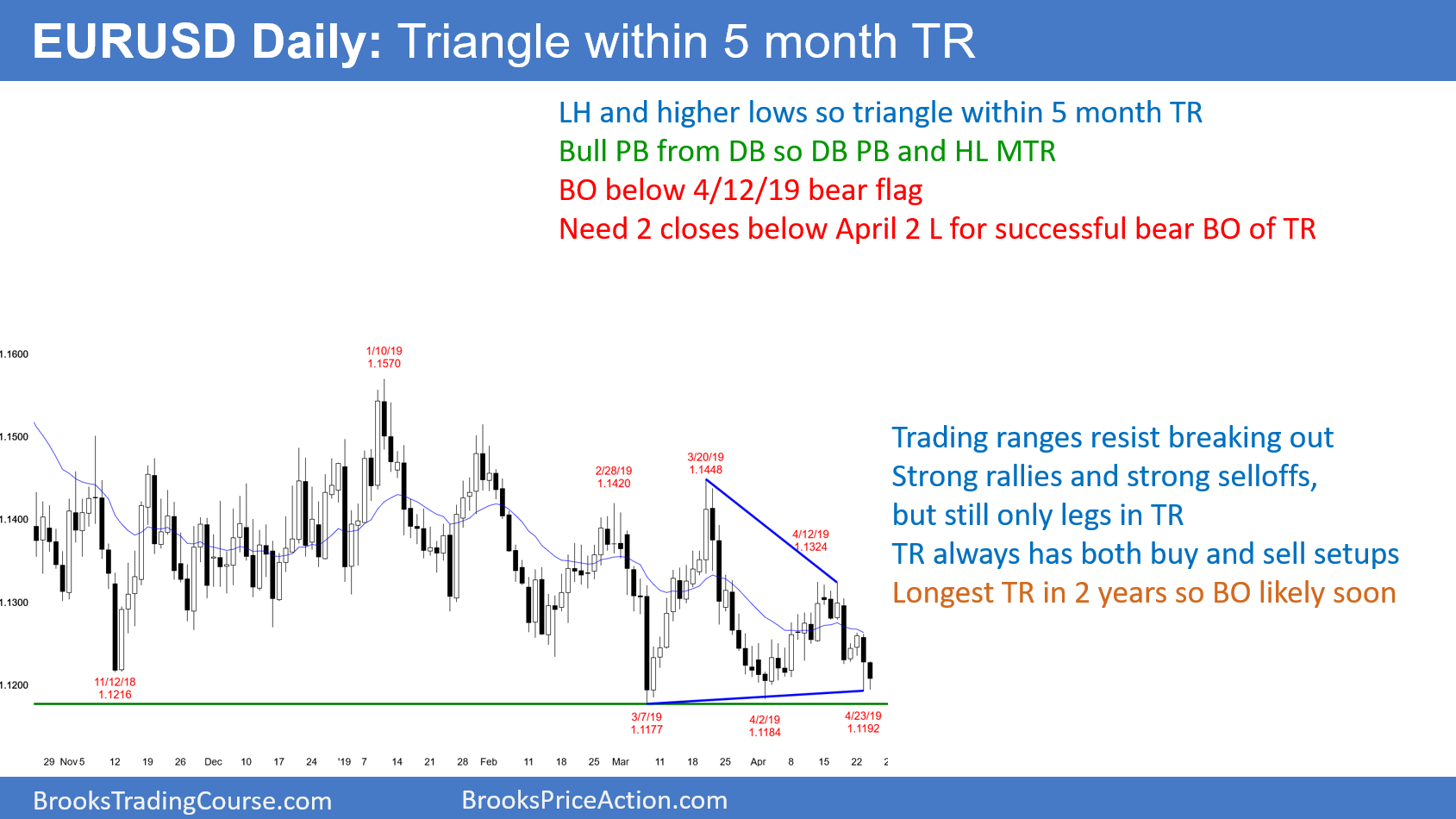

The EUR/USD daily chart has been in a trading range for 5 months and a triangle for 1 month. This is the longest trading range in 2 years and therefore the odds favor a breakout soon.

Trading ranges always look bearish when the market is near the bottom and bullish near the top. However, they could not continue if either side had a significant advantage. Consequently, traders will continue to bet on reversals until there is a clear breakout. They typically want to see consecutive closes above or below the range before they will switch to trend trading.

Overnight EUR/USD Trading

The EUR/USD 5-minute Forex chart has been in a 30-pip range overnight. In addition, it is within yesterday’s range. Because it is testing the low of the 5-month range, traders are prepared for either a reversal or a breakout. Either could lead to a big trend day.

More likely, today will continue to be quiet. The bulls will try to get the day to close above the open. It would then be a bull inside bar on the daily chart. In addition, it would form a micro double bottom with yesterday’s low. This would be a buy signal for a reversal up from the bottom of the 5-month range.

The bears always want the opposite. Not only do they want a bear day on the daily chart, they would prefer to get the day to close on its low. Today would then be a sell signal bar on the daily chart. This would increase their chance of breaking below the 5 month range tomorrow. They then would hope for a series of bear days over the next few weeks.

Because today so far is small, traders are probably looking at it as a potential buy or sell signal bar for tomorrow on the daily chart. The bulls will buy dips and try to get the day to close near the high. The bears will sell rallies and try to get the day to close near its low. While a breakout could come today, it is unlikely with the bars and range as small as they are.