Thankfully it's Friday! A couple of ugly events have gripped investor's imagination this week. One will never go away, and has managed to scar many -- Brazil's shellacking by Germany on home soil. The other occurred in Europe, managing temporarily to freak out global markets, as participants collectively experienced some Euro-zone crisis flashbacks. Portugal's largest bank, Banco Espirito Santo (LISBON:BES), shares were suspended from trading after a wealth management affiliate delayed payments on debt and Moody's downgraded the firm. The knock on effect began a global equity and periphery bond rout and a mini-break from risk trading.

The Capital Market managed to push the yield on Portugal's 10-Year note back to +4%, the highest since early April, while two Spanish banks were forced to suspend bond sales. Anything affecting one Euro-periphery member basically affects all nowadays -- the yields on other peripheral members sovereign bonds also blew out, reminding all of the darkest days of the euro-debt crisis. Throw into the mix some weak industrial data from France and Italy and you have an investor, who may not be wholly tuned in, fearing deja vu.

Risk versus Yield?

Fear not, this week's reaction to the events surrounding Portugal (BES) should serve to remind investors that "risk versus return" should be as an important consideration as "yield and carry." What has transpired in Europe -- the Brazil result is along way from being fixed -- is being treated as a "flash in the pan." So far, Euro-debt concerns have had a marginal affect on Australasian credit spreads overnight, as investors continue to focus on buying new issues. Even the Euro bourses are in the green as we head stateside. This bout of volatility has at least woken the market up from its deep slumber (and it's not even considered the summer doldrums yet). If investors consider looking at FX, bond and equity implied volatility; one will notice that we are still some distance from trading in a contagion/systemic risk environment. Portugal's BES is a reminder to the Euro authorities what work remains to be done to wholly convince the global investor of the health of their financial system. Remember, the ECB has the safety mitts and a backstop - VLTRO!

Unwinding of risk-aversion positions

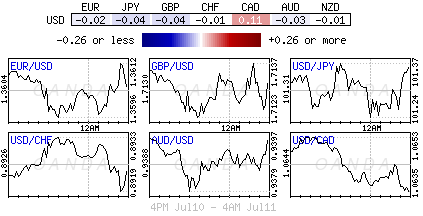

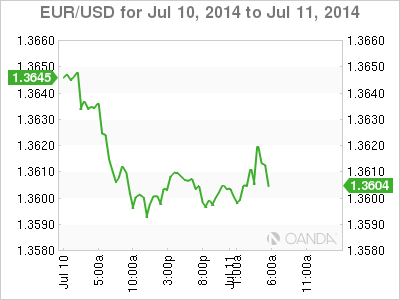

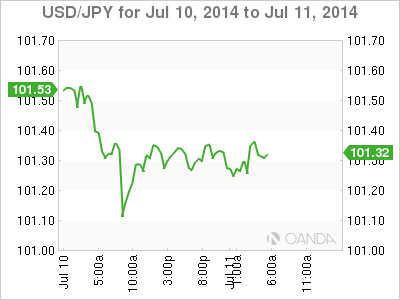

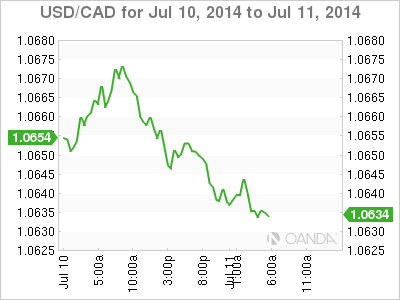

So, a positive start for the main Euro bourses and a small sell off in core government bonds certainly is proof of an easing of yesterday's risk-aversion setup. The forex market is reacting with a small unwind of the common safety trades, which see JPY (¥101.30) and USD USD/JPY trade a tad weaker versus the 18-member single unit (€1.3615) and the commodity currencies (CAD $1.0635 and AUD $0.9400).

The EUR has been pushed reluctantly higher as traders continue to pare their risk-averse bets. A 10bp narrowing for 10-year German/Portugal bond spreads was the first signal for the market to consider covering some of its EUR shorts. However, ultra low option vols continue to dominate FX thinking (moves are nearly non existent). With little data of note to spur on traders, the market should expect very little chance of any significant (or any) moves away from €1.3600 today.

Is UK Growth Under Threat?

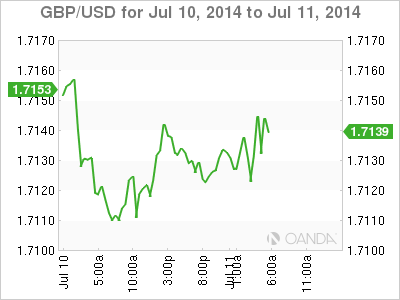

There are not many data points for investors to get their teeth into this Friday. The only one of note has been out of the UK this morning. Until recently, Q2 UK GDP growth looked on course to match the +0.8% print of Q1 expansion, however, many are suggesting that this may be in doubt now, especially after this morning's construction releases. UK Data headlines this morning reveal that construction output actually fell -1.1% in May. Despite being a volatile report, add today's results to UK's IP falling -0.7%, manufacturing output down -1.3% and a widening trade deficit and one gets the smallest of feeling that Governor Carney and company may be loosing some of that Midas touch. The BoE will have to look to the UK's dominant service sector for much needed support, as well as an uptick in June's construction output and IP. The pound has seen a quick unwind of the pre-data buying that pushed it up to a fresh day high (£1.7151). Until something does happen, £1.7085 below is still considered as key support.

Canada Employment Takes Center Stage

There is little of note to spur on the various asset classes as we close out the week. Nevertheless, Canada will try to do its part with the release of its June employment report. The markets forecast is for a headline print of +20k and an unemployment rate of +7%. The consensus view is that a strong report will threaten the $1.0600 option barrier in play (current $1.0635). Stronger numbers should give the impetus to blow through last week's six-month low ($1.0620). The dollars pre figure resistance remains at $1.0654 (Asia high) and $1.0676.