Investing.com’s stocks of the week

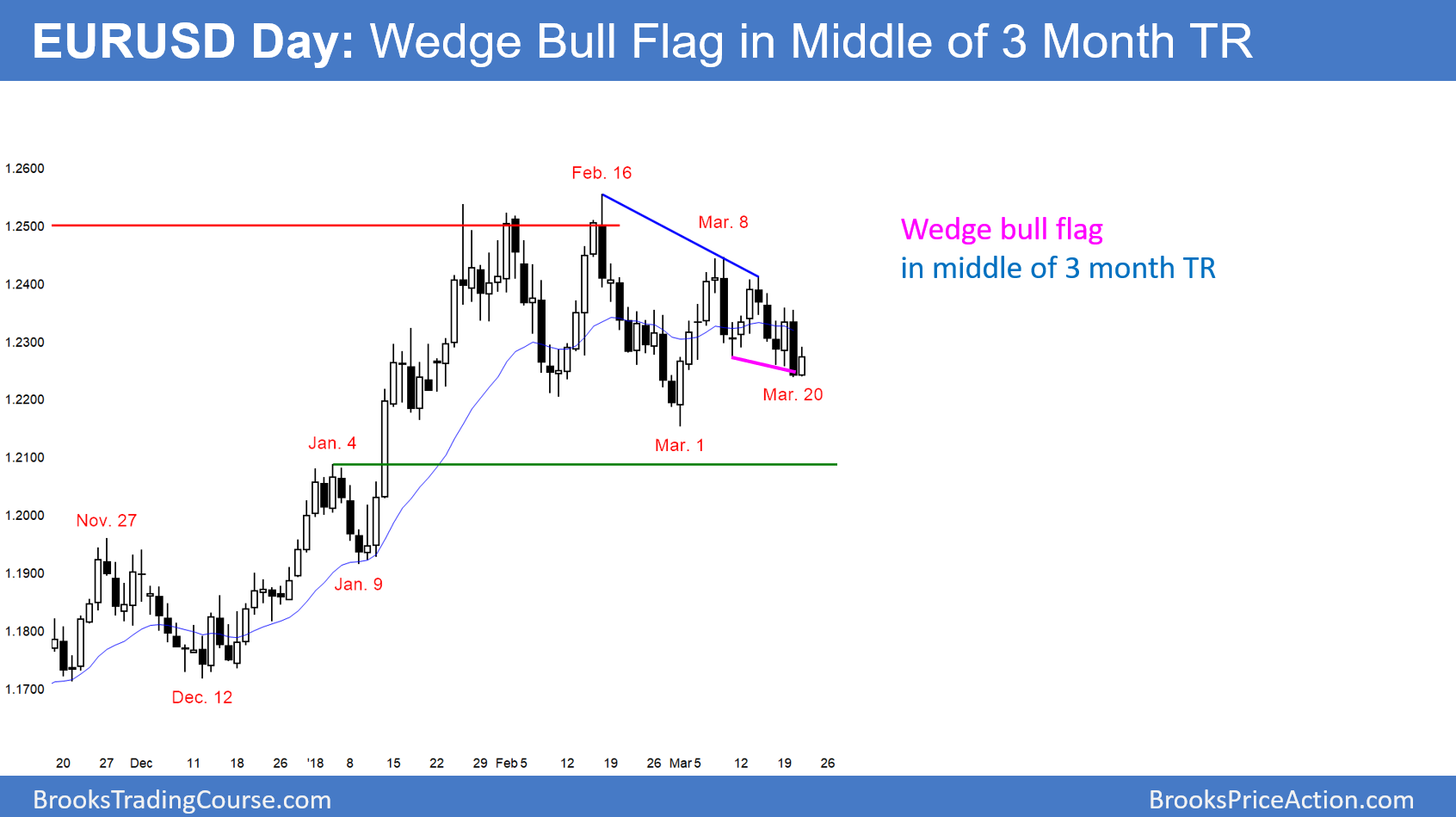

Over the past 3 weeks, the EUR/USD daily Forex chart has pulled back from a 6 day rally. The pullback has 3 pushes down and is therefore a wedge bull flag. However, it is in the middle of a 3 month trading range. That lowers the probability of a bull breakout.

Today’s FOMC announcement that will probably lead to a big move up or down on the EUR/USD daily Forex chart. It is more important than any current chart pattern. This is especially true because the daily chart is in the middle of a 3 month trading range. Neither the bulls nor the bears have had an advantage that lasted more than a week.

No matter what happens this morning, the 11 a.m. PST FOMC announcement will overwhelm all early movement. A small wedge bull flag means that there is a higher probability of at least a few days up over the next week. Yet, the probability is much closer to 50% because of today’s FOMC meeting. That means that there is also almost a 50% chance of a bear breakout below the bull flag and then a swing down to the March 1 low instead of up to the March 8 high.

Overnight EUR/USD Forex trading

The EUR/USD 5 minute Forex chart has been in a 30 pip range over the past 6 hours. While yesterday’s selloff was strong, the 50 pip rally up from yesterday’s low created confusion. The result is that a trading range is likely this morning. Also, since the FOMC announcement is so important, most day traders will take quick profits until the news. Therefore the odds of a big swing up or down this morning are small. In addition, most will stop trading about 30 minutes before the report.

However, surprises happen. If there is a strong breakout up or down in the next couple of hours, traders will hold for a swing. But, day traders should exit all positions before the report. Furthermore, 50% of FOMC reports create breakouts that reverse. Hence, day traders should wait for at least 10 minutes after the 11 a.m. PST report before resuming trading.