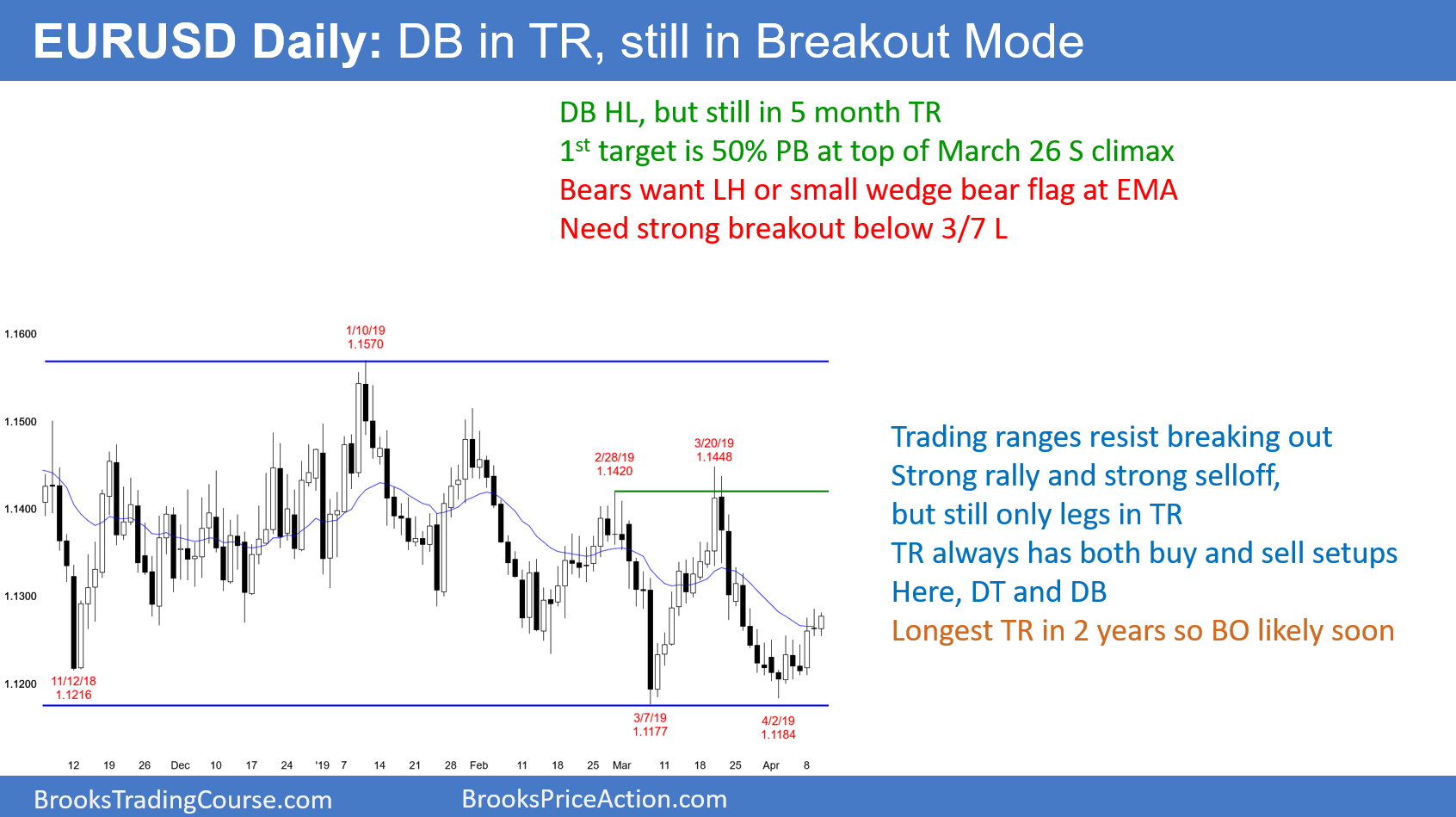

The EUR/USD daily Forex chart has rallied for 7 days from a higher low double bottom. The rally lacks consecutive big bull bars closing near their highs. It therefore is not strong. However, a reversal up from a spike and channel sell climax typically tests the top of the channel. That is the March 25 high, which is about 50 pips above today’s current high. This rally is so weak that it might test down first.

Yesterday was a doji bar at the EMA. Each of the past 5 days had tails on top. Day traders are selling rallies. This lack of conviction reduces the chance of the rally continuing much longer. Consequently, there will probably be a test back down within a few days. The 1st target for the bears is Monday’s buy climax low.

Overnight EUR/USD Trading

The EUR/USD 5-minute chart reversed down 10 minutes ago from above yesterday’s high. On the 240-minute chart, the 7 day rally is a wedge. That is a buy climax. Traders will therefore expect a couple legs down on the 240-minute chart starting within a few days. It could be starting today.

Yesterday was a doji day, which is a one day trading range. So far, today is a doji day as well. Furthermore, it reversed up from a perfect double bottom test of yesterday’s low and down from above yesterday’s high. That is a type of outside down day. If it closes near the low, the EUR/USD will probably test 1.12 over the next few days.

Because most of the trading over the past 2 weeks was mostly sideways in the US session, day traders expect to scalp up and down today. The selloff of the past 10 minutes will probably remain as the high of the day. day traders will sell rallies and look to buy reversals up from around yesterday’s low. But, the reversal down was strong enough so there is a slightly increased chance of a bear trend day.