EUR/USD approached 1.1300 in mid-July on bets that the Fed would soon announce a pause and the ECB would have to keep hiking. Fast-forward to today, the pair is down for the eleventh week in a row and is now trading below 1.0500. The Fed did skip a raise in September but still persists in its hawkish tone. The ECB signaled that it was likely done tightening after its 10th interest rate hike in a row.

What should be immediately obvious is that none of the central banks’ decisions were as expected. What exactly would Jay Powell and Christine Lagarde do was impossible to predict. How then, was it possible to stay ahead of the collapse we saw in EUR/USD during the past two months? The answer has nothing to do with interest rates. It was all about the patterns, which the market itself had drawn. Let’s take a look.

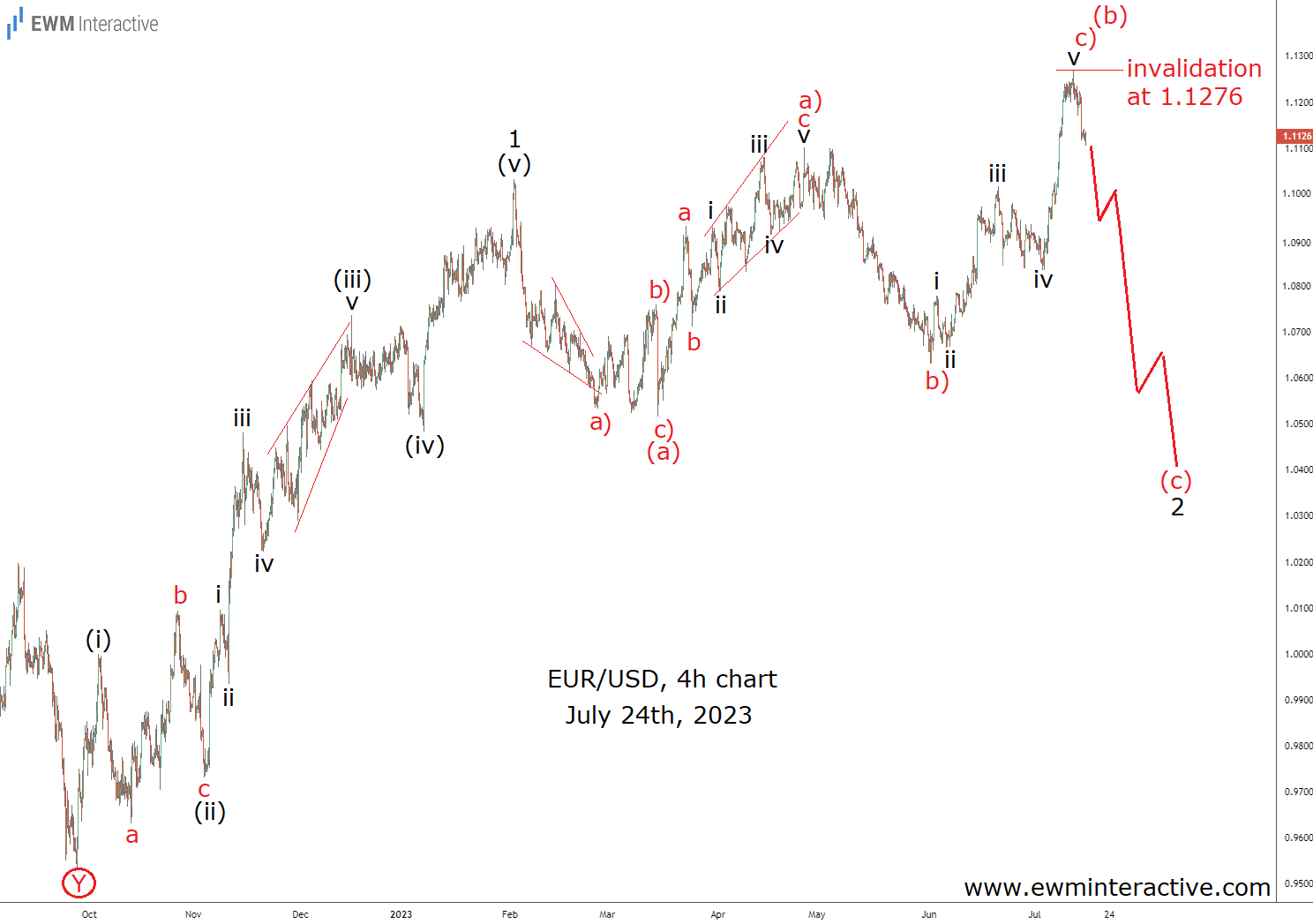

According to this count, the recovery from 0.9536 to 1.1033 was a five-wave impulse, labeled (i)-(ii)-(iii)-(iv)-(v). Wave (ii) was a running flat correction and the five sub-waves of wave (iii) were also visible. The Elliott Wave theory states that a three-wave correction follows every impulse.

And indeed, a drop to 1.0516 unfolded between early February and mid-March. It was far too shallow, though, so we always kept in mind that it might be only wave (a) of a bigger retracement. The following rally to 1.1276 in mid-July was a three-wave sequence. This meant that the only way the correction would be still under construction was if it was an expanding or a running flat.

Given that the expanding variety is a lot more common, we thought that targets below 1.0500 are plausible in wave (c). This might have been an alternative count back then, but its risk/reward ratio was hard to resist. Not to mention that after a complete i-ii-iii-iv-v impulse in wave c) or (b) up, a corrective pullback to at least 1.0900 was supposed to occur anyway.

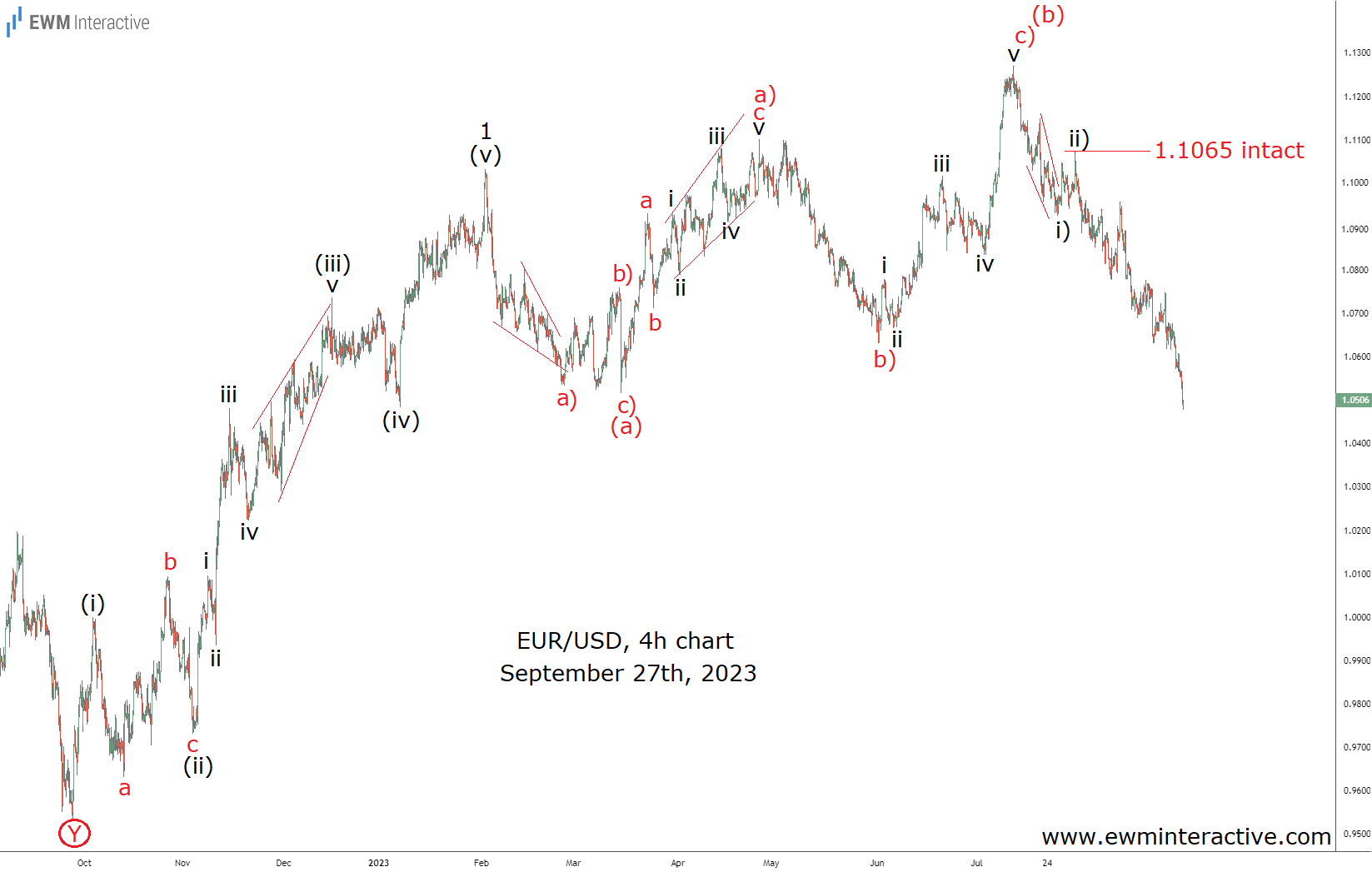

By mid-August, when EUR/USD was already down to 1.0947, the count above turned from just a tradeable alternative to our primary scenario.

The drop from 1.1276 to 1.0912 looked like a leading diagonal in wave i) of (c), followed by wave ii) up to 1.1065. This mark became our new stop-loss level. 1.0500 was still there for the taking by the bears as wave (c) was supposed to evolve into a much bigger selloff. And evolve it did. Earlier today, EUR/USD touched 1.0488. More importantly, 1.1065 remained intact the entire time.

Wave (c) just dragged EUR/USD below the bottom of the wave (a), technically fulfilling the requirements for an expanding flat correction. The initial bearish target, which Elliott Wave analysis helped us to identify two months ago, has now been reached. And the best part was that it wasn’t necessary to monitor every piece of economic data or follow every central banker’s comment. All it took was an eye for patterns and a good understanding of the possible Elliott Wave scenarios. Ah, and some patience.