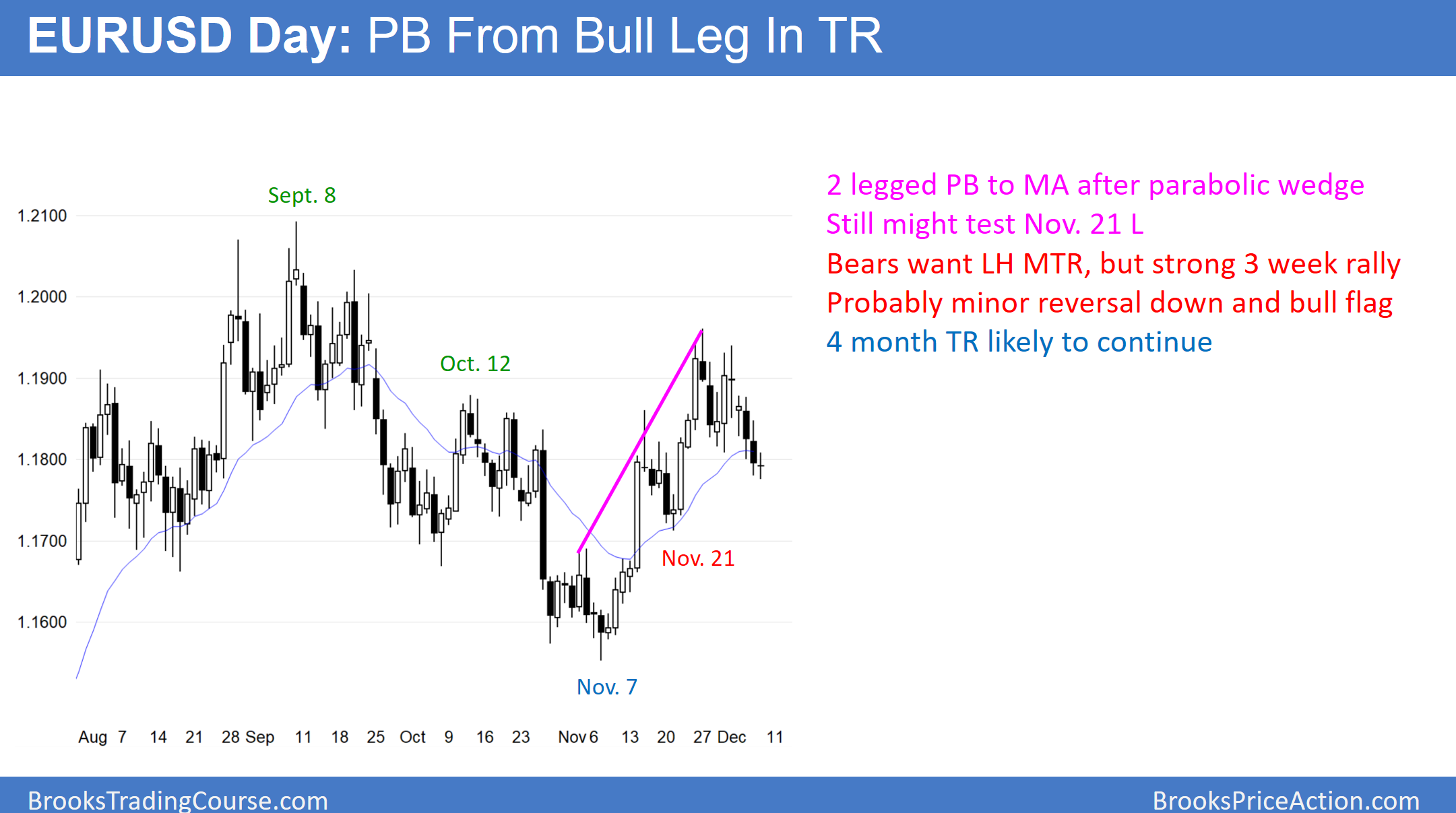

The EUR/USD daily Forex chart has sold off for 2 weeks from a wedge top. However, the selloff has many small bars with prominent tails.

In addition, it is at the 20-day exponential moving average and above the most recent major higher low. It is therefore more likely a bull flag than a bear trend.

The pullback on the daily EUR/USD chart continues to grow. There is a 50% chance that it will fall to the November 21 low before the bulls will again buy aggressively. The lack of big bars up or down is a sign of complacency. It means that the market is waiting for more information. Tomorrow’s Congressional vote on a continuing budget resolution and the upcoming vote on Trump’s tax reform both have important financial implications. Either could lead to a big move up or down in all financial markets. Therefore, all are trying to get neutral before the votes.

Since the daily chart is in the middle of a 5-month trading range, the most likely thing that it will do after the votes is stay within the range. This is because most attempts to break out of trading ranges fail.

Overnight EUR/USD Trading

The EUR/USD 5-minute Forex chart has had a small range overnight. Since this 2-week selloff is a bull flag and it is at support, bulls will look to buy for a swing up. The 240-minute chart is in a wedge bear channel and above the November 21 major higher low. The odds favor a bull breakout today or tomorrow.

Whenever the odds favor one direction, traders always need to be ready for the opposite. Therefore, there might be a strong bear breakout below the bull flag. The daily chart is in breakout mode. While a wedge bull flag has a 60% chance of a bull breakout, there is a 40% chance of a bear breakout. Day traders will continue to scalp until the breakout comes. Yet, they need to be prepared for a swing trade up or down.