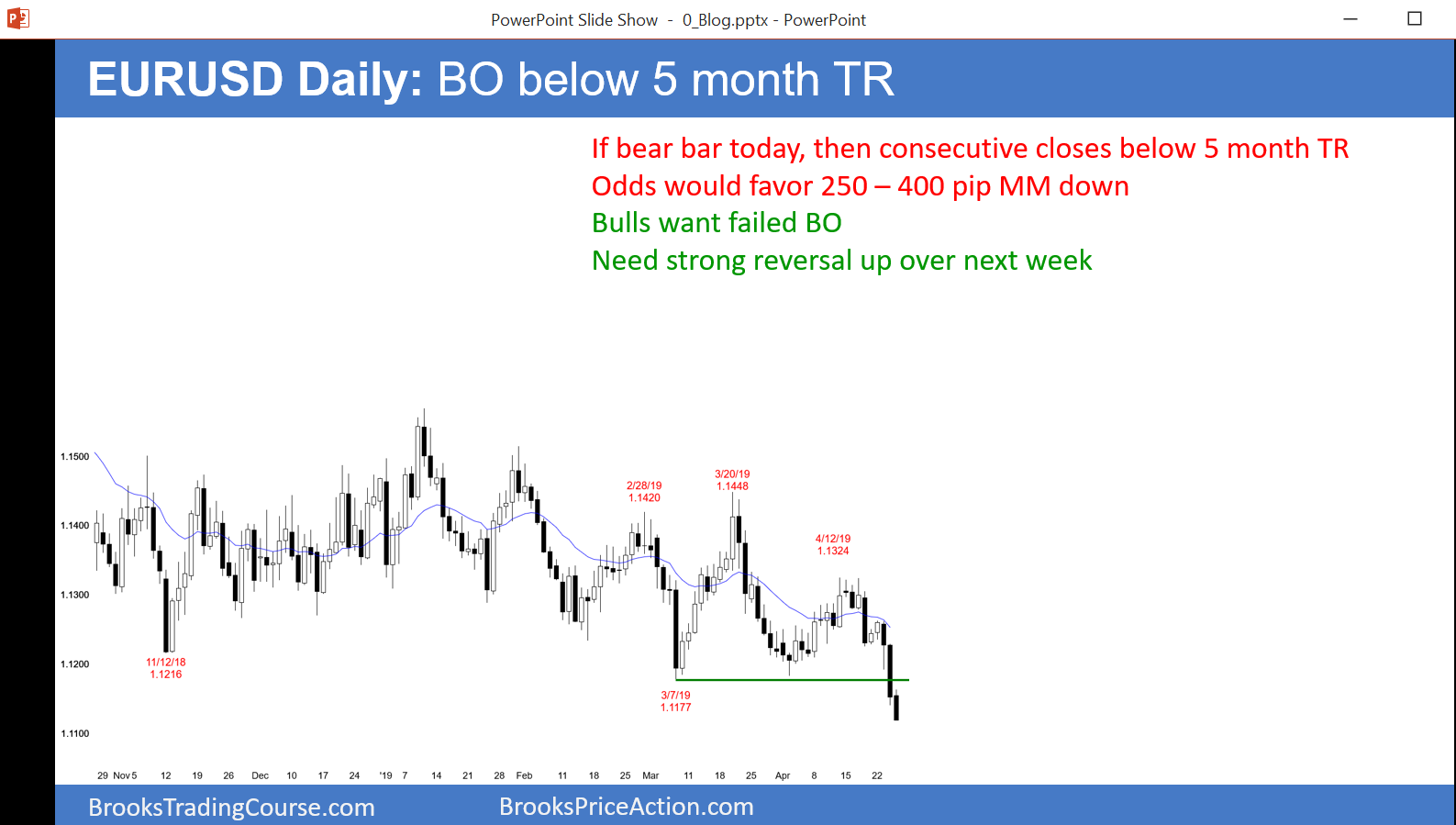

The EUR/USD daily Forex chart broke below the 5 month trading range yesterday. So far, today is a 2nd consecutive bear trend day. It today has a bear body on the daily chart, it will confirm the breakout.

That means the odds would favor a swing down to around measured move targets. The nearest one is 243 pips below the March 7 low of 1.1177. That low is the neck line of the February 28 and March 20 double top. The target would be 1.0944.

If the selloff continues below that target, the next one is based on the height of the 5 month trading range. Some computers will use the November 12 low and others will use the March 7 low. That means traders would look for about 350 pips below the March 7 low, or about 1.08.

Another reasonable target is based on the June and September double top. The neck line is the August 1.1301 low. The projection is 550 pips below that low, or around 1.0750.

What if the bulls get a strong bull trend reversal today? They would need several bull days to undo this bear breakout. The weekly chart has been in a bear channel for 10 months. It would take a rally above the January high to convert the channel into a trading range.

Overnight EUR/USD Trading

The EUR/USD 5 minute Forex chart sold off 40 pips overnight. However, the selloff lacked consecutive big bear trend bars. It therefore is not a strong bear trend. Bull day traders therefore will buy for scalps today. They would like a bull trend reversal day today to avoid a bear body. But, the small bars and prominent tails are a sign of a lack of energy. There is no sense that the price is terribly wrong. That reduces the chance of a big move up or down.

The bears will sell rallies. Their minimum goal is a bear body on the daily chart. The do not need the selloff to continue lower today. If the day closes around its current level, today would be a strong follow-through bar on the daily chart. That would increase the chance of lower prices over the next month or two.