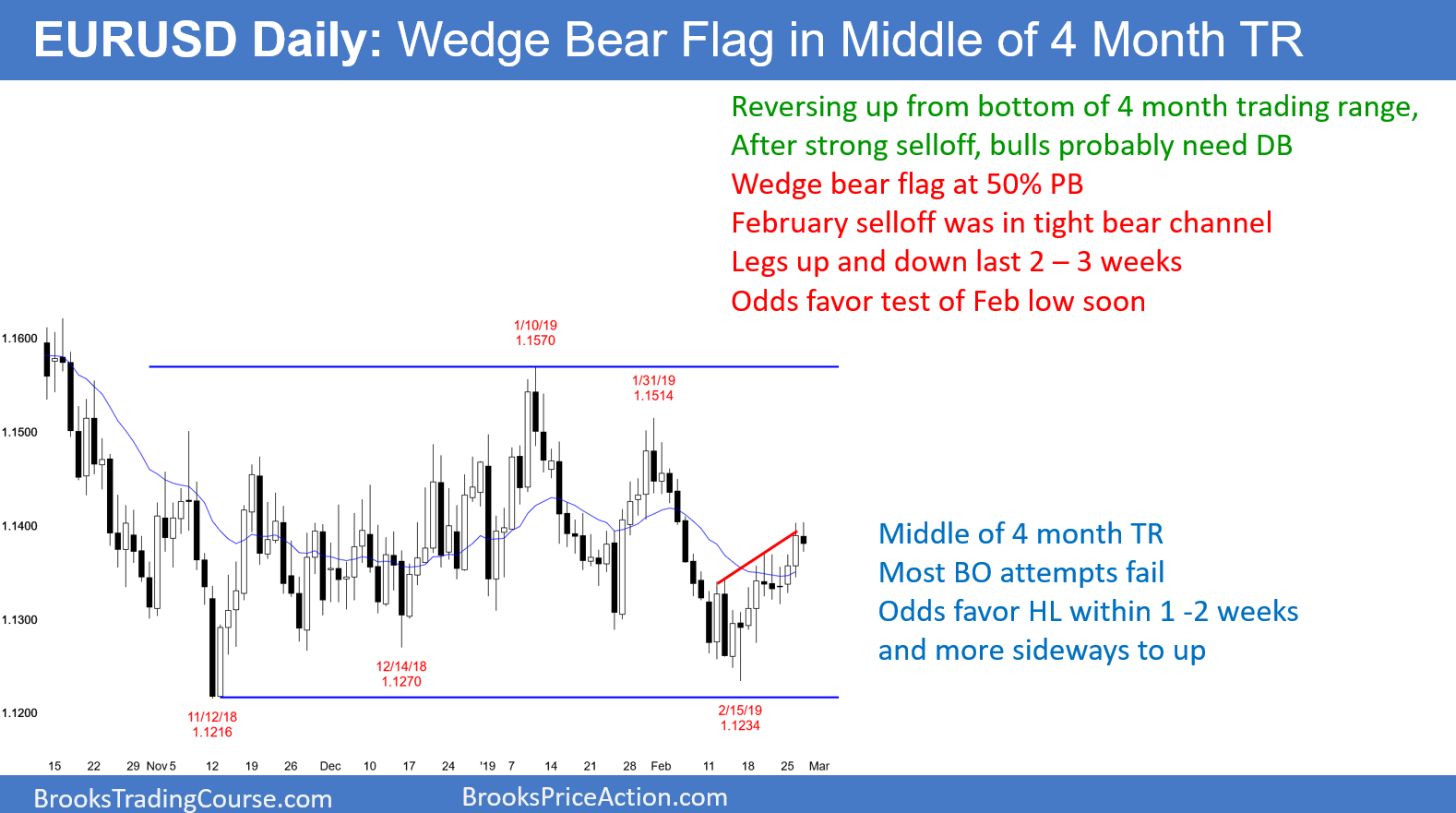

The EUR/USD daily Forex chart is back to the middle of its 4 month trading range. Legs up and down have lasted 2 – 3 weeks. This leg will probably end soon.

The February selloff was unusually strong. When that is the case, the bear low typically gets tested. Consequently, the daily chart will probably begin retrace at least half of the 3 week rally within a week.

While the February selloff was strong, so were many of the rallies over the past 4 months. Trading ranges always have legs that look like they will begin a trend. But, a hallmark of a trading range is disappointment.

When traders see strong legs repeatedly reversing, they correctly conclude that reversals are more likely than breakouts. As a result, they exit trades within 2 – 3 weeks and look for a trade in the opposite direction. That will probably happen within the next few days.

The daily chart is in Breakout Mode. It is waiting for information from Brexit. Once the future is clear, there will be a trend up or down. A reasonable goal is a 300 – 400 pip measured move based on the height of the 4 month range.

The breakout can be up or down. Finally, there is a 50% chance that the 1st breakout will reverse and there would then be an opposite breakout.

Overnight EUR/USD Forex Trading

The 3 week rally has had 3 legs up. It is therefore a wedge bull channel. A wedge bull channel typically breaks to the downside and sells off for a couple legs. The swing down will probably begin this week.

There is a 40% chance of a bull breakout above a wedge bear flag. That then usually leads to a couple legs up. A measured move up from here is at the top of the 4 month range.

The 5 minute chart has been in a 30 pip range overnight after yesterday’s bull breakout. The odds are that the daily chart will start to turn down within a few days. Consequently, day traders will continue to scalp, but look for a downside breakout. Once they see it, they will swing trade. In addition, they will be more willing to sell rallies than buy dips for a week or two.

Less likely, the bulls will get the upside breakout. If so, day traders will be more eager to buy dips than sell rallies.