The U.S. dollar should find support and turn higher next week. Metals and miners should break their trendlines/necklines and begin to drop consistently toward their spring targets. The topping process has been prolonged and frustrating, but it's nearly complete.

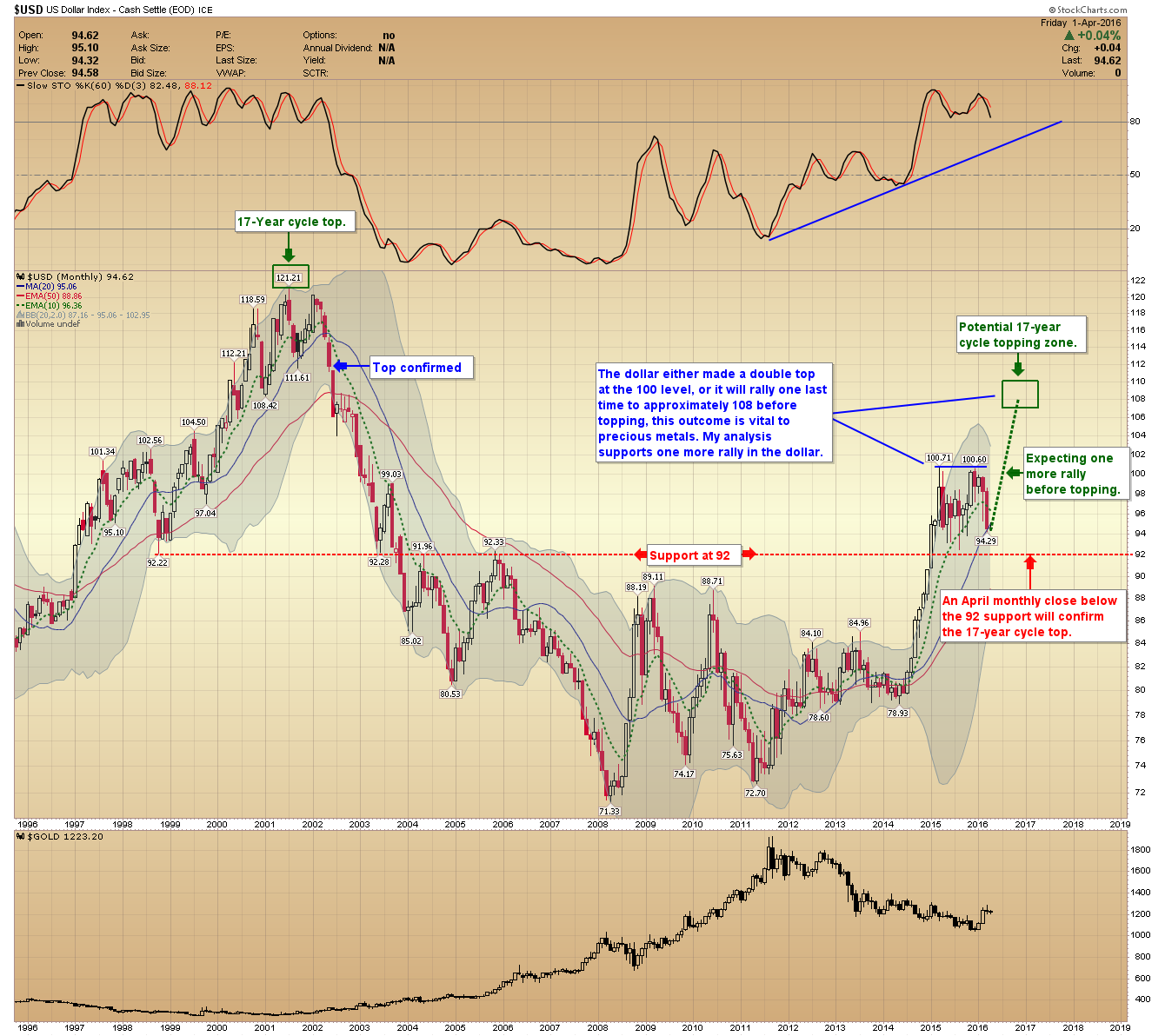

-DOLLAR MONTHLY CHART- The dollar either made a double top at the 100 level, or it will rally one last time to approximately 108 before topping. This outcome is vital to precious metals. My analysis supports one more rally in the dollar.

-US DOLLAR DAILY- Prices are close to entering the green safety zone, and a confirmed price swing next week should produce a significant bottom.

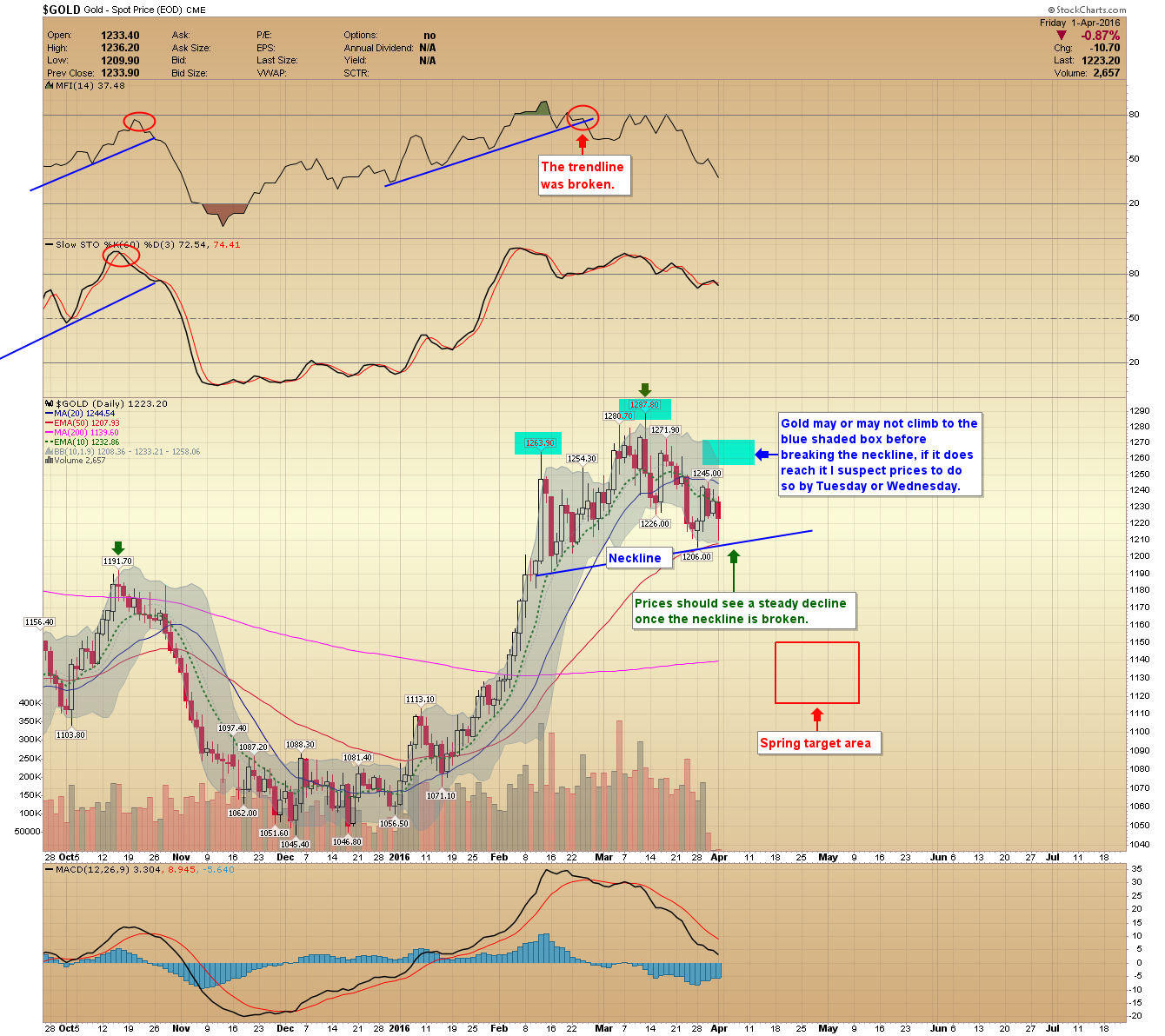

-GOLD WEEKLY- At 17 weeks the intermediate gold cycle is maturing; prices should drop swiftly over the next few weeks into the spring low.

-GOLD DAILY- Gold may or may not reach the blue shaded box (right shoulder) before breaking the neckline; if it does reach it I suspect prices will do so by Tuesday or Wednesday. Prices should see a steady decline once the neckline is broken.

-SILVER DAILY- Prices broke down from the bear flag as described Thursday and successfully closed below the 50-day moving average.

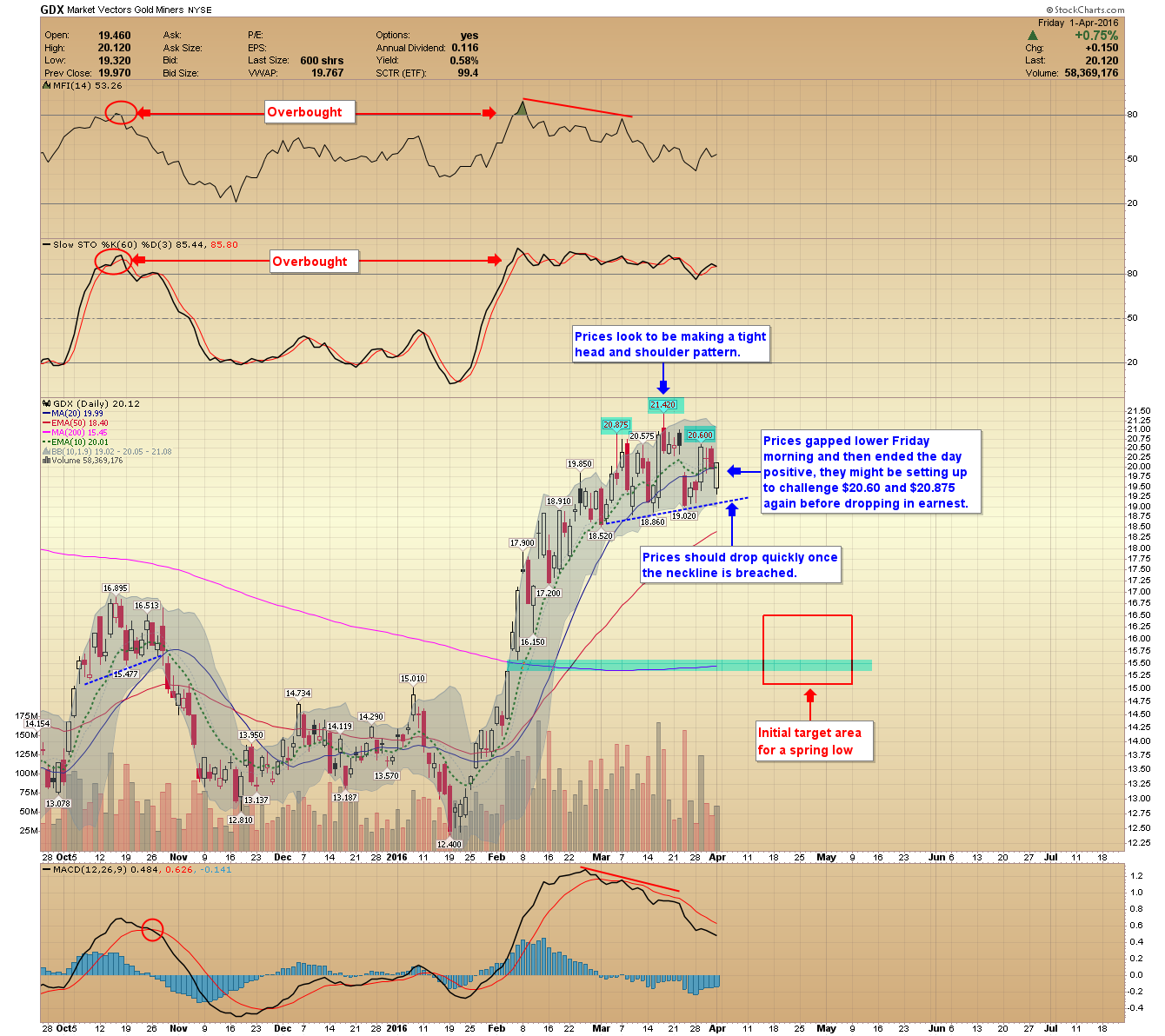

-Market Vectors Gold Miners (NYSE:GDX)- Prices gapped lower Friday morning and then ended the day positive. Prices may be setting up to challenge $20.60 and $20.875 again before dropping in earnest. Prices will drop quickly once the neckline is breached.

It should be an interesting week, but overall prices are expected to drop into a late April to early May intermediate cycle low.