EUR/USD: Trump disappointed investors, focus turns to ECB now

Macroeconomic overview: In the plan, unveiled at the White House by Trump economic adviser Gary Cohn and Treasury Secretary Steve Mnuchin, Trump proposed cutting to 15% both the income tax rate paid by public corporations and that paid by "pass-through" businesses, including partnerships, S corporations and sole proprietorships.

The top corporate rate is now 35%, though few multinational companies pay it, thanks to loopholes that allow them to lower their effective tax rates. Despite this, corporations have pushed for a tax rate cut for many years, and Trump has obliged.

The top rate for pass-throughs, which account for most small businesses, is 39.6%, the same top rate paid by individuals. Unlike corporations, the profits of "pass-through" businesses flow directly onto their owners' tax returns.

In another concession to long-standing demands from corporate America, Trump called for bringing corporate profits being held offshore by multinationals into the country at a rate well below the current 35% rate now owed on "repatriated" earnings. He did not say what that rate would be, but said the administration was working with Congress on a low rate.

About USD 2.6 trillion in profits are being held tax-exempt abroad by U.S. multinationals under a rule that says they are only taxable if brought into the United States.

If enacted, the repatriation tax holiday would produce a one-time surge in government revenue. If it were dedicated to infrastructure spending, it could attract votes from Democrats.

The plan also urged adoption of a "territorial" corporate tax system that would largely exempt foreign profits of U.S.-based corporations from federal taxation.

For average U.S. taxpayers, Trump proposed help by doubling the standard deductions for individuals who do not itemize; simplifying tax returns by reducing the number of tax brackets to three from seven; and providing unspecified tax relief for families with child and dependent care expenses.

He also called for repealing inheritance taxes on estates and the alternative minimum tax, both measures that would help a handful of wealthy taxpayers.

Trump's laundry list of tax cuts would reduce revenues for the U.S. government, which is already running a deficit and deeply in debt. He offered few proposals to offset those losses.

Democrats and fiscal-hawk Republicans will be concerned about how much Trump's proposals would expand the deficit. To minimize that, Republicans will rely heavily on "dynamic scoring," an economic modeling method that attempts to predict economic growth and new tax revenues resulting from tax cuts.

Mnuchin said the revenue losses would also be offset by killing many tax loopholes. He said at a briefing that Trump's plan would kill most tax deductions, except those for charitable giving, retirement savings and mortgage interest.

U.S. President Donald Trump's tax plan offered no fresh surprises and as a result the USD weakened against the EUR. Investors are focused now on ECB’s monetary policy decision.

Despite solid growth data in the Eurozone, we do not expect new policy announcements, nor do we anticipate any material change of rhetoric.

There are two main reasons for this. First and most important, the ECB is unlikely to depart from its long-held caution just before the second round of the French presidential election. After Emmanuel Macron’s win in the first round, one of the key threats to financial stability and, therefore, to economic activity and price stability in the whole Eurozone has gone. That is why, the ECB may acknowledge a further reduction of downside risks already today, although a formal move towards a balanced risk assessment would probably still have to wait until the new round of forecasts, which will be published in June.

Second, headline inflation in March fell more than generally expected as the recent boost from energy and food prices started to reverse, while the late Easter holiday caused a visible weakening of core inflation, which, however, is totally technical and, therefore, is not going to last. The large noise in these data will not allow the ECB to draw any firmer conclusions about the strength of underlying price pressure, although, at the margin, the material drop in headline inflation vindicates the doves advocating prudence.

With the introductory statement unlikely to change much, the Q&A may be the only catalyst for markets. The exit sequence in the forward guidance has recently been at the center of mixed signals from ECB speakers, which reveal a lively debate within the Governing Council. This has generated significant volatility in rate hike expectations. However, chief economist Peter Praet has restored order by highlighting the merit of starting to reduce accommodation from the term premium at the long end of the curve, before raising the whole structure of interest rates via impulses to the deposit rate – currently the key policy rate. Therefore, despite all the noise and misleading signals, we do not think that the ECB is anywhere close to reconsidering its view that rate increases will only come after QE is terminated.

Overall, we think that today’s meeting will be used by the ECB as a “bridge” to the June rendezvous, which promises to be important. If, in line with our expectations, the French will elect Emmanuel Macron, on 8 June the ECB is likely to scale back some of its prudence and the new staff projections will finally show a broadly balanced risk assessment. In turn, this should convince the ECB to drop its easing bias, thus meeting the intensified requests from the hawkish faction of the Governing Council.

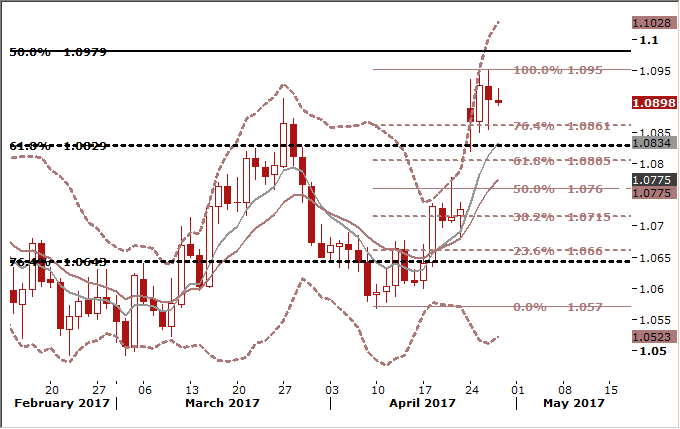

Technical analysis: The pair is off this week’s 1.0950 peak and a correction looks likely. The next important resistance level is 1.0979 (50% fibo of May 2016-January 2017 fall). But we think the most likely scenario is a fall to at least April 20 high at 1.0777.

Short-term signal: Short at market price (1.0907) for 1.0770.

Long-term outlook: Bullish

USD/JPY: BOJ keeps policy unchanged, but sounds upbeat on economy

Macroeconomic overview: In a widely expected move, the BOJ maintained its short-term interest rate target at minus 0.1% and a pledge to guide 10-Year government bond yields around zero percent. "Japan's economy has been turning toward a moderate expansion," the BOJ said a quarterly review of its long-term economic and price projections, compared with the previous month's view that it was "improving moderately as a trend." It was the first time since March 2008 the BOJ used the word "expansion" in describing the state of the economy.

But the central bank slightly cut its inflation forecast for this fiscal year in a quarterly review of its projections, suggesting that it will maintain its massive monetary stimulus for the time being to achieve its ambitious 2% target.

In the quarterly review, the BOJ cut its core consumer inflation forecast for the year ending in March 2018 to 1.4% from 1.5%, blaming stubbornly weak services and durable goods prices. The BOJ also complained that public perceptions of future price rises remained weak with no clear signs of a pick-up. But it maintained its projection that inflation will reach 2% during the fiscal year ending in March 2019 on the view that a tightening job market would gradually push up wages.

BOJ Governor Haruhiko Kuroda reminded markets the Japanese central bank is nowhere near an exit from its massive stimulus. Kuroda said after the policy meeting:

We expect inflation to accelerate toward 2% but currently, inflation is around zero percent ... Talking about a specific exit strategy now would cause undue confusion in markets. The prerequisite for such debate to happen is for inflation to achieve 2%.

Japan's economy has shown signs of life, as exports rose the most in over two years in March and manufacturers' confidence hit the highest since the global financial crisis a decade ago. But core consumer prices for February rose just 0.2% from a year earlier, as weak private consumption has discouraged companies from raising prices.

While a pioneer in deploying unorthodox stimulus, the BOJ is likely to lag behind its peers in withdrawing monetary support. The U.S. Federal Reserve is already embarking on interest rate hikes, while the European Central Bank may send a small signal in June towards reducing stimulus.

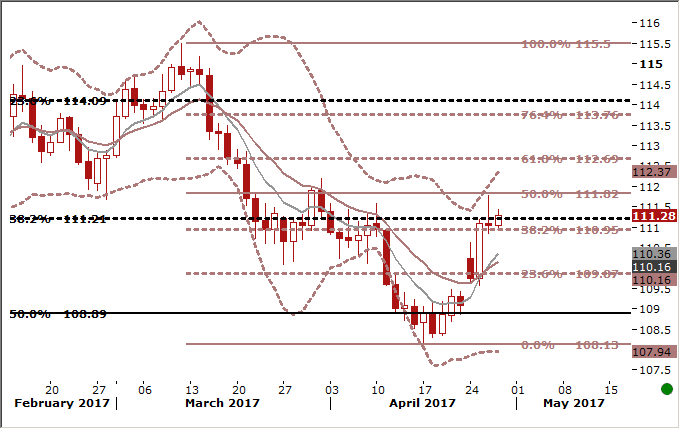

Technical analysis: Long upper shadow on Wenesday’s candlestick line weighs on the USD/JPY. The market reached a high of 117.77. 111.82 (50% retrace of 115.50-108.14) fall continues to offer supply and is also where the weekly tenkan line currently resides. Breaking above these levels could be a big hurdle for currency bulls.

Short-term signal: Flat

Long-term outlook: Bearish

USD/CAD: Trump will not terminate NAFTA treaty yet

Macroeconomic overview: U.S. President Donald Trump told the leaders of Canada and Mexico on Wednesday that he will not terminate the NAFTA treaty at this stage, but will move quickly to begin renegotiating it with them.

The announcement came after White House officials disclosed that Trump and his advisers had been considering issuing an executive order to withdraw the United States from the trade pact with Canada and Mexico, one of the world's biggest trading blocs.

During his election campaign Trump threatened to renegotiate NAFTA. He recently ramped up his criticism of Canada and this week ordered 20% tariffs on imports of Canadian softwood lumber. Canada said it was ready to come to talks on renewing NAFTA at any time.

The Mexican and Canadian currencies rebounded in Asian trading after Trump said the U.S. would stay in NAFTA for now.

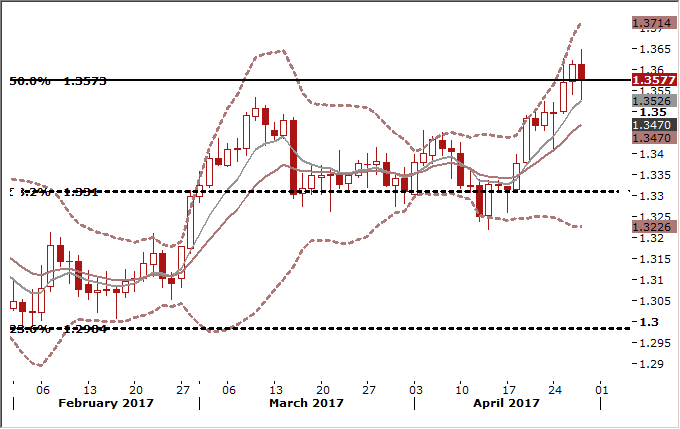

Technical analysis: The USD/CAD broke above the 1.3598 high on December 28 yesterday and is at its highest level since February 24 last year. The pair continued to rise in Asia and recorded a fresh cycle high at 1.3647. Despite a corrective move the USD/CAD remains above 7-day exponential moving average, which suggests that the very short-term outlook is still bullish.

Short-term signal: No position is justified from risk/reward perspective

Long-term outlook: Flat

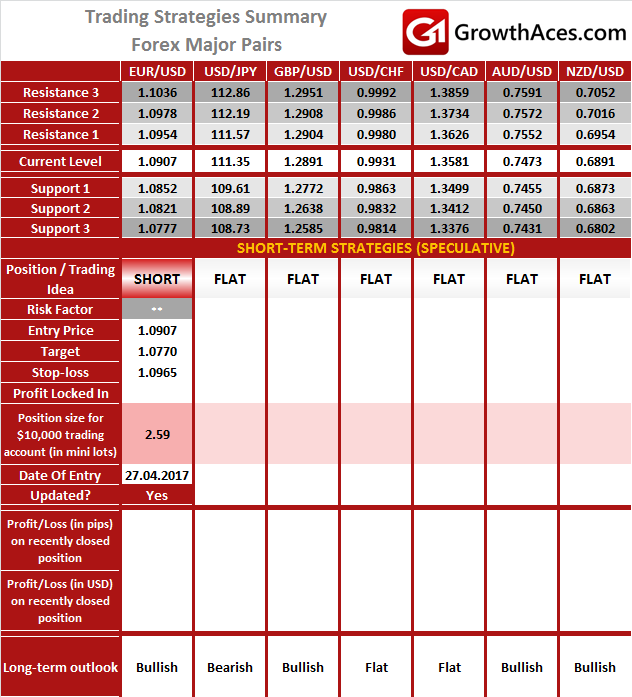

TRADING STRATEGIES SUMMARY:

FOREX - MAJOR PAIRS:

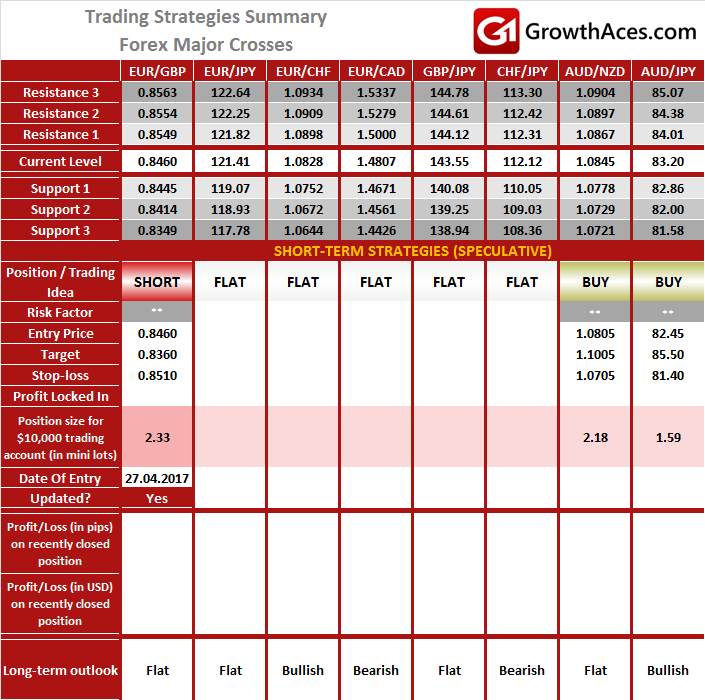

FOREX - MAJOR CROSSES:

Source: GrowthAces.com - your daily forex trading strategies newsletter