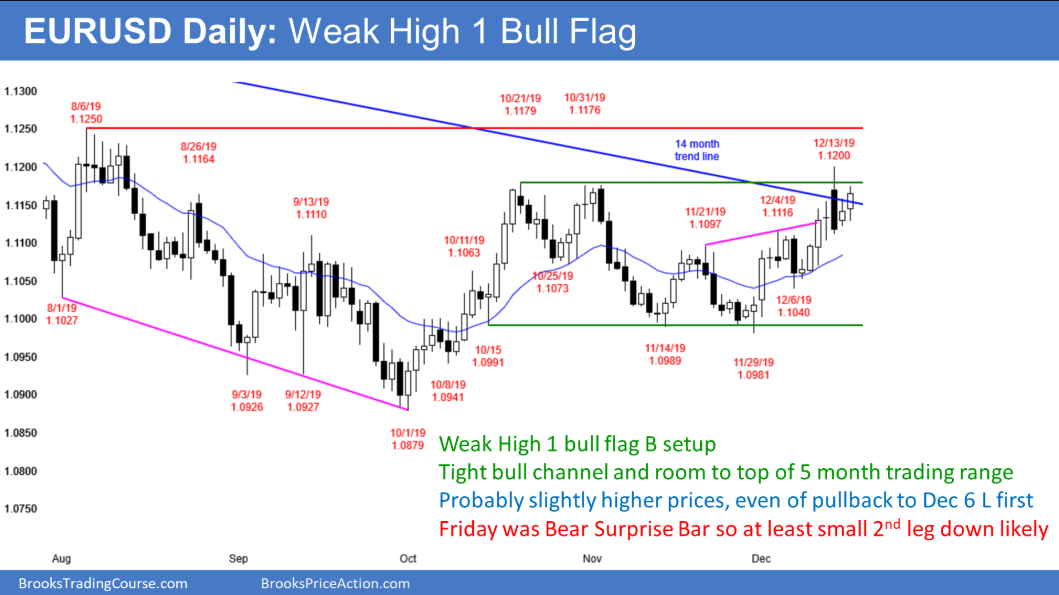

The daily chart of the EUR/USD Forex market reversed down on Friday after breaking above the October high and the bear trend line. Friday was a surprisingly big bear bar closing near its low. A Bear Surprise Bar typically has at least a small 2nd leg sideways to down.

Yesterday was a bull inside day in a 4-week rally. It was therefore a High 1 bull flag buy signal bar. By the EUR/USD today going above yesterday’s high, it triggered the buy signal. But yesterday was a doji inside bar. That is a lower probability buy setup. Friday’s Bear Surprise Bar further lowers the probability of an immediate resumption of the bull trend.

The 4-week rally is strong enough to continue up to the August high and possibly the June high. But the EUR/USD will probably have to go sideways to down for a few days before it will strongly break above Friday’s high.

Overnight EUR/USD Trading

The 5-minute chart of the EUR/USD Forex market rallied 45 pips overnight. By going above yesterday’s high, it triggered a buy signal on the daily chart. But remember, the buy setup on the daily chart is not strong. That reduces the chance of a big bull day today.

Since the 6-hour rally was in a tight bull channel, the odds are against a bear trend today. However, the reversal down from a small buy climax over the past hour means that the bulls have begun to take profits. They now will switch to buying pullbacks instead of at the market. In addition, they will be less willing to hold onto longs for swing trades. They will be scalping more.

The small reversal down is probably the start of a trading range. If so, the bears will finally begin to sell reversals down for scalps.