Macroeconomic overview:

The EUR/USD remains pressured by nervousness over the upcoming French presidential election. The campaign is being closely followed by investors, as the far right Marine Le Pen has threatened to pull France out of the European Union if she wins, fuelling concerns of an unravelling of the bloc after Britain's vote to leave it last year. Polls have for weeks shown Le Pen and centrist Emmanuel Macron on track to top the first round of voting on April 23 and go through to the May 7 runoff.

But recent polls have shown the race tightening as the front-runners faltered and far-left maverick Melenchon surged after strong performances in two televised candidates' debates. A Kantar Sofres poll showed Macron and Le Pen tied on 24% in the first round, with Melenchon taking third place for the first time on 18%, up six points since mid-March.

New York Fed President William Dudley said the Fed might avoid raising interest rates at the same time that it begins shrinking its balance sheet, prompting only a "little pause" in the central bank's rate hike plans.

The comments shed more light on the Fed's developing plan for when to stop topping up bonds that expire as it does now, how it plans to execute it and how far it will ultimately go in shrinking its balance sheet. The Fed has hiked rates twice in the last three months and aims, according to policymakers' forecasts, to tighten policy three times in each of the next few years. Minutes from the Fed's mid-March meeting showed most policymakers expected to start shedding bonds later this year, a sentiment Dudley endorsed again on Friday, adding it could also happen in 2018.

U.S. job growth slowed sharply in March amid continued layoffs in the embattled retail sector, but a drop in the unemployment rate to a near 10-year low of 4.5% suggested labor market strength remained intact.

Nonfarm payrolls increased by 98k jobs last month, the fewest since last May, the Labor Department said on Friday. The market had forecast payrolls increasing 180k last month and the unemployment rate unchanged at 4.7%.

Job gains, which had exceeded 200k in January and February, were also held back by a slowdown in hiring at construction sites, factories and leisure and hospitality businesses, which had been boosted by unseasonably warm temperatures earlier in the year. In March, temperatures dropped and a storm lashed the Northeast and Midwest.

Average hourly earnings increased 5 cents or 0.2% in March after rising 0.3% in February. That lowered the year-on-year gain in wages to 2.7%.

The economy needs to create 75k to 100k jobs per month to keep up with growth in the working-age population and some Federal Reserve officials view the labor market as being at full employment. Other measures also showed labor market slack shrinking. The labor force participation rate, or the share of working-age Americans who are employed or at least looking for a job, held at an 11-month high of 63% in March. A broad measure of unemployment, which includes people who want to work but have given up searching and those working part-time because they cannot find full-time employment, fell three-tenths of a percentage point to 8.9%, the lowest level since December 2007. The employment-to-population ratio increased one-tenth of a percentage point to a fresh eight-year high of 60.1 %.

Although the headline figure came in below expectations, we still expect another Fed rate hike in June.

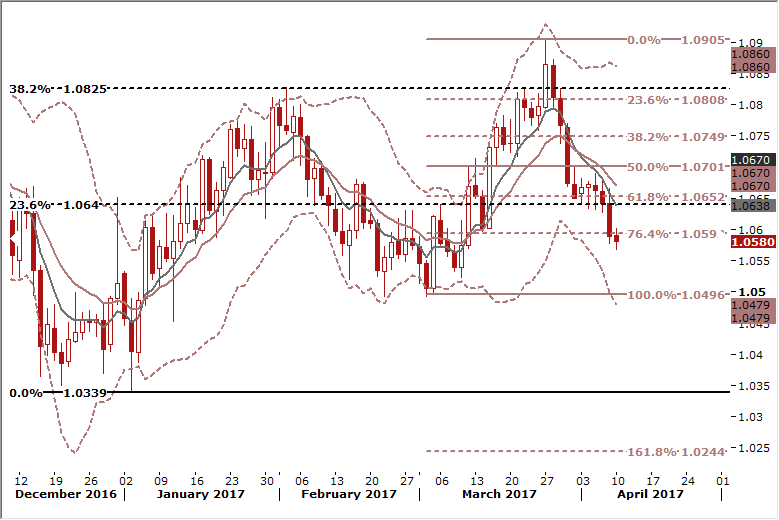

Technical analysis: Bearish pressure remains. The pair broke below 1.0593 (76.4% fibo of March rise) and there is little in the way of support ahead of March’s 1.0496 low.

Short-term signal: Short for 1.0500.

Long-term outlook: Neutral

EUR/CAD: Loonie supported by strong Canadian jobs report

Macroeconomic overview: Canadian employers added a greater-than-expected 19.4k jobs in March and the unemployment rate edged up to 6.7% as more people sought work, Statistics Canada said on Friday in a report that suggested Canada's economy has finally turned the corner. The market had forecast 5k new positions and said the jobless rate would increase to 6.7% from 6.6% in February.

The surge in jobs was the fourth straight monthly increase and adds to pressure on the Bank of Canada to sound more optimistic about the economy after a prolonged slump caused by low oil prices.

Policymakers at the central bank are expected to keep interest rates on hold this week when they release their quarterly monetary policy report.

Bank of Canada Governor Stephen Poloz said the economy had a lot more room to grow, arguing it would be "odd" for policymakers to forget about downside risks just because some data had come in stronger than expected.

The jobs report looked strong even beyond the headline, with gains largely in full-time work and both manufacturing and construction adding employment. Statistics Canada said 18.4k full-time jobs and 1k part-time jobs were added.

Still, there remain some signs of slack in the economy, with hourly wages of permanent employees up just 0.9% from March 2016. Muted wage pressure in the energy-producing province of Alberta, hard hit by the oil crash, was partly responsible.

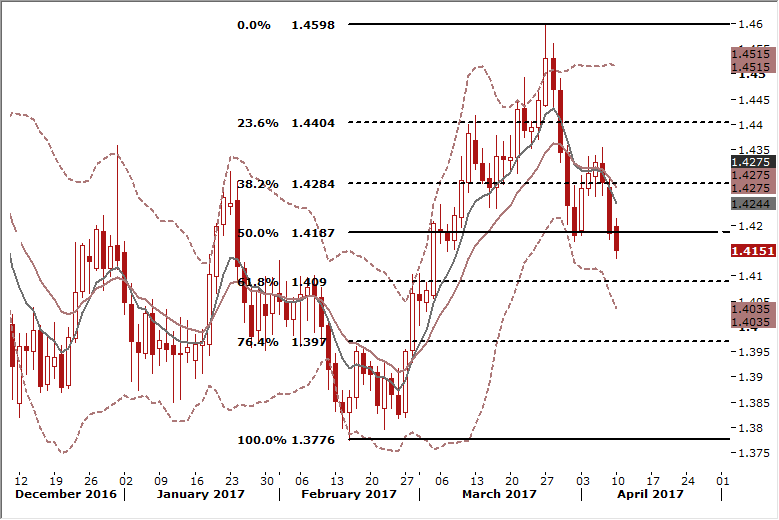

Technical analysis: The EUR/CAD broke below 50% of February-March rise today and remains below 14-day exponential moving average, which highlights the short-term bearish structure.

Short-term signal: Stay short at 1.4245 for 1.4020. Stop-loss lowered to 1.4215

Long-term outlook: Bearish

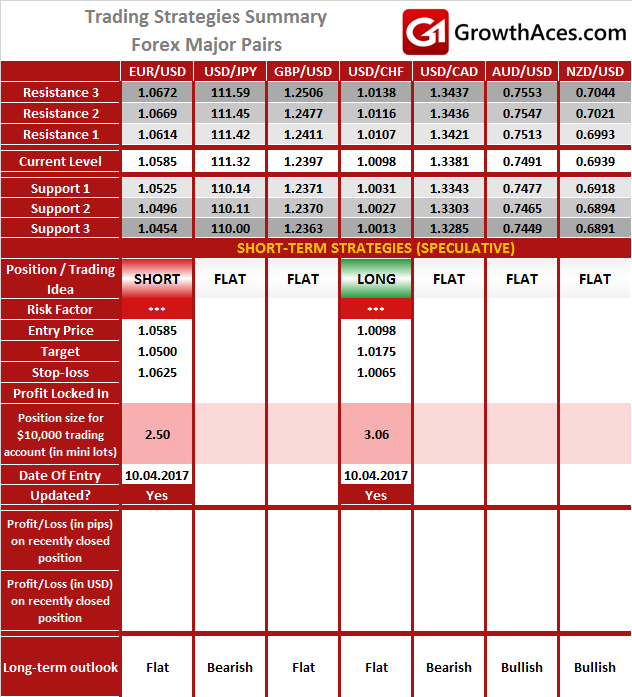

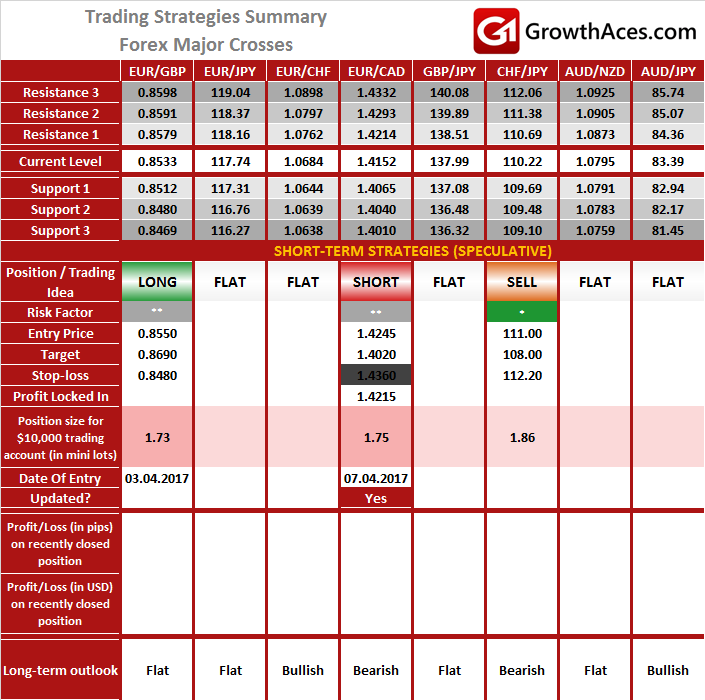

TRADING STRATEGIES SUMMARY:

FOREX - MAJOR PAIRS:

FOREX - MAJOR CROSSES:

Source: GrowthAces.com - your daily forex trading strategies newsletter