- EUR/USD dived beneath medium-term uptrend line

- Remains well below 200-day SMA

- Momentum oscillators extend bearish bias

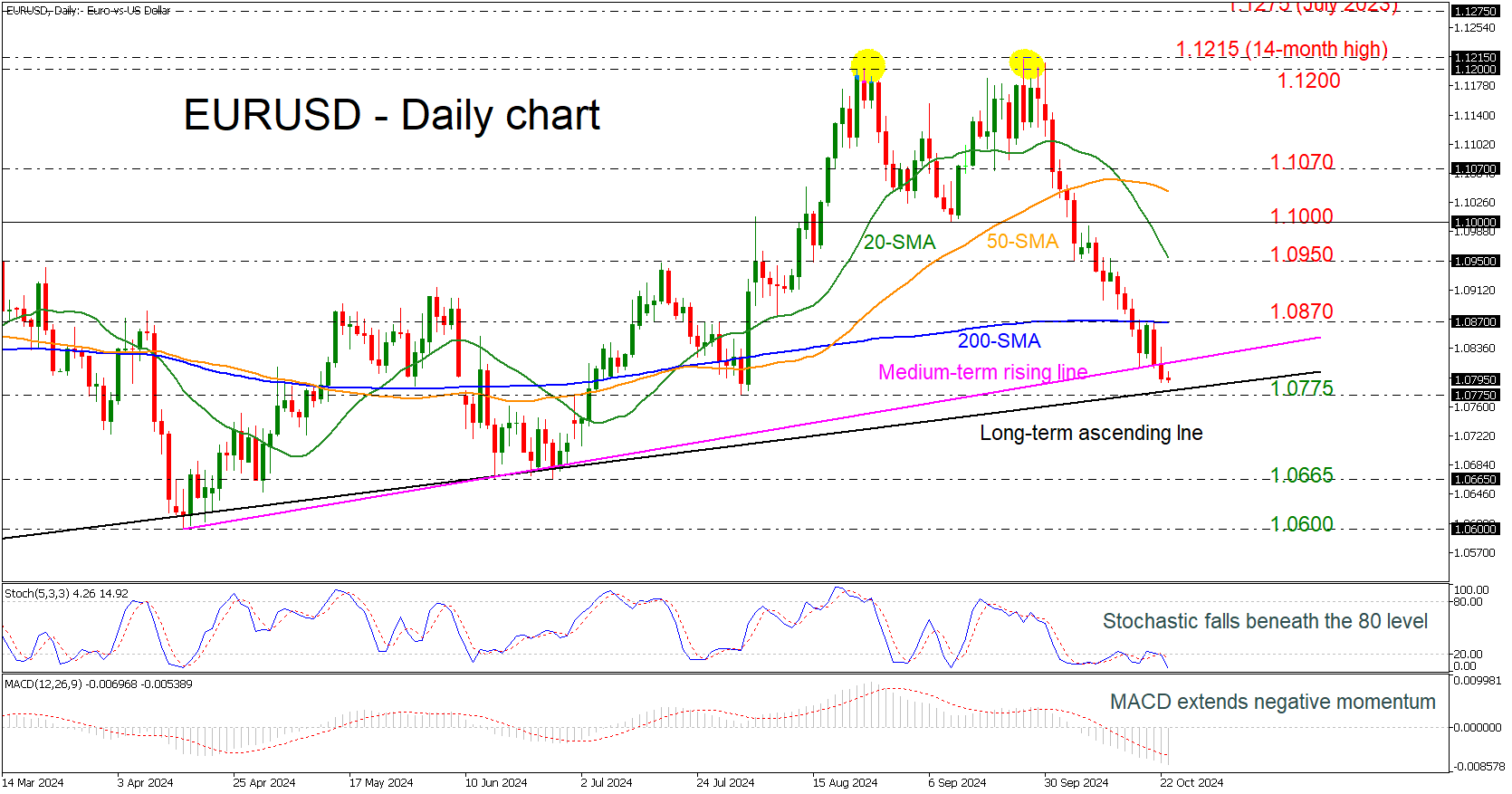

EUR/USD tumbled beneath the medium-term ascending trend line, meeting a fresh almost three-month low below the 1.0800 round number. The pair lost 3.8% from the pullback at the 1.1215 resistance level, with the technical oscillators extending their negative momentum. The stochastic is still falling in the oversold territory, while the MACD is holding well below its trigger and zero lines.

If the market retreats further and the bears break the long-term uptrend line and the 1.0775 support, then they may switch the broader bullish outlook to bearish, flirting with the 1.0665 and the 1.0600 key levels.

In the positive scenario, a closing session above the 200-day simple moving average (SMA), which overlaps with the 1.0870 barrier, could drive traders toward the 1.0950 resistance. Moving higher, the 1.1000 psychological mark could halt upside movements.

In summary, the short-term view of EUR/USD has been strongly negative since the end of September. However, a successful decline below the long-term rising trend line could shift the overall positive picture to a negative one.