Germany and Italy are dark spots on the euro-area economic map.

When EUR/USD has been trading in the range of 1.12-1.18 during the past 9 months, and the Forex volatility is down to the lowest levels since 2014 amid high geopolitical risks and a decline in global GDP growth, it looks at least strange. Macroeconomic instability should generate strong volatility of foreign exchange rates; however, the rally of stock indexes eases the concerns about a slowdown in global GDP growth, and the central banks’ easy monetary policies provide investors with basic necessities, the liquidity. It looks like Forex is sleeping, but it is not so in fact.

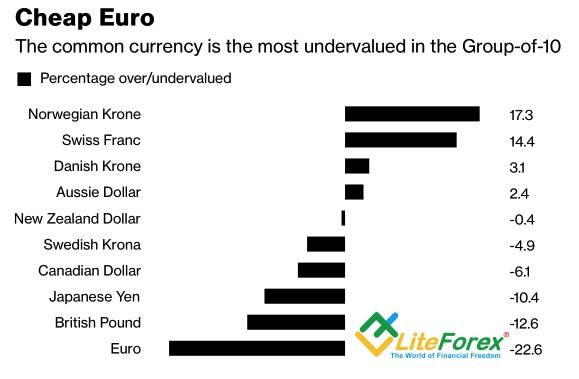

The further trend of EUR/USD will depend not only on macroeconomic statistics and trade wars but also on whose change in the policy course, that of the Fed or the ECB, will be taken more seriously by investors. According to MUFG, the end of monetary normalization by the Federal Reserve looks to be a more significant event, then the ECB hints at its easing. In addition, the euro is undervalued, from the point of view of purchasing power parity, so, it makes some sense to go long.

Estimation of G10 currencies, based on purchasing power parity

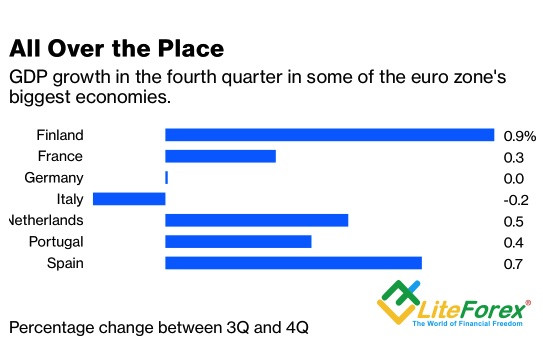

It is remarkable that the euro’s advantage may emerge from its weakness. Since the euro area appeared, they have been discussing the euro vulnerability because of the diversity of the euro-area economies. Now, on the contrary, different growth patterns may work to the EUR/USD bulls’ advantage. We are used to discussing the problems of Italy, and Germany, being on the verge of recession; but if you look at Spain, Finland, the Netherlands, and other countries, the situation doesn’t look like a disaster.

GDP growth in eurozone’s economies

Rome suffers form fiscal consolidation, Berlin – from trade wars; however, the stabilization of Italian financial markets and investment promotion in Germany can improve the situation. According to the Bundesbank, nothing scary is going on at all. Some temporary troubles, including the challenges of car industry, are gradually vanishing, but the strong labour market and the steady growth of wages, in addition to the fiscal stimulus, are likely to support the consumption rise. The eurozone seems to have reached the bottom and is able to recover, followed by the euro growth. Provided, of course, there aren’t any new troubles.

I mean a potential boosting of US tariffs on car imports. If Donald Trump increases them up to 25%, then, according to the German institute, IFO, it will reduce German car exports by 7.7%, or by €18.4 billion. The production volume in the automotive sector will be 5% down, which is worth €7 billion. The EU is willing to equally retaliate to the USA, having already prepared the list of products worth €20 billion. A new round of trade wars doesn’t suggest anything positive for the euro-area economy; what seemed to be the bottom may in fact become a drain to the sewage system. It is rather hard for the EUR/USD bulls to go on for a counter attack, being challenged by the US tariffs on the eurozone’s cars. Negative, sent by trade wars, will encourage the EUR/USD bears to once again test the bottom of the consolidation range of 1.1265-1.1485.