GROWTHACES.COM Forex Trading Strategies:

Taken Positions

EUR/USD: long at 1.0820, target 1.1180, stop-loss 1.0690, risk factor *

GBP/USD: long at 1.4820, target 1.5000, stop-loss 1.4740, risk factor ***

USD/JPY: short at 119.40, target 117.50, stop-loss 120.40, risk factor ***

USD/CAD: short at 1.2650,target 1.2350, stop-loss 1.2790, risk factor ***

AUD/USD: long at 0.7660, target 0.7930, stop-loss 0.7540, risk factor ***

EUR/GBP: long at 0.7295, target 0.7450, stop-loss 0.7220, risk factor *

EUR/CAD: long at 1.3650, target 1.3900, stop-loss 1.3520, risk factor *

Pending Orders

USD/CHF: sell at 0.9700, if filled – target 0.9300, stop-loss 0.9850, risk factor **

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading strategies.

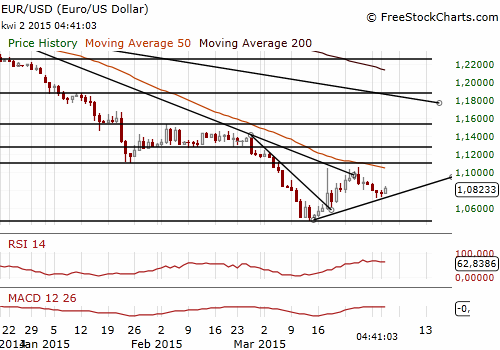

EUR/USD: Long Position Ahead Of Non-Farm Payrolls Could Be A Winning Strategy

(long for 1.1180)

- ADP National Employment Report showed U.S. private employers added 189k jobs last month, the lowest since January 2014. The reading was clearly below the median forecast for 225k. February's private payrolls were revised up to an increase of 214k from the previously reported 212k.

- The ADP figures come ahead of the U.S. Labor Department's more comprehensive non-farm payrolls report on Friday, which includes both public and private-sector employment. The ADP data confirm that March jobs data may be weaker. Our fine-tuned non-farm payroll forecast is at the level of 220k vs. market expectations for 244k. The unemployment rate is expected to have remained at 5.5%.

- We should mention that the market is extremely bearish on the EUR now. Even slightly weaker U.S. non-farm payrolls reading on Friday has the potential to generate a sustainable pullback. In our opinion getting long on the EUR/USD ahead of the tomorrow’s jobs data could be a winning strategy.

- U.S. ISM manufacturing said its index of national factory activity fell to 51.5, the lowest reading since May 2013, from 52.9 the month before. The reading was below expectations of 52.5. The index shows that strong USD is weighing down on the U.S. economy, especially manufacturing sector.

- Atlanta Federal Reserve President Dennis Lockhart (voting this year) expects June-September is a reasonable timeframe to assess rate-increase prospects. He added: “The weakness of the first quarter got my attention. I still believe the factors are transitory.”

- The EUR/USD fall was stopped near 1.0720 and we see a recovery on this pair today after yesterday’s weak U.S. macroeconomic figures. The EUR/USD broke above the 21-dma, which suggests that our previous buy order at 1.0650 has low chances to be filled.

- We do not change our medium-term forecast pointing to a rise in the EUR/USD. In our opinion levels near 1.0800 are still good opportunity to get long as we expect the USD to weaken further, especially in case of much weaker non-farm payroll data tomorrow.

- We have got EUR/USD long at 1.0820 and set the target at 1.1180. We have got also EUR/CAD long at 1.3650 with the target of 1.3900.

Significant technical analysis' levels:

Resistance: 1.0846 (high Mar 31), 1.0858 (10-dma), 1.0900 (high Mar 30)

Support: 1.0713 (low Mar 13), 1.0651 (low Mar 20), 1.0618 (low Mar 19)

Source: Growth Aces Forex Trading Strategies

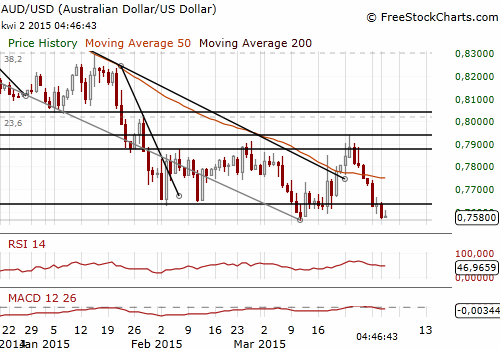

AUD/USD: We Stay AUD Long And Expect The RBA To Keep Rates On Hold

(long for 0.7930)

- Australian trade deficit rose to AUD 1256.0 million in February from AUD 1003.0 million in the previous month. The reading was slightly lower than the median forecast for a deficit of AUD 1300 million.

- The Australian Bureau of Statistics showed total job vacancies rose to 151.7k seasonally adjusted in the February quarter, their highest from late 2012, from 150.5k in the three months to November. That left vacancies up 6.3% yoy. Vacancies in the private sector edged up 0.3% qoq 138.3k. Public sector vacancies rose 5.6%, though at 13,300 they remain at low levels historically. Employment in the public sector had been hit by belt-tightening by both Federal and state governments. The vacancies series are a reliable leading indicator of labor demand.

- Debt markets imply a 77% chance of a quarter point easing on April 7, when the Reserve Bank of Australia holds its policy review. In our opinion the RBA will leave interest rates on hold which would be a strong boost to the AUD. We stay AUD/USD long for 0.7930.

Significant technical analysis' levels:

Resistance: 0.7665 (high Mar 31), 0.7706 (21-dma), 0.7740 (10-dma)

Support: 0.7561 (low Mar 11, 2015), 0.7451 (low May 18, 2009), 0.7335 (low May 6, 2009)