(Wednesday market open) Major indexes ride into Tesla’s (TSLA) earnings later today on a long winning streak that carried stocks to new 15-month highs yesterday. Hopes for an economic “soft landing” based on recent positive data drove gains.

Investors appear to expect more positive news after the close from Tesla (NASDAQ:TSLA). Its stock climbed the past eight trading sessions and is up more than 160% year to date. The EV company lost nearly 70% in stock value in 2022 due to economic and management headwinds. See more on Tesla below.

Besides Tesla, a host of major companies report today, including Netflix (NASDAQ:NFLX), Haliburton (HAL), and U.S. Bancorp (USB). This morning’s earnings from Goldman Sachs (NYSE:GS) wrap up reporting from the nation’s largest banks, but smaller ones like First Horizon (NYSE:FHN) today and Regions Financial (NYSE:RF) later this week could provide more color on the credit market and deposits after several small banks failed earlier this year. There’ve been some struggles for regional banks given deposit slippage and higher funding costs, but regional bank shares rose again in premarket trading after climbing yesterday.

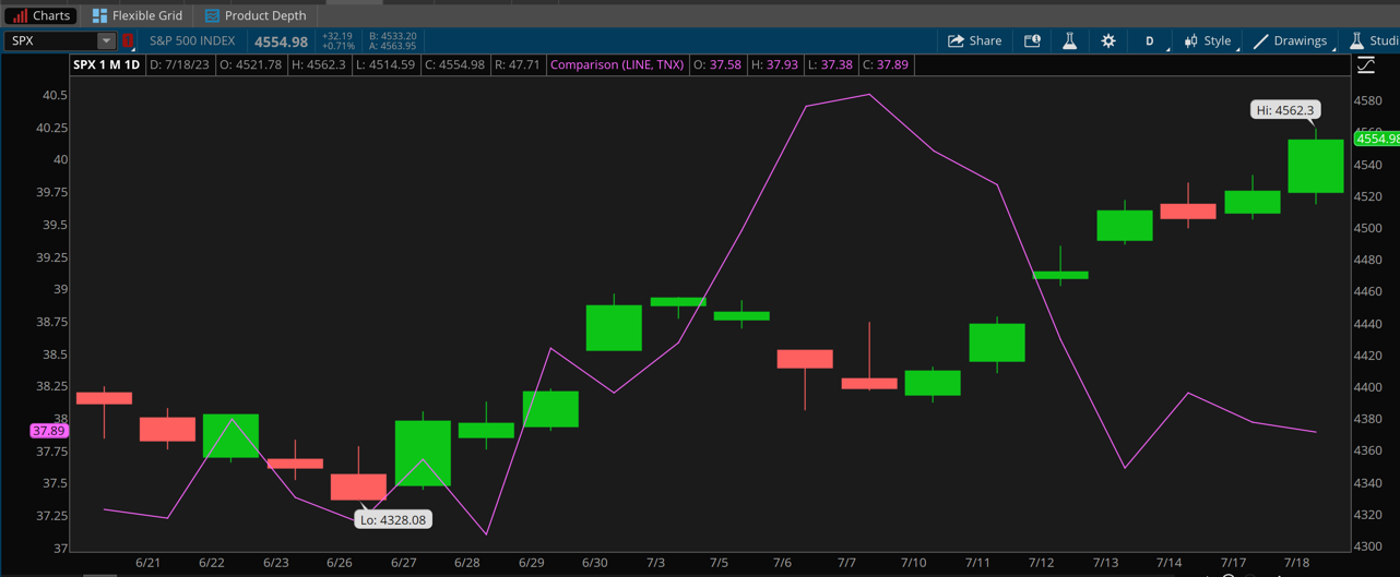

Don’t overlook Treasuries’ role in the recent stock market upswing. A 20-basis-point plunge in yields since their recent highs on July 5 early this month provided some breathing room. Reports like yesterday’s June Retail Sales, which showed moderating consumer spending, might have played into ideas that the Federal Reserve could be nearing the end of its rate-increase cycle. The bond market prices in one more rate hike this year and cuts next year, but quantitative tightening is likely to continue, says Kathy Jones, Schwab’s chief fixed income strategist.

Morning rush

- The 10-year Treasury note yield (TNX) fell 4 basis points to 3.74%.

- The U.S. Dollar Index ($DXY) climbed to 100.20 amid strength versus the Japanese yen.

- Cboe Volatility Index® (VIX) futures were steady at 13.33.

- WTI Crude Oil (/CL) jumped to $76.23 per barrel.

Just in

This morning’s June Housing Starts and Building Permits data failed to meet analysts’ lofty expectations. Starts of 1.434 million were short of the 1.475 million consensus estimate, while permits of 1.44 million missed analysts’ forecast of 1.472 million. Additionally, May’s surprisingly strong starts figure was downwardly revised, though it remains above the long-term trend that’s been roughly steady.

Building permits is a component of The Conference Board’s Leading Economic Index (LEI), the June update of which is due tomorrow morning. Analysts expect a 0.6% slip in LEI, according to Briefing.com. The Leading Index has declined in each of the last 14 months.

D.R. Horton (DHI), the largest U.S. home builder by volume, reports Thursday morning.

Stocks in Spotlight

Center stage: Tesla faces high expectations charging into this afternoon’s earnings report, having previously announced blockbuster deliveries for Q2. Lower prices, incentives, and more models helped drive quarterly sales across the industry, but Tesla appears to have lost some market share to competitors, according to research firm Cox Automotive. Even so, Tesla delivered 466,000 vehicles last quarter—well above market expectations of 448,000.

The company may face questions on its call regarding inventory and pricing, as well as it plans to keep those strong deliveries flowing. Tesla lowered prices earlier this year but also saw its gross margin fall in Q1 to 19.3%. Another thing to listen for is demand from China, where competition is heavy and economic growth continues to struggle. Tesla could also discuss new products after its first, long-awaited Cybertruck pickup model finally rolled off the assembly line this week.

Consensus estimate on Wall Street is for earnings per share of $0.82 on revenue of $24.48 billion. The results are expected shortly after today’s closing bell.

Slight stumble: Shares of Goldman Sachs lost ground early Thursday after the bank came up short of Wall Street’s average expectations on earnings per share (EPS). Revenues did surpass analysts’ estimates, and the company raised its dividend—two factors that might have prevented worse initial losses for its shares. The company’s Investment Banking business hit speed bumps during the latest quarter amid a lack of corporate merger and acquisition activity, hurting revenue in that segment. Trading activity was also a drag, as were the company’s commercial real estate holdings.

Screen share: Netflix also reports after the close today. Shares rallied Tuesday in what might have been anticipation of stronger revenue and subscriber growth. Last quarter, Netflix projected June quarterly revenue of $8.2 billion and earnings per share of $2.84, with subscriber growth near the 1.75 million level from Q1.

Eye on the Fed

Futures trading indicates a 99.8% probability that the Federal Open Market Committee (FOMC) will raise interest rates by 25 basis points at its meeting next week, according to the CME FedWatch Tool.

There’s a growing sense that the expected rate hike next week could be the final one of this cycle, says Collin Martin, a director of fixed income strategy at the Schwab Center for Financial Research. Although inflation is still elevated, “it’s moving down in the right direction,” he adds.

What to Watch

Tomorrow’s key data is June Existing Home Sales. The report, due out shortly after Thursday’s open, is expected to show sales at a seasonally adjusted annual rate of 4.25 million, down from 4.3 million in May, according to analyst consensus from Briefing.com. Existing home sales are down sharply from a year ago, partly because many people are reluctant to sell homes bought with affordable mortgage rates.

Tomorrow morning also brings the government’s weekly initial jobless claims report. Consensus from Briefing.com is 240,000, up from 237,000 the prior week and near the middle of the recent range.

Talking technicals: The S&P 500® Index’s (SPX) climb above 4,500 this week puts it in shouting distance of a possible resistance area near 4,600, where the index ran into selling back in early 2022.

Targeting inflation: How much more does the Fed need to do to bring inflation down to its 2% long-term target? Check out the analysis from Schwab’s experts in the latest Schwab Market Perspective.

CHART OF THE DAY: SUMMER BREEZE. Cooler winds from 10-year Treasury note yields (TNX—purple line) over the last two weeks could be one major force helping major indexes like the S&P 500 (SPX—candlesticks) march higher. Data sources: S&P Dow Jones Indices, Cboe. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Thinking cap

Ideas to mull as you trade or invest

Mega mania: Tesla’s report today is a reminder that earnings are underway for the so-called mega-cap companies that account for so much of the SPX’s gains year-to-date. Tesla kicks things off, followed next Tuesday by Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT). Meta Platforms (META) comes right on their heels next Wednesday, followed by Amazon (NASDAQ:AMZN) on Thursday, July 27. Apple (NASDAQ:AAPL) reports in the first week of August. All this could potentially inject volatility next week after so many months of relative calm, considering the Magnificent Seven together form more than 25% of the SPX’s market capitalization. Any significant misses could have an outsized impact on the index, and that’s when investors should consider paying close attention to individual sector performance for a better sense of how the other 493 SPX stocks are doing. At such times, it can also be useful to step back and assess the environment until cooler heads prevail.

Margin call: Profit margins arguably grow more important from here, especially if inflation is truly easing. With high inflation, companies could often grow margin by raising prices along with competitors. That ran into roadblocks earlier this year as it became harder for companies to justify higher prices. In some cases, they faced growing competition from discounters. But wages continue to rise—a cost that’s tough to avoid. One way to grow margin without alienating customers is through increased automation to improve productivity. That’s something PepsiCo (NASDAQ:PEP) touts while acknowledging that higher prices hurt demand in its latest quarter, CNBC reported. Another strategy is to accept slightly lower margin in return for growing the business footprint. That seems to be UnitedHealth’s (NYSE:UNH) approach, as margins for its Optum health services business continued retreating last quarter even with double-digit sales growth. The decline in Optum margin reflected investments in services provided to patients and customers to support growth, the company said in its earnings press release. In a case like this, investors must decide if they can accept pressure on near-term earnings if it might fuel revenue and earnings growth over time.

Can’t Buy? Invest! Decades ago, a popular television ad featured the company’s CEO signing off with the words, “I liked (the product) so much, I bought the company.” A similar strategy helped Berkshire Hathaway (NYSE:BRKa) (BRK.A) Chairperson Warren Buffett make billions. But what if you can’t buy the company? There are other ways to go if your takeover bid gets rejected, and chip firm Nvidia (NASDAQ:NVDA) appears to be mapping a fresh route with U.K. chipmaker Arm, media reports said last week. Arm is expected to go public after Nvidia’s takeover bid failed to get regulatory approval, and Nvidia is reportedly considering an “anchor investment” in Arm’s initial public offering (IPO), Barron’s reported. Arm is owned by Japan’s SoftBank. Of course, it’s not often that a failed purchase leads to an IPO allowing a company to invest in the firm it just tried to buy. Still, it’s an interesting approach as U.S. and European regulators continue taking a tough stance on mergers and acquisitions (M&A). Major deals still on the table include Amgen’s (AMGN) proposed purchase of Horizon Therapeutics (NASDAQ:HZNP), Microsoft’s (MSFT) proposed purchase of Activision Blizzard (NASDAQ:ATVI), and Kroger’s (KR) of Albertson’s (ACI).

Calendar

July 20: June Existing Home Sales, June Leading Indicators, and expected earnings from Abbott Labs (NYSE:ABT), American Airlines (NASDAQ:AAL), Philip Morris (NYSE:PM), Johnson & Johnson (JNJ), D.R. Horton (DHI), Freeport McMoran (FCX), Travelers (NYSE:TRV), and CSX (NASDAQ:CSX)

July 21: Expected earnings from American Express (NYSE:AXP), AutoNation (NYSE:AN), and Regions Financial (RF)

July 24: Expected earnings from Domino’s Pizza (DPZ) and Whirlpool (NYSE:WHR)

July 25: July Consumer Confidence and expected earnings from Alaska Air (NYSE:ALK), Archer Daniels (ADM), Biogen (NASDAQ:BIIB), Dow (DOW), Alphabet (GOOGL), General Electric (NYSE:GE), General Motors (NYSE:GM), Kimberly-Clark (NYSE:KMB), Verizon (NYSE:VZ), Microsoft (MSFT), and Visa (NYSE:V)

July 26: June New Home Sales and expected earnings from AT&T (T), Boeing (NYSE:BA), Coca-Cola (NYSE:KO), Union Pacific (NYSE:UNP), Chipotle (NYSE:CMG), Meta Platforms (META)

Disclosure: TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.