A month ago, I wrote about the resilience of cocoa prices in the face of an avalanche of weaker agricultural prices. Given my opportunistic strategy for trading cocoa through the iPath Bloomberg Cocoa SubTR ETN (NYSE:NIB), I laid out a price target for locking in profits on the latest trade.

I have since sold my holdings in NIB and am now looking for the next entry point. That next entry may be coming in the next month or so as even cocoa seems to be wavering in the facing of an intensifying sell-off in commodities.

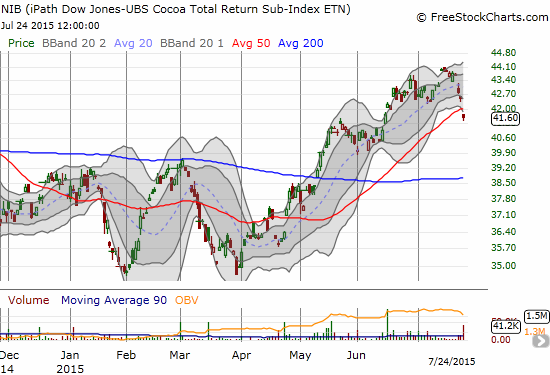

The iPath Bloomberg Cocoa SubTR ETN (NIB) ends the weak with a red flag: a gap down and breakdown below support at the 50-day moving average (DMA)

Source: FreeStockCharts.com

Per my commodity crash playbook, I am priming myself to load up on NIB under the assumption the current sell-off is heading toward a crescendo sooner than later.

There have been several important news items since I last wrote about cocoa.

Ghana’s output for the 2014/2015 season came to about 653,000 tonnes. This output was well short of the 1M originally forecast. Factors blamed for the shortfall include poor weather, and insufficient fertilizer and pesticides. Ghana’s cocoa crop was hit hard by diseases like black pod. (See “Ghana says has sold enough cocoa to service 2014 loan“). The crop for the next season should be much larger. The Ghanaian government has issued a forecast 900,000 tonnes. Skepticism should abound but as soon it seems likely this forecast will prove true, I expect cocoa prices to take a dip. If prices have not fallen by then, it should provide a good buying opportunity for NIB.

The biggest wildcard comes from Ivory Coast, the world’s #1 cocoa producer. Earlier this month, farmers were alarmed by heavy rains and overcast conditions that threatened to damage the flowers budding for next season’s crop. Clearly, under these conditions, a fall in NIB from general pressure on agricultural commodities would present a clear buying opportunity.

Be careful out there!

Full disclosure: no positions