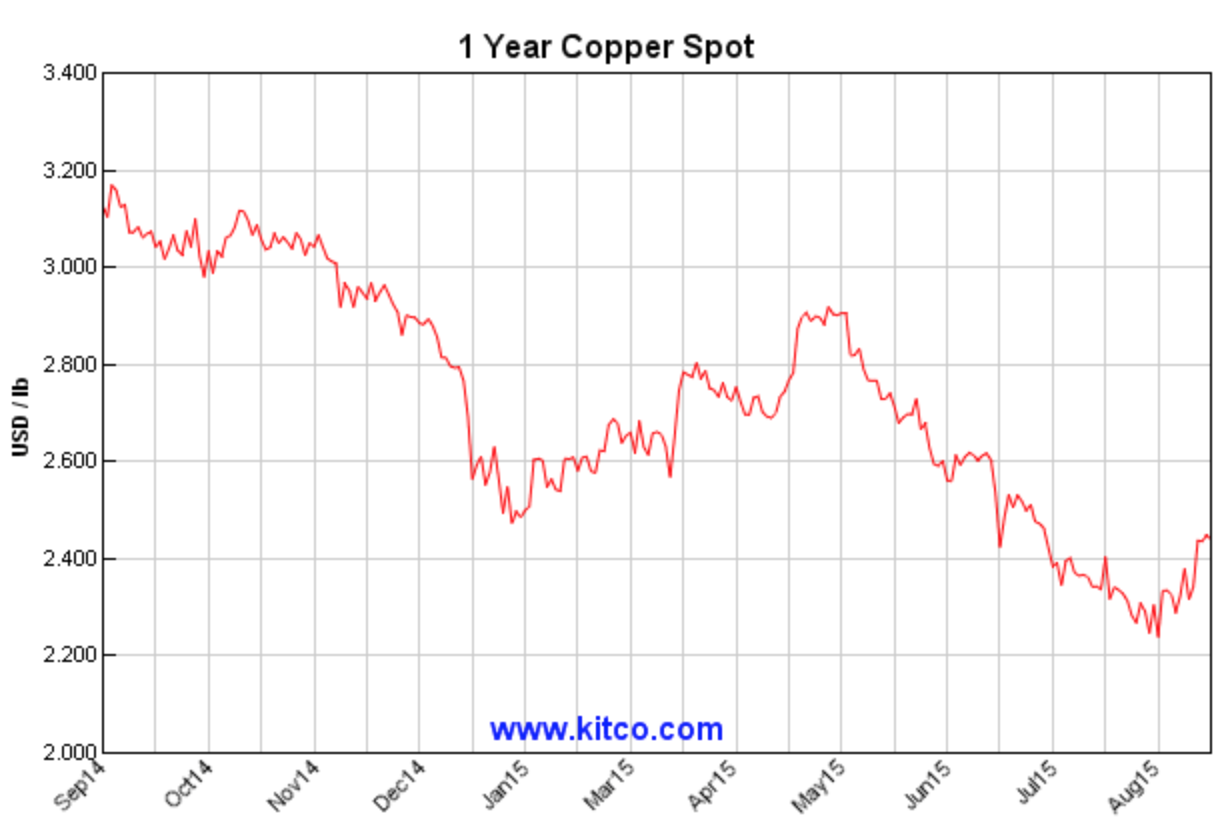

1-Year copper spot price. Source: Kitco

However the fundamentals for copper are better than just about all the other major commodities. China does not control supply in the same way as it does for aluminum or steel, in fact it consumes some 45% of global production but that has been part of the problem and will, in course, be the solution to current low prices.

The problem is that as Chinese industrial production has slowed, it has depressed copper prices, but the solution will come because those same low prices are beginning to impact supply and ultimately supply shortages will be the driver for a return to higher prices. China’s demand for copper has softened but it will not disappear. Supply remains the key for price support and low prices are slowly adding momentum for supply reductions.

Debt-laden Glencore (LONDON:GLEN) plans to cut copper output by 400 kilotons over 18 months in an effort to reduce costs. According to the Financial Times the mining firm announced on Monday it was halting production at its Katanga mine in the DRC and its Mopani operation in Zambia for 18 months, as part of its new debt reduction plan.

Katanga produces about 200,000 metric tons per year, the equivalent to roughly 20% of the DRC’s copper output according to the FT, while Mopani produce’s about 110,000 mt per year, equal to 15% of Zambia’s output. There was a time not so long ago that such an announcement would have caused a severe rise in prices but it is a testament to the current gloom that prices rose only modestly.

The firm is also planning to invest in production improvements and new shafts but the time scale may get stretched if prices remain low. Nor is Glencore alone, China Non-ferrous Mining said production at its Baluba mine and Luanshya slag copper recovery project in Zambia have been suspended blaming reduced power supplies but most analysts are putting it down to low prices.

Maybe more significantly for the long-term support of copper prices is the situation in Chile. Codelco says it needs to invest $25 billion over 5 years to keep production flowing. The government has so far pledged just $4 billion in returned profits between 2015 and 2020, adding to Codelco’s technical, environmental and financial problems.

In truth, copper has some pretty solid medium to long-term fundamentals, meaning 2 to 3 years, but in the meantime it is going to take more mine closures to provide significant support for prices above current levels.

by Stuart Burns