- Hot Canadian inflation report sees USD/CAD sink to known support level

- EUR/USD whipsawed by geopolitical headlines; near-term bullish bias retained

Overview

Canada’s inflation report was a little too hot to handle, helping the short USD/CAD setup suggested on Tuesday reach its target. Meanwhile, the EUR/USD long setup’s conditions weren’t met, though a bullish pin candle hints at potential upside ahead.

With a quiet macro calendar, we revisit USD/CAD and EUR/USD trade setups to evaluate what could happen next.

Inflation Dents BoC Follow-up 50 Odds

Canada’s inflation report delivered a clear upside surprise, significantly reducing the odds of another 50bps hike from the Bank of Canada next month. Headline inflation rose to 2%, above the 1.9% forecast, while core inflation climbed to 2.55%, exceeding the expected 2.4% and moving further away from the BoC’s end-2024 forecast of 2.3%.

Source: TradingView

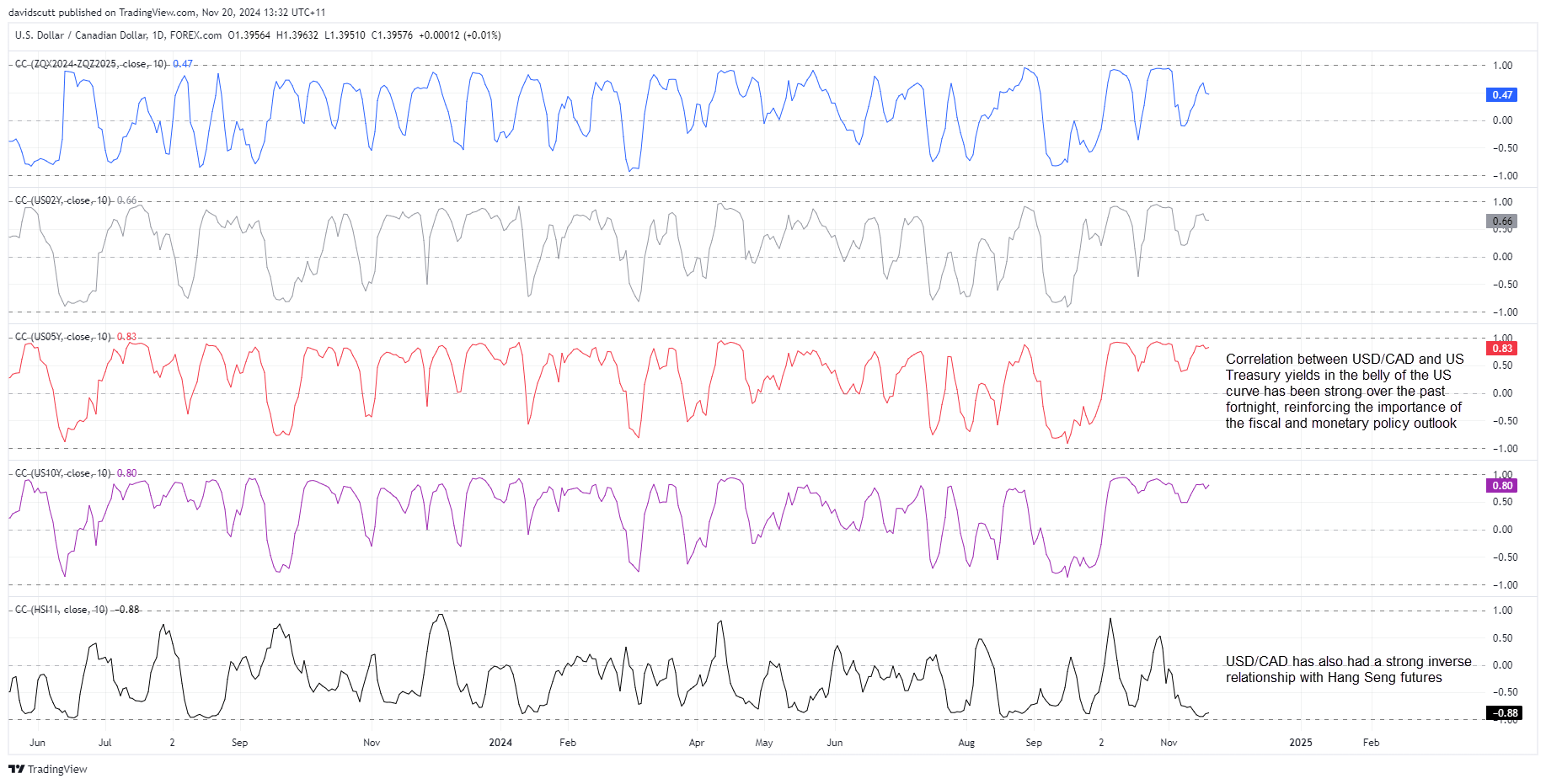

Arguably, traders could have reacted more to the data, if domestic factors were in the driving seat. But they’re not. U.S. rate expectations and Treasury yields remain the dominant market drivers, with USD/CAD’s response echoing moves seen in the Kiwi and Aussie dollars.

With the report in the rearview mirror, that’s what traders should be paying attention to when evaluating USD/CAD setups. It’s also been strongly inversely correlated with Hang Seng futures recently, hinting China sentiment is something to watch, especially regarding proposed US tariffs.

Source: TradingView

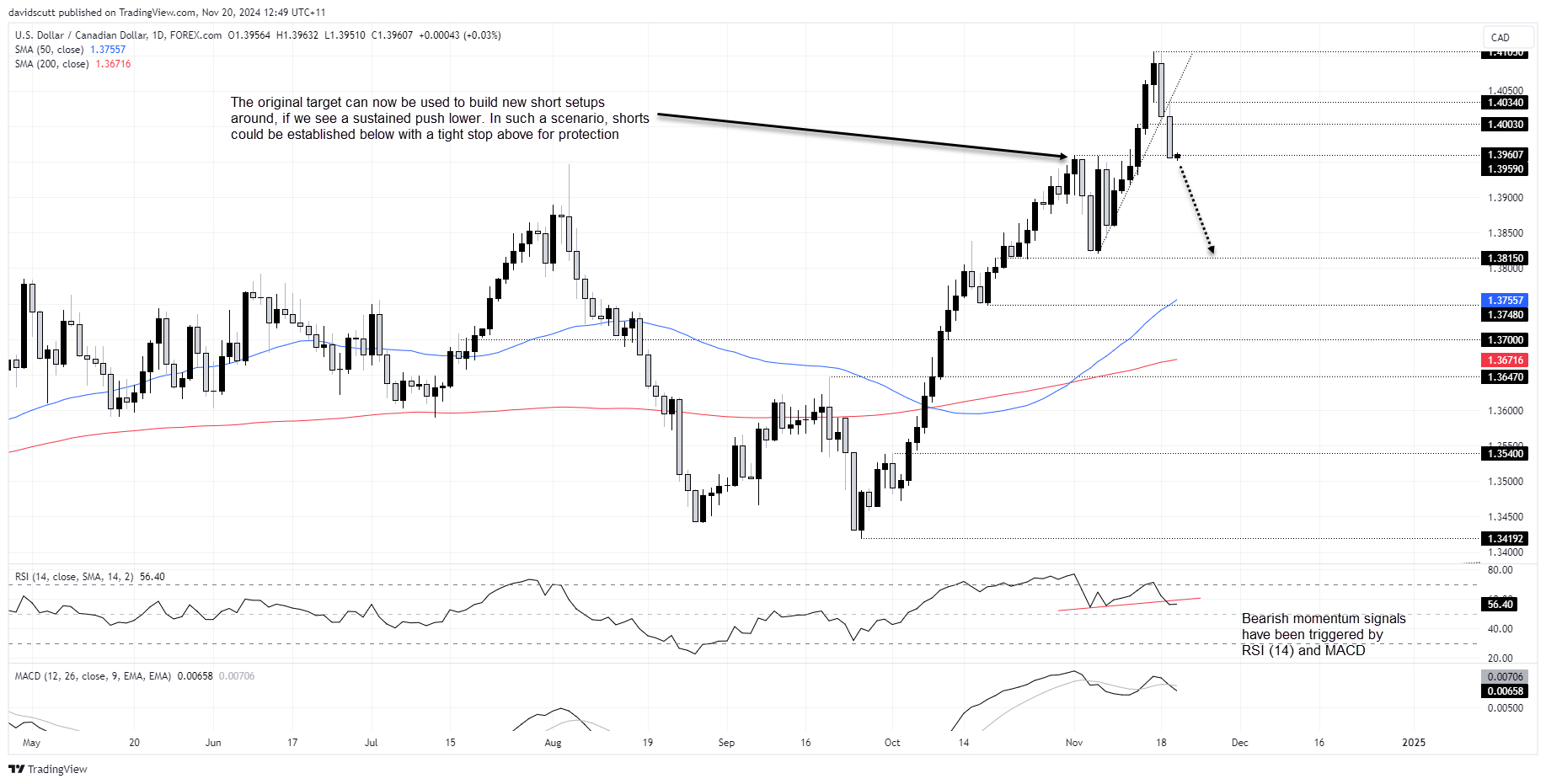

Not that the USD/CAD short setup has reached its target of 1.3959, it’s time to look at fresh trades involving the pair. From a momentum perspective, the picture has turned bearish with RSI (14) breaking its uptrend while MACD has crossed over from above, confirming the signal. Selling rallies is favoured in the near-term.

However, to get excited about an extended bearish unwind, it would be preferable to see the price push below 1.3959 and hold there, allowing for shorts to be set beneath with a tight stop above for protection.

There’s little to speak of until you get towards 1.3825, the double-bottom of early November. There’s also 1.3815, a minor level that acted as support and resistance in October. They are two potential targets.

EUR/USD Whipsawed by Headlines; Bullish Bias Retained

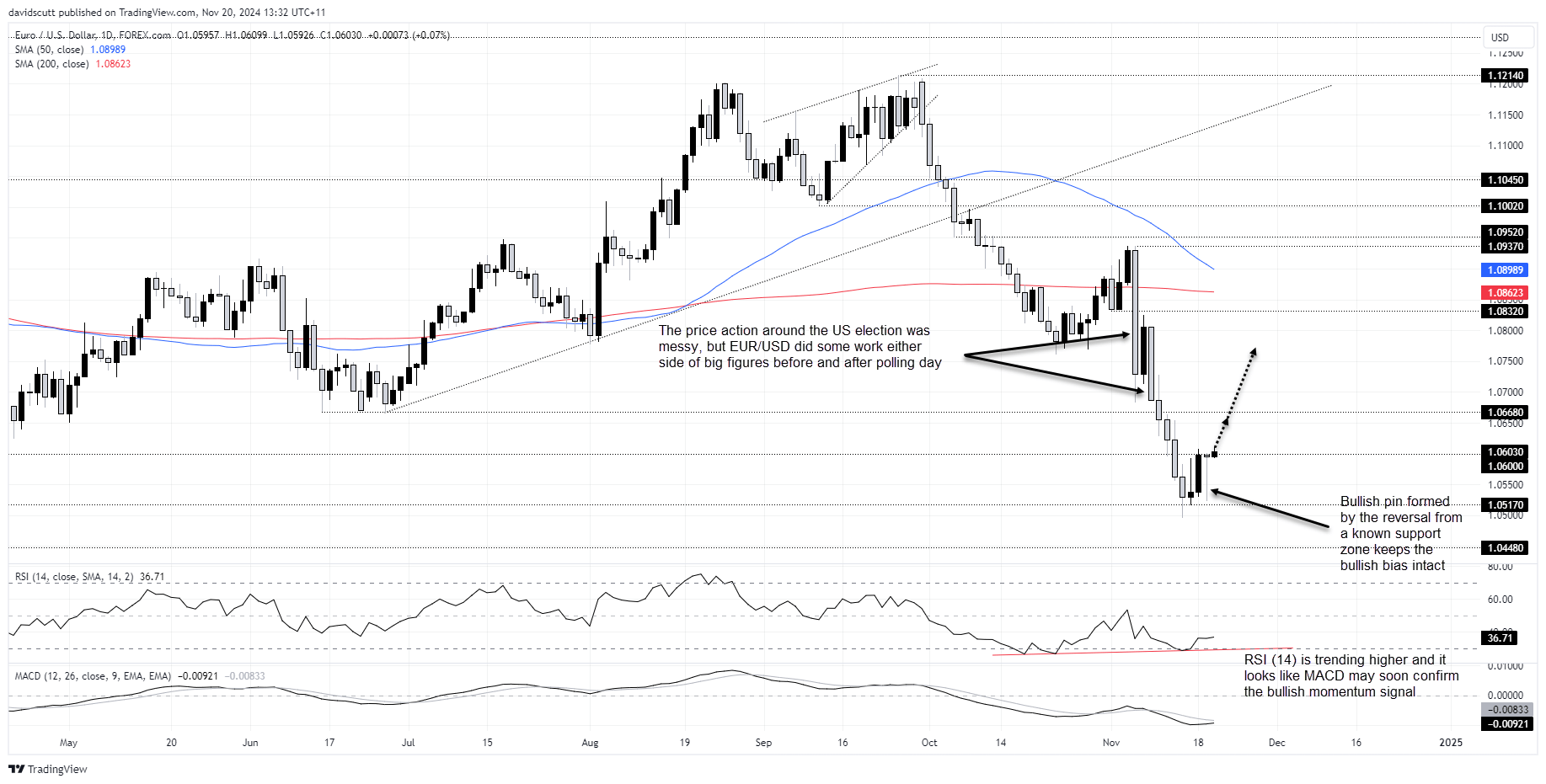

The EUR/USD long setup tied to a morning star pattern wasn’t triggered, as the price failed to break and hold above 1.0600 during the session. Instead, geopolitical headlines caused a knee-jerk selloff before a sharp reversal toward the close.

The bullish pin candle that bottomed just ahead of a known support zone hints that downside may be difficult near-term without a major left-tail-type event. As such, the same initial setup remains in play.

Source: TradingView

If we were to see EUR/USD push and hold above 1.0600, longs could be established above with a tight stop below for protection. It’s already had a look in Asia but it’s unlikely we’ll see a definitive break in this time zone; that’s more likely to be a European session story.

1.0668 is the first target with a break above that level opening the path for a potential push towards 1.0700, 1.0800 or 1.0832, three levels the price did some work either side of during the prolonged downside flush of November.

The signals from RSI (14) and MACD are mixed, although it looks like the latter may soon crossover from below, confirming the bullish signal from the former.