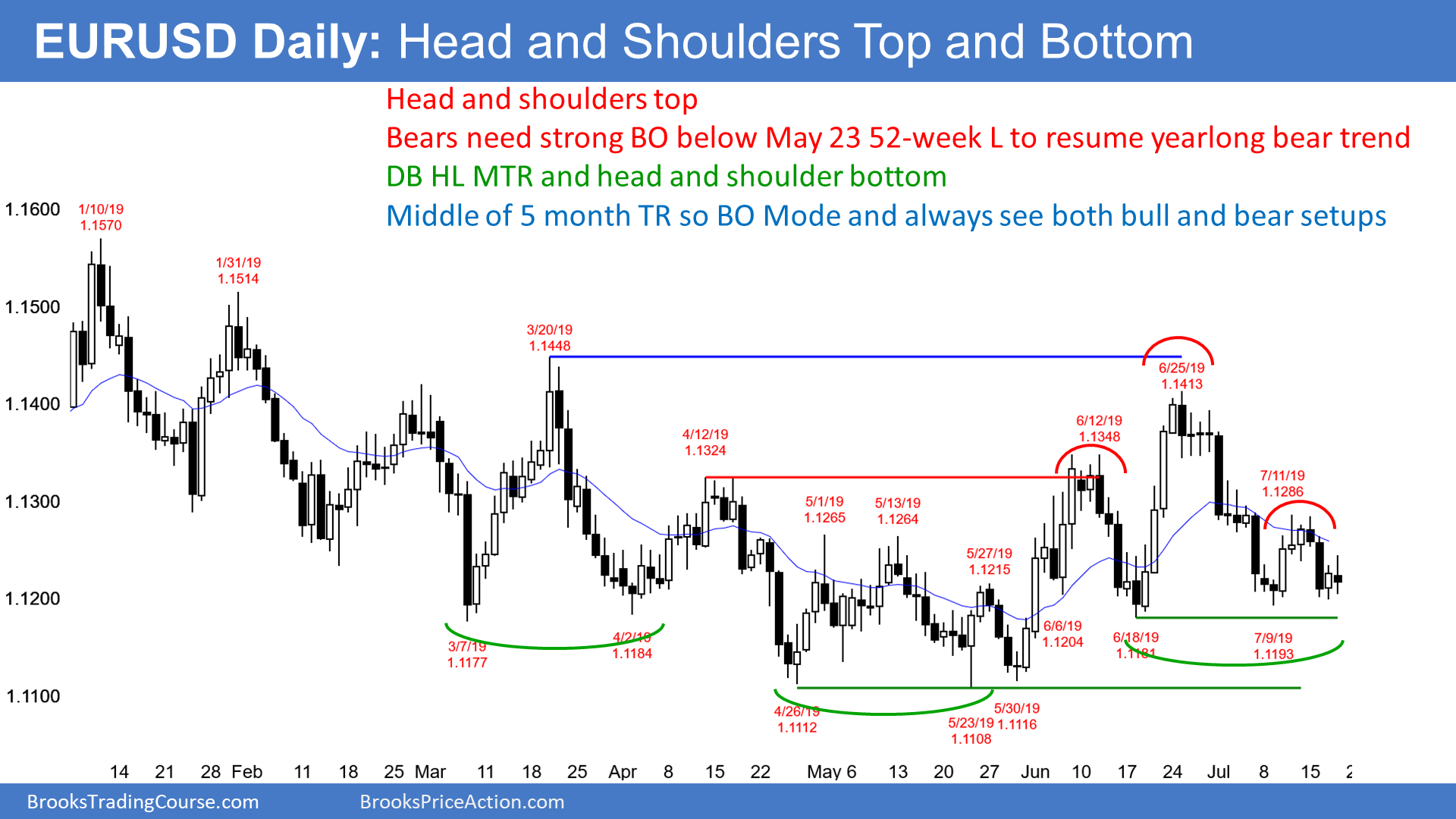

The EUR/USD daily chart has been in a trading range for 5 months. There is therefore always going to be both a reasonable buy and sell setup. The bears want a break below the May low and then a measured move down from a head and shoulders top. They hope that last week’s lower high is the first in a series of lower highs and a resumption of the yearlong bear channel.

The bulls have a double bottom and a higher low after a strong rally in June. This is a double bottom higher low major trend reversal. It is also the right shoulder of a bigger head and shoulders bottom. They need a break above the June high, which is the head.

It is important to note that every new low over the past year reversed up. Consequently, even if the bears get a break below the May low, it will probably fail and there will then be a rally lasting 2 – 3 weeks, like every other breakout in over a year.

The chart is still in a trading range and it continues to reverse every few weeks. There is no sign that this is changing.

Traders are deciding whether this week will go below last week’s low and become an outside down week. If it does and remains small, it will not be a sign of strong bears. More likely, next week would go sideways for a third week and form a small breakout mode pattern on the weekly chart.

Overnight EUR/USD Trading

The EUR/USD 5-minute chart reversed down from above yesterday’s high overnight. While yesterday was a buy signal bar on the daily chart, there is still room down to the neck line of the head and shoulders bottom. Consequently, traders are not convinced the bottom is in. In addition, the 2-day selloff was strong. Many bulls want a micro double bottom and a 2nd buy signal.

The 5-minute chart has been in a trading range for 2 days. But, last week’s low is a magnet below. With the strong momentum down on Tuesday, there is a 50% chance that today or tomorrow will trade below last week’s low.

However, since last week was small and this week so far is small, and the chart is at the bottom of a month-long trading range, there will probably be buyers below last week’s low. The odds are against a big move up or down today.