There is an important battle for the long-term trend in the EUR/USD pair. The central bank speeches in Jackson Hole on Friday have enough potential to break or reinforce the direction of the past 11 months.

EURUSD is trading near the 1.0850 level during European trading following Wednesday’s notable moves. The single currency was hit by a sell-off following weak German services PMI data, dragging down the Eurozone Composite PMI.

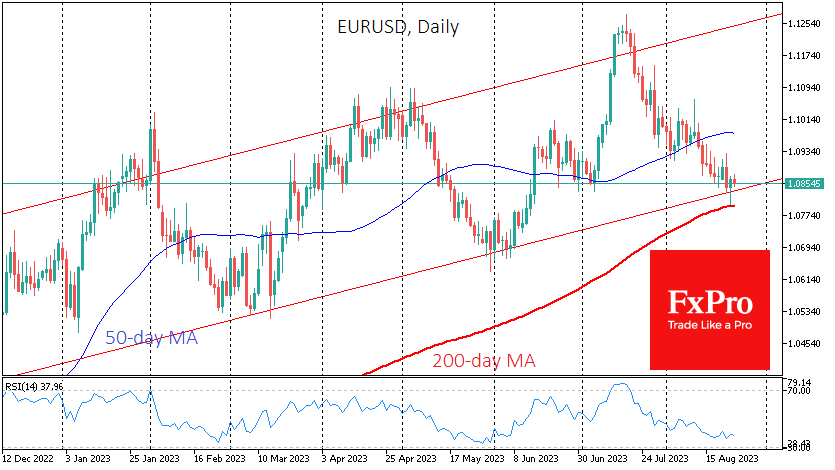

In minutes, the single currency fell back to the psychologically important round 1.08 level. This is also where the 200-day moving average passes through. These technical factors have rekindled interest in the euro among sellers.

We should also not forget the positive correlation between the single currency and equity indices. The latter’s positive traction helped the EURUSD fully recover, although the move did not develop on Thursday.

The EURUSD is now clinging to the lower boundary of the bullish corridor of the past few months, from which it also reversed in March and early June.

Most likely, the bears haven’t had their last word yet, as the pair hasn’t reached the over-sold region on the daily RSI, even after five and a half weeks of declines, leaving the potential for further drop.

Technically, the bearish reversal followed a failed attempt to break above the 200-week average at 1.12. The single currency has been trading below this since November 2021.

The bears also have the 50-day moving average, which acts as a medium-term trend, on their side. Earlier this month, it turned from support to resistance, taking eight trading sessions. It is, therefore, not surprising that the tug-of-war is intensifying as we approach the long-term trend indicator, the 200-day.

So far, we are seeing more signals in favour of further declines in the pair. However, the most prudent tactic would be to wait for the EURUSD to make a decisive move away from the 200-day moving average. The direction of this breakout promises to be the most accurate indicator of where the pair is headed in the coming months.

If the bulls win, we could see the pair rally to 1.1050 within a few weeks and consolidate the uptrend for months.

A strong EURUSD move below 1.08 in the coming days would be a resounding defeat for the bears, opening a quick path to 1.0650 and the prospect of further weakening the pair to parity in the coming quarters.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD’s Trend Battle Rages On

Published 08/24/2023, 08:58 AM

EUR/USD’s Trend Battle Rages On

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.