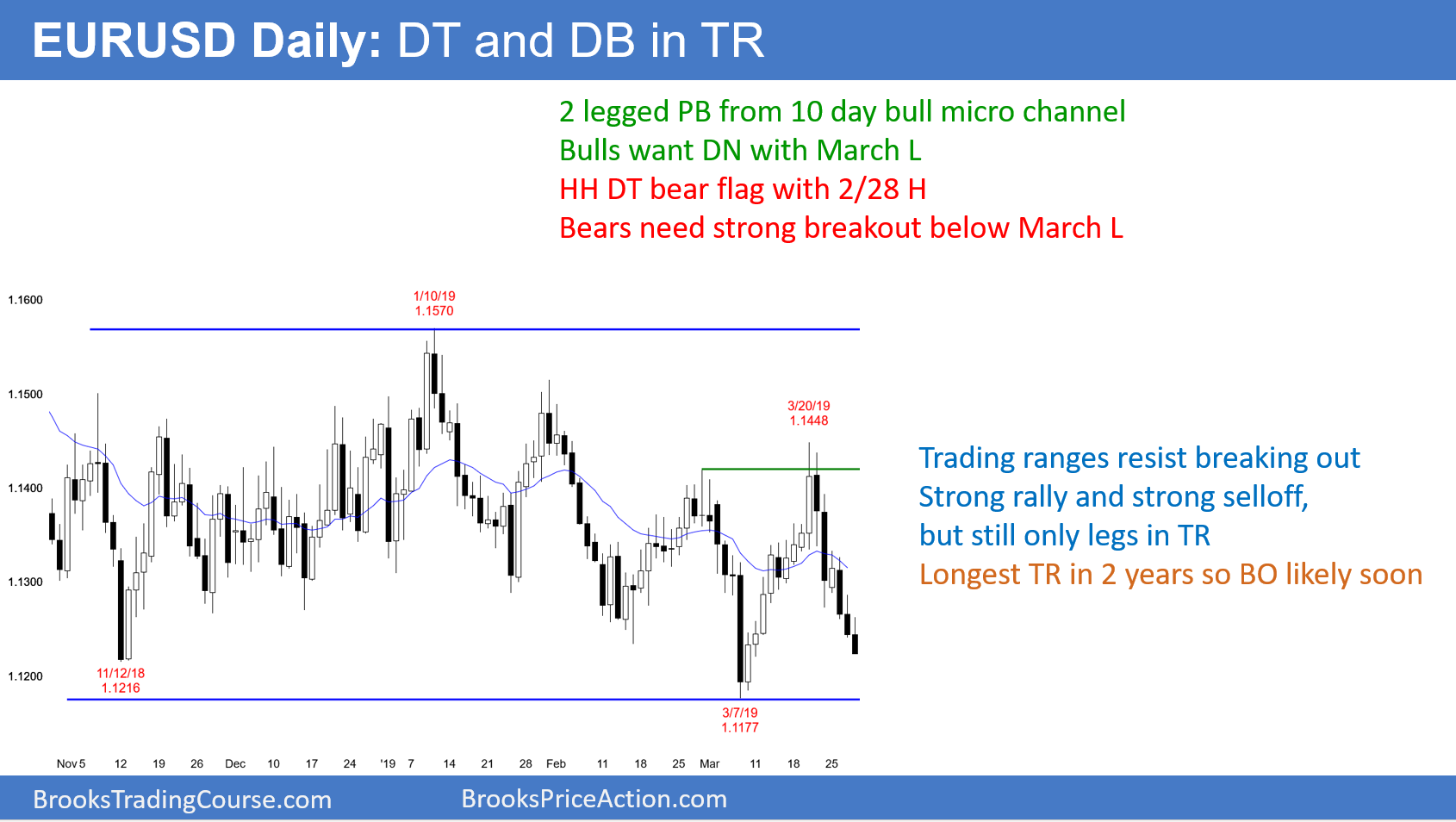

The EUR/USD daily Forex chart sold off again overnight. It is now in its seventh day of a bear micro channel after a 10-day bull micro channel. The volatility is increasing, and this increases the chance of a breakout soon.

While the momentum down over the past 6 days favors the bears, there have been many strong legs up and down. Therefore, the probability is only slightly higher for the bears. They need consecutive closes below the range or one close far below the range to convince traders that the 4 month trading range has ended and a bear trend has begun.

How Does A Double Top Work?

The EUR/USD had sold off strongly from its breakout above the February 28 high. There is a very important point about the strong rally to the March 20 high. It might be forming a possible double top with the February 28 high.

One of the reasons why a double top can lead to a strong bear trend is that there is often a very strong 2nd leg up. The March 20 rally was a 10-bar bull micro channel and it broke above the February 28 high. It qualifies as a strong rally. It therefore was likely to have a 2nd leg up after a pullback.

Because traders know that the probability favored a higher low this week, traders can find themselves trapped. For example, a bull who bought at any point during the 10-day rally theoretically has a stop below the March 7 low. Consequently, his risk is big and he is now trapped into a disappointing long trade. If the selloff drops below that low, he will sell out of his longs for a big loss.

Also, the bears know that a higher low has been likely. Many bears did not sell over the past 6 days. If the selloff breaks below that low, it would be an early sign of a possible strong bear trend. Those who are not short will be eager to sell.

Therefore, that strong rally will have trapped bulls into a bad long and trapped bears out of a good short. If there is a breakout, both will have an urgent need to sell. That heavy selling can lead to a fast and big move down. The first target is a 200 pip measured move, based on the height of the double top.

Overnight EUR/USD Trading

The EUR/USD 5-minute Forex chart has sold off 40 pips overnight. While the selling this week has not been strong, it has been relentless. Day traders therefore are only scalping for 10 – 20 pips.

Because the selloff is now near the bottom of the 4-month range, there is an increased chance of either a strong bear breakout or a strong reversal up. The Brexit news is becoming increasingly important, and an announcement can come very soon that will lead to a trend up or down.

It might come out sometime early Friday morning during the European session. Once it comes out, day traders will probably have many days with big swing trades. Until the intraday ranges increase, day traders will continue to scalp.