GROWTHACES.COM Forex Trading Strategies

Taken Positions:

EUR/USD: short at 1.0760, target 1.0540, stop-loss 1.0850, risk factor **

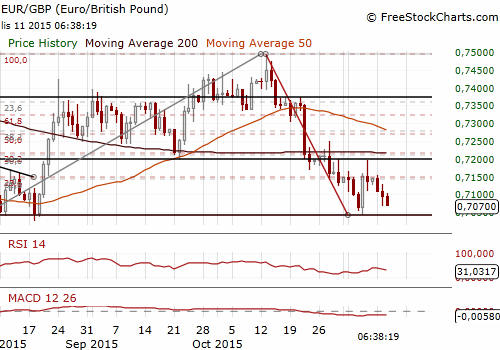

EUR/GBP: short at 0.7075, target 0.6950, stop-loss 0.7125, risk factor ***

More Forex Signals - GrowthAces.com

EUR/USD: Draghi Today, Yellen Tomorrow

(short at 1.0760)

- San Francisco Federal Reserve President John Williams said Tuesday there's a "very strong case" for the Fed to raise interest rates next month if the economy continues to improve and policymakers are confident that inflation will pick up. He acknowledged lingering obstacles, which include overseas weakness that has strengthened the dollar, hobbled exports and curtailed inflation. But he added, "Despite the headwinds and despite all the concerns about the risk, we still seem to plow ahead with 2% growth." Noting the global turmoil has been more than offset by solid consumer spending and a recovering housing market, he said, "We're in a much better place than we were a few years ago."

- He said inflation has been restrained by temporarily low oil prices and a strong dollar, but he's confident it will accelerate because the economy is already near full employment. He noted markets are accustomed to near-zero rates but doesn't expect a quarter-point bump to have much impact on growth. It can even send a positive signal to consumers and businesses, he said.

- Williams' remarks are significant because he's a voting member of the Fed's policymaking committee, and he's considered a centrist whose views generally align with those of Fed Chair Janet Yellen.

- Chicago Federal Reserve Bank President Charles Evans, one of the US central bank's most dovish policymakers, said Tuesday that he looks forward to the time when the economy is strong enough to handle a Fed rate hike.

- Recent Fed policymakers’ comments did not change the market picture, as investors are almost sure that the Fed will raise rate in December. In our opinion, the Fed’s mission for now is to signal gradual path of hikes post lift-off. Such a rhetoric will be aimed to stop the USD rally that may hurt the US economy. Fed Chair Janet Yellen’s speech is scheduled for tomorrow. We think that she will signal a hike in December and gradual hikes next year.

- European Central Bank governing council member Ignazio Visco said the bank would consider a cut to its deposit rate and changes to its asset purchase programme to achieve its inflation target. The market consensus has shifted toward a deeper deposit rate cut (more than 10 bp) from the ECB.

- The German government's panel of economic advisers warned on Wednesday that the low interest rate policies of the European Central Bank were creating substantial risks for financial stability and could ultimately threaten the solvency of banks and insurers.

- European Central Bank chief Mario Draghi is expected to speak at around 13:15 GMT. We expect dovish comments and jawboning the EUR.

- Our EUR/USD sell order at 1.0760 was filled on the rise to 1.0774. The short targets 1.0540. The nearest support levels are 1.0674 low on November 10 and 1.0666 low on April 23.

Significant technical analysis' levels:

Resistance: 1.0774 (session high Nov 11), 1.0790 (high Nov 9), 1.0852 (10-day ema)

Support: 1.0674 (low Nov 10), 1.0666 (low Apr 23), 1.0660 (low Apr 21)

EUR/GBP: Short At 0.7075

(short at 0.7075)

- Britain's unemployment rate dipped to 5.3% in the third quarter, its lowest level since the three months to April 2008. The market expected the rate to hold steady at 5.4%.

- The Office for National Statistics said that the total earnings of workers, including bonuses, rose by 3.0% in the three months to September. That was the same rate as in the three months to August and slower than a market forecast of 3.2%. In the month of September alone, total wages rose by 2.0%, a sharp slowdown from 3.2% in August and the weakest increase since February this year.

- Excluding bonuses, average weekly earnings growth also slowed noticeably to 2.5% in the third quarter and 1.9% in the month of September alone, both the weakest readings since the first quarter of 2015.

- The GBP/USD dipped after data showed UK earnings grew slower than expected in the third quarter, keeping pressure off the Bank of England to raise interest rates any time soon. Until recently the BoE was expected to move within a few months of the Fed - but a gap of almost a year has now opened up between market expectations for when the two central banks will tighten monetary policy. UK interest rates are not expected to lift off their record lows until late next year.

- Bank of England chief economist Andy Haldane said British economic growth has not been spectacular and the recent slowdown bears watching.

- The ECB is expected to expand its already huge stimulus programme in December, which should pressure the EUR downwards against the GBP, limiting any pick-up in UK inflation.

- We went EUR/GBP short at 0.7075 after the GBP reaction to jobs data had been limited. Our EUR/GBP short targets 0.6950, near July-August lows.

- (Read more - GrowthAces.com)

Significant technical analysis' levels:

Resistance: 0.7120 (10-dma), 0.7195 (high Nov 6), 0.7199 (high Oct 30)

Support: 0.7043 (low Nov 5), 0.7027 (low Aug 18), 0.7016 (low Aug 7)