EUR/USD: U.S. Economy Accelerates On Higher Exports

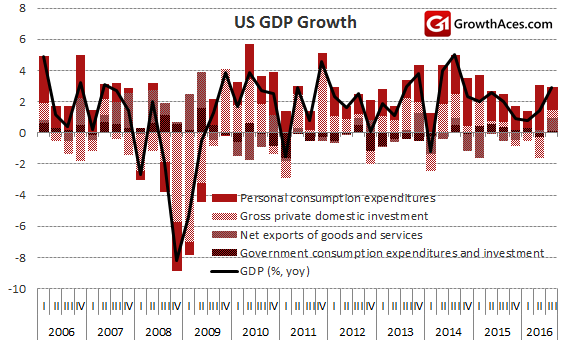

- U.S. GDP increased at a 2.9% annual rate after rising at a 1.4% pace in the second quarter.

- That growth rate was the strongest since the third quarter of 2014 and beat market expectations for a 2.5% expansion pace. Business investment improved last quarter, though spending on equipment remained weak.

- Consumer spending supported the economy in the third quarter by increasing at a 2.1% rate, but down from the second quarter's robust 4.3% pace. With a tightening labor market generating steady increases in wages, spending could accelerate in the fourth quarter. Data on Friday from the Labor Department showed worker compensation rose 0.6% in the third quarter after a similar gain in the second quarter, leaving the year-on-year gain at 2.3%. A separate report on Friday, however, showed consumer sentiment fell in October.

- A surge in soybean exports after a poor soy harvest in Argentina and Brazil helped to shrink the U.S. trade deficit in the third quarter, giving a lift to growth. It is worth noting that soybean-driven export growth spurt could reverse in the fourth quarter.

- Overall exports increased at a 10% rate, the biggest rise since the fourth quarter of 2013. As a result, trade contributed 0.83 percentage point to GDP growth after adding a mere 0.18 percentage point in the April-June quarter.

- Businesses increased spending to restock after running down inventories in the second quarter. Businesses accumulated inventories at a USD 12.6 billion rate in the last quarter, contributing 0.61 percentage point to GDP growth.

- Spending on non-residential structures, which include oil and gas wells, increased at a 5.4% rate, the fastest pace since the second quarter of 2014, after falling in the second quarter.

- Business spending on equipment slipped at a 2.7% rate, dropping for a fourth straight quarter. While the pace of decline has been ebbing as oil prices stabilize and the dollar's rally gradually fades, a strong turnaround is unlikely in the near-term.

- Coming ahead of a Federal Reserve policy meeting next week, the data are unlikely to change views that the U.S. central bank would wait until December, after the November 8 presidential election, to raise interest rates.

- The labor market is near full employment and price pressures have been steadily increasing, raising confidence that inflation will gradually move towards the Fed's 2.0% target.

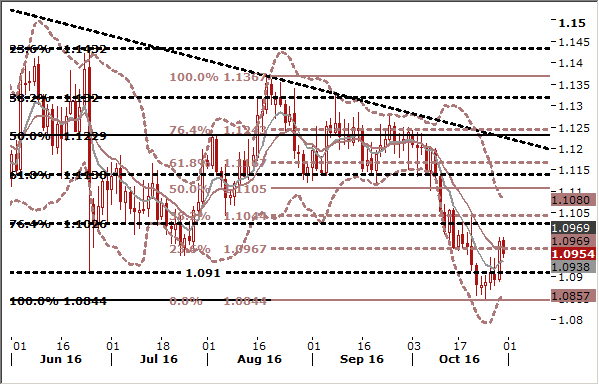

- The EUR/USD rose on Friday despite stronger-than-expected U.S. GDP growth, as investors were taking profits on recent EUR/USD selling positions. We opened EUR/USD long at 1.0905 and are looking for a recovery to 1.1035.

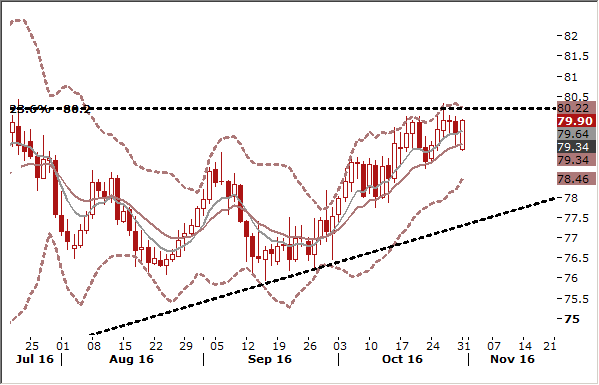

AUD/JPY: Bullish Position Remains Intact

- The Australian dollar was largely flat against the USD today ahead of a central bank policy meeting this week. The Reserve Bank of Australia is likely to keep the official cash rate unchanged at 1.50%, especially after high CPI numbers at home (third quarter 2016). Yet, the AUD may marginally suffer should the bank, in its statement, raise concerns about: 1. the weaker hiring momentum in Australia following the September labor data, which showed a net decline in jobs of 9.8k, mainly in full-time employees. 2. a still strong currency. That being said, the exchange rate is not at levels that would cause a serious headache for the central bank and we still expect a modest strengthening over the medium term on the back of investors continuing to look for yield.

- We keep our long position on the AUD/JPY. The 14-day ema is positively aligned, which highlights the overall bullish structure on the AUD/JPY. We will consider long-term bullish position on this pair.

- We got long on the AUD/USD today at 0.7605. The AUD/USD rebounded from the trendline on Friday. The long tail of Friday’s white candlestick suggest a recovery may be continued in the coming days.