The EUR/USD pair declined to 1.0504 on Thursday, influenced by investor reactions to the latest US inflation data.

The November US Consumer Price Index (CPI) showed a rise of 0.3% month-over-month, aligning with forecasts but indicating a slight acceleration from the previous 0.2% increase. This recent uptick has adjusted market expectations significantly, reducing hopes for a substantial interest rate cut by the Federal Reserve in the upcoming meeting. According to CME Watch, the likelihood of a 25-basis-point cut is now pegged at 94%.

US inflation stands at 2.7% year-on-year, slightly up from 2.6%, suggesting persistent inflationary pressures despite elevated interest rates. This scenario indicates that consumers remain active, which could complicate the Federal Reserve’s monetary policy strategy.

Meanwhile, the political situation in France has been factored into the EUR/USD rates, though some underlying tensions persist.

Attention now turns to the European Central Bank (ECB), whose interest rate is 3.4%. Market participants are keenly awaiting whether the ECB will adjust rates in its upcoming meeting.

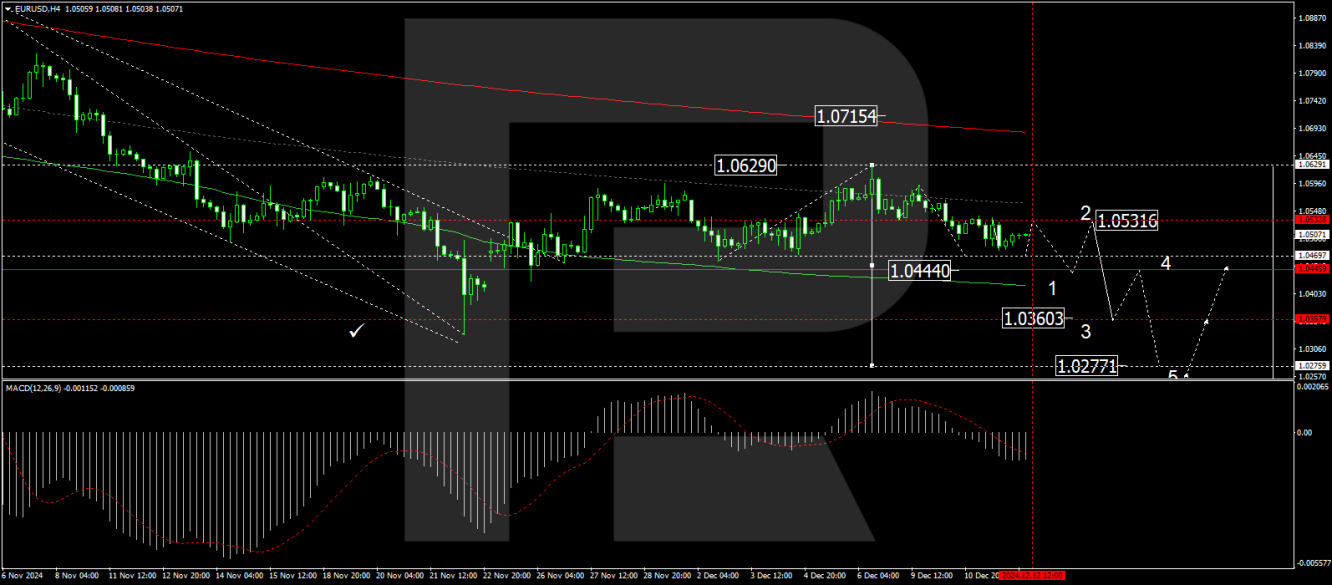

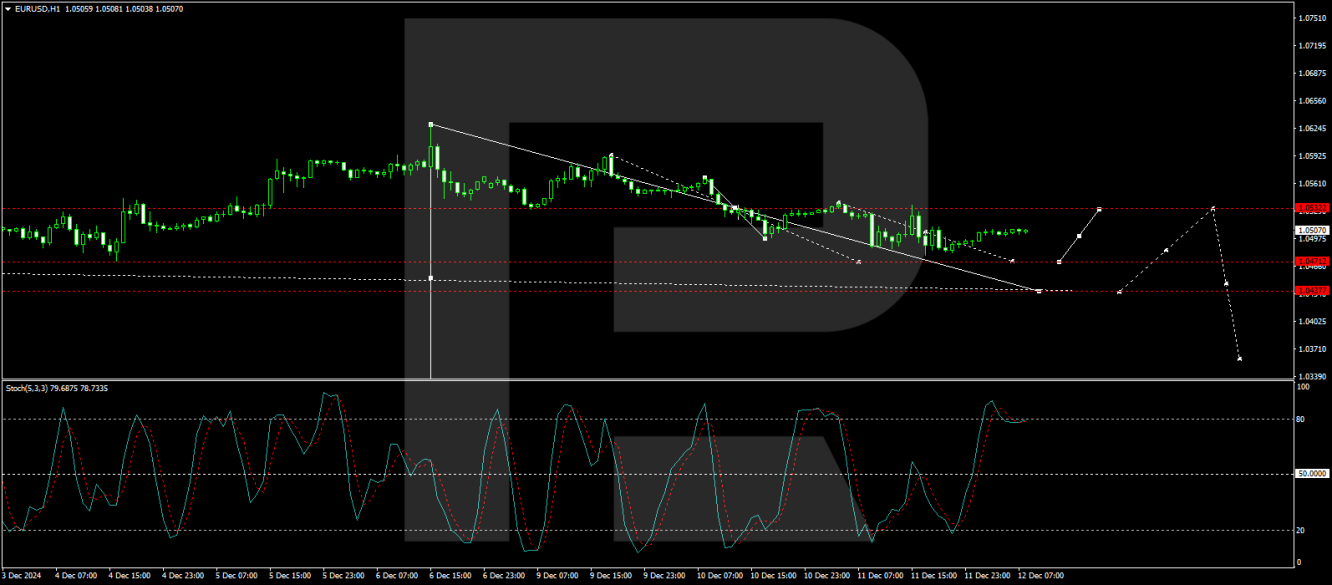

Technical analysis of EUR/USD

H4 chart: the EUR/USD has recently completed a decline to the level of 1.0479 and appears poised to continue this downward trend towards 1.0470. Following this, a corrective move to 1.0535 is anticipated, and once this is complete, another decline to 1.0444 could follow. This bearish outlook is supported by the MACD indicator, with its signal line positioned below zero and trending downwards, indicating continued selling pressure.

H1 chart: the pair is developing a downward structure towards 1.0470, currently consolidating around 1.0505. A breakout below this level could lead to reaching the target level of 1.0470. Subsequently, a rebound to 1.0535 might occur, followed by a further decline to 1.0444. This scenario is supported by the Stochastic Oscillator, with its signal line above 80 but poised to drop towards 20, suggesting a potential shift from overbought conditions to lower levels.

By RoboForex Analytical Department

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.