Policy divergence between Fed and ECB may cause EUR/USD to fall below parity in 2016

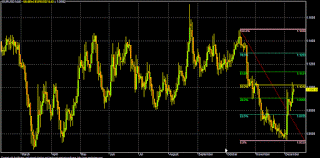

CMP: 1.0955

Sell

TGT: 1.07-1.04*-0.97-0.90 (1-12M/FY-17)

TSL>1.12 (1.11975)

Note: Consecutive closing above 1.12 for any reason, EUR/USD can rally up to 1.15-1.17-1.21 in the alternative scenario (most unlikely).

As we are heading towards December 16th, the Fed Day, market has already discounted to a great extent a "one and off" token rate hike (0.25-0.50%) by Dec'15-Apr'16 and FFR is also projecting around 80% probability of this.

Now the market is looking for FFR guidance in 2016. Will it be "one and off" token lift off or 0.25% increase in every alternate Fed meet to make the FFR 1.25-1.75% by Dec'16-Apr'17?

On the other side, ECB seems to be waiting for real Fed day action and its reaction on EUR/USD. A hawkish Fed will automatically cause EUR to drift towards 1.05 and an ultra hawkish FOMC statement/guidance will cause it towards parity or even below it (0.97-0.90) with out any further ECB QQE.

Considering all the factors like low inflation in US, tepid manufacturing data, strong USD (which is hurting US economy on export front) along with fragile strength of domestic economy, (as inventory built up and trade data suggests) and block buster job reports, Fed may not be ultra hawkish and might go for a token hike this time with slightly dovish tone to keep everything in balance.

Fed may also surprise the street for the December year end factor and they might opt for Feb-Apr'16 hike and they will take excuse for more data to confirm about inherent strength of US economy and do not want to experiment (destabilize) at Dec year end (Geo-Political Factor). In that scenario, it will be also interpreted as lack of confidence of Fed on US/Global/China economy and USD will be again sold.

Also, a strong USD might be acting as a proxy for higher real interest rate itself!

Following Fed rate hike and subsequent FFR guidance, we may see series of rate hikes both in DM and EM to keep the currency interest rate differential in check and to prevent massive USD outflows. Also, China may devalue its yuan as they are now holding a substantial amount of EUR by trimming its USD reserves (in case of ultra hawkish Fed).

For India, without much reform on the ground and political logjam, we may see moderate to massive USD out flows (specially from bonds) and it will be very difficult for RBI to cut rates further in FY-17 in order to keep the USD/INR interest rate differential in check, because further rate cut will cause more USD outflows (in case of ultra hawkish Fed) and USD/INR may break 70 level.

Thus, considering all the EM and DM and its own domestic factors, Fed will not be ultra hawkish in 2016, which is also the US Presidential Election Year and no government will like to go for an election with a disorderly financial market. At best, Fed will go for a token "one and off" rate hike (0.25-0.50%) in 2016. We may also see some targeted small stimulus (negative bank deposit interest rate like in EU or some small QE like China) in US in this 2016 election year to keep the "Main Street" happy, keeping the "Wall Street" in an orderly and healthy condition.

In any way, if Yellen goes for a "one and off" rate hike on Dec-16, EUR/USD will eventually fall to 1.05 area with out any need for "Bazooka" from "Mario Whatever It Requires Draghi" and in that scenario a "Water Pistol" is sufficient for Draghi to keep everyone happy (as 1.08-1.05 zone may be an ideal rate for both EU and German economy).

In case of a Fed surprise (if it does not opt for rate hike for any reason), Draghi has to unleash his sets of "Bazooka" (more QQE) to bring EUR towards his/ECB objective range (1.08-1.05) to stimulate the EU economy.

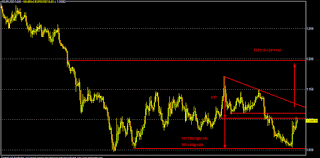

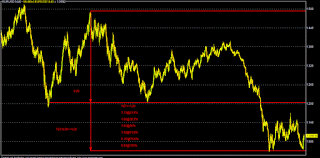

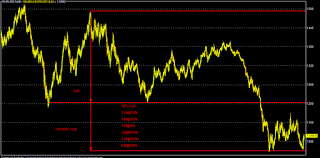

Analytical Charts: