Investing.com’s stocks of the week

Monday starts on the EUR/USD with the long-awaited reversal. Many sellers can say it is just the dead-cat bounce but the thing is that this upswing is not happening in a random place and is supported by a strong technical candlestick pattern.

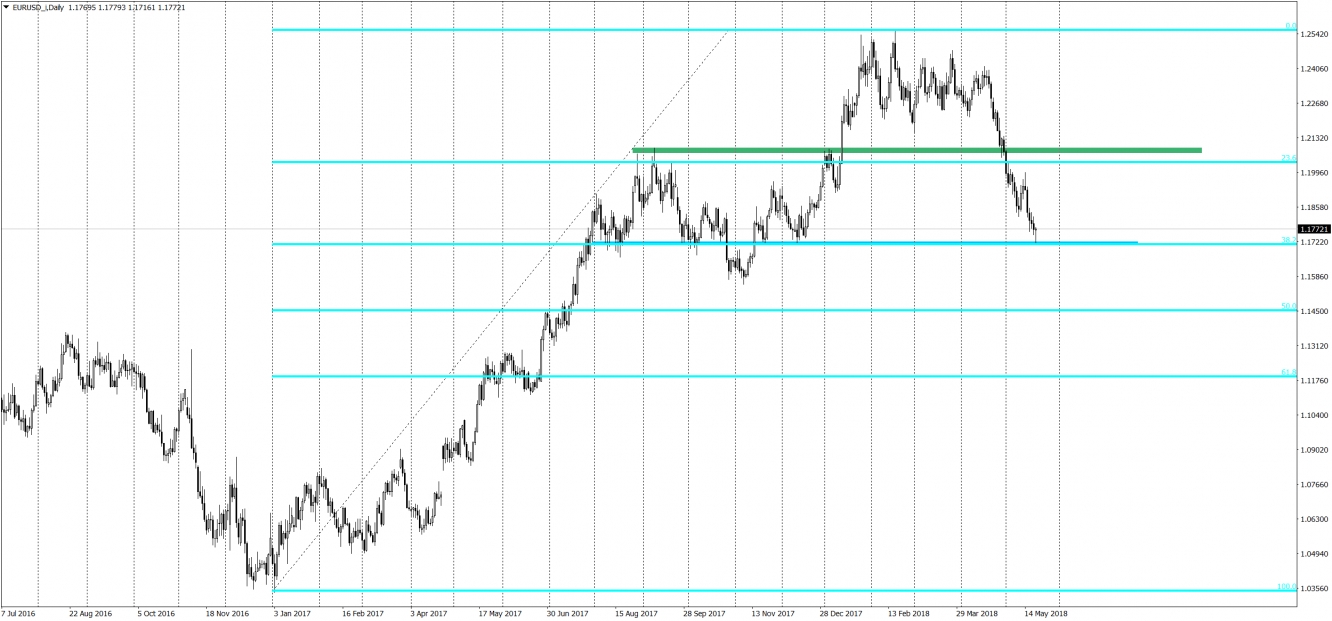

The pair is in the strong downtrend since the middle of April, when the EUR/USD ended the symmetric triangle and went south. Since that, we broke many significant supports and eventually reached the 38,2% retracement of the main up trend, which started in 2017. 38,2% is usually a strong support and it is a case for any instrument and any timeframe. The daily chart on the EUR/USD is no different here. As for now, the price is forming a hammer candlestick pattern, which in theory, can be a first candle of the new mid-term up trend.

The potential target for this rise is the green area around 1.208, which should create an occasion with a desirable risk to reward ratio. One thing though, now we do have a hammer but everything can change during the American session so be aware of that. If buyers will manage to keep this formation alive till the end of the day, that will create a legitimate setup to go long.