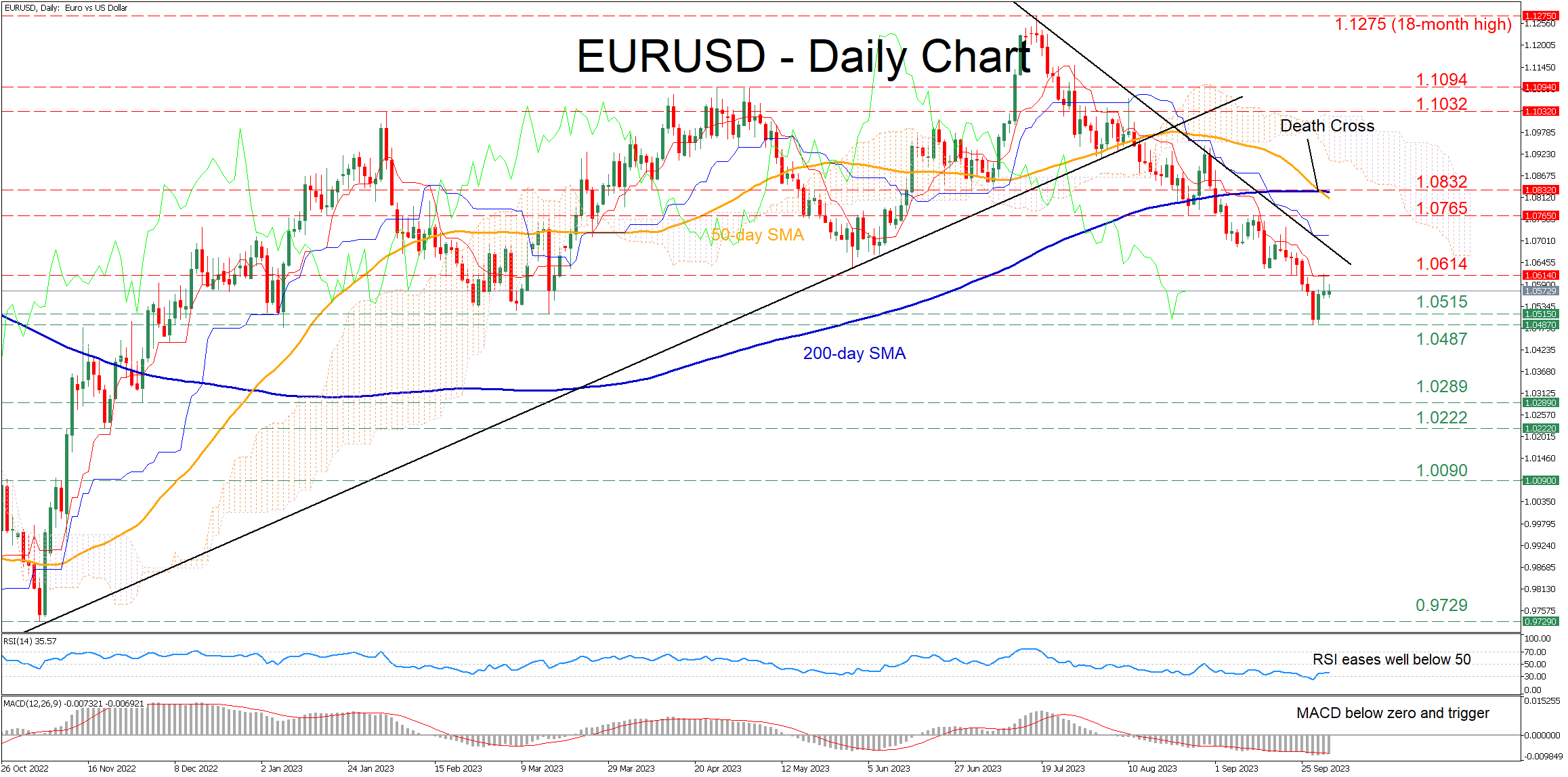

- EURUSD stuck in a clear downward path, posting a fresh 8-month bottom of 1.0487

- Formation of a death cross between 50- and 200-day SMAs could spell more trouble

- Despite latest rebound the momentum indicators remain skewed to the bearish si

EURUSD has been in a steady retreat after peaking at the 18-month high of 1.1275 on July 18, generating a series of lower highs and lower lows. Even though the pair managed to find its feet at the eight-month bottom of 1.0487, the bearish short-term structure remains in place.

EURUSD has been in a steady retreat after peaking at the 18-month high of 1.1275 on July 18, generating a series of lower highs and lower lows. Even though the pair managed to find its feet at the eight-month bottom of 1.0487, the bearish short-term structure remains in place.

Should the bears attempt to push the price lower, the March bottom of 1.0515 could prove to be the first barrier for the pair to clear. A violation of that floor could pave the way for the recent eight-month low of 1.0487. Piercing through that region, the price might then slide towards the November 2022 support zone of 1.0289.

On the flipside, if the pair reverses back higher, initial advances could be rejected at the recent resistance region of 1.0614 before the 1.0765 hurdle gets tested. Even higher, the June-July support of 1.0832 may serve as strong resistance in the future. Failing to halt there, the pair could then ascend towards the February peak of 1.1032.

In brief, despite the latest bounce, EURUSD remains stuck in a steep downtrend. Looking forward, the recent completion of a death cross between the 50- and 200-day simple moving averages (SMAs) could induce further downside pressures.