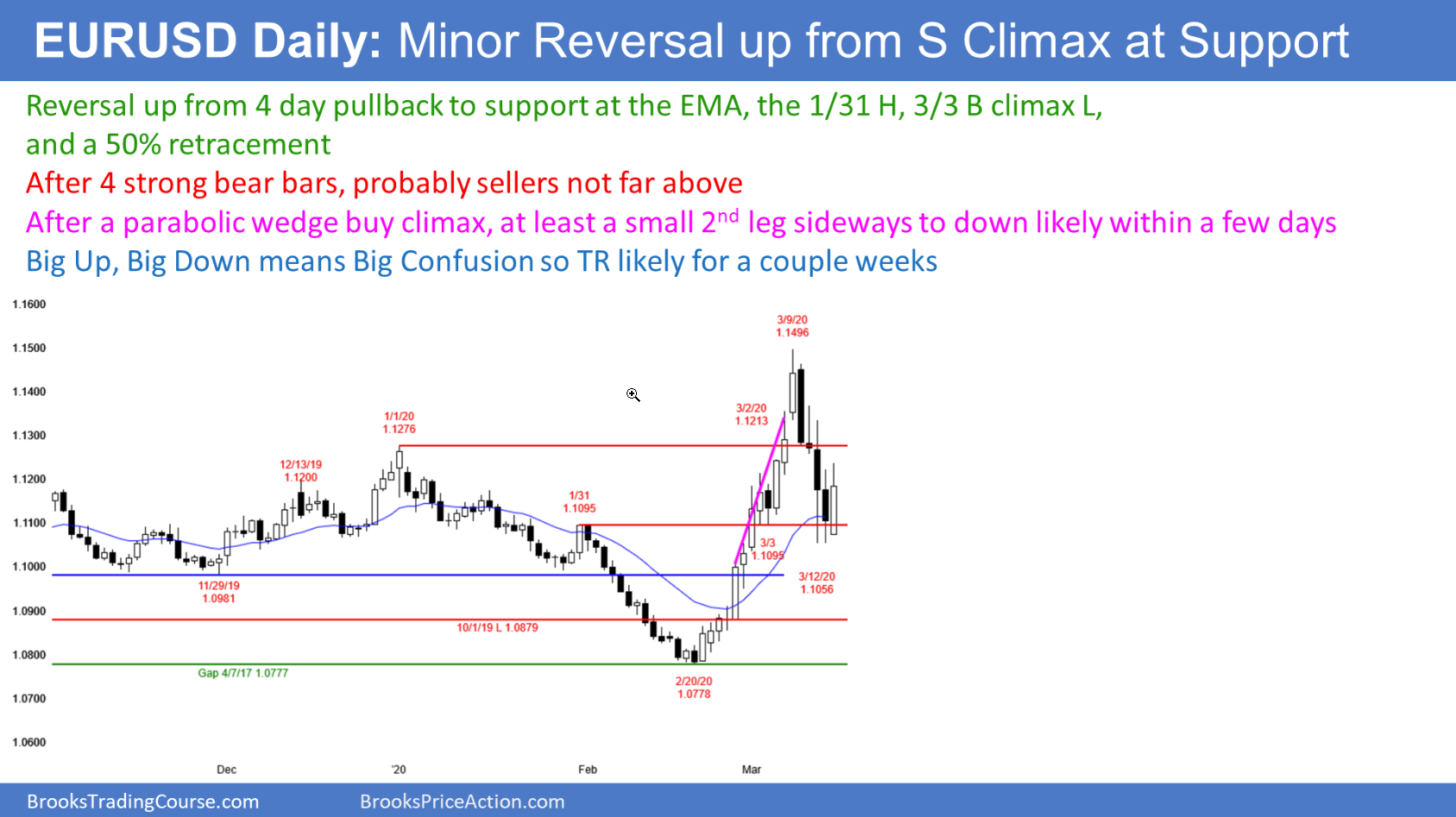

The daily chart of the EUR/USD Forex market had a big rally and then 4 big bear days. Big Up, Big Down creates Big Confusion. That typically results in a trading range.

I said last week at the top of the buy climax that there would a 50% pullback to the EMA, the January 31 breakout point, and the March 3 buy climax low. Last week’s selloff reached those targets and therefore the bears will take profits. The bulls expect a 2nd leg sideways to up after their strong 2 week rally, but they want to make sure the selling has ended. They will wait for a 2nd reversal up. The bears expect a 2nd leg down from their strong selloff. Therefore, traders should expect sellers not far above Friday’s high.

Overnight EUR/USD Trading

The 5-minute chart of the EUR/USD Forex market tested Friday’s low overnight and reversed up. It broke above Friday’s high and pulled back.

This is trading range price action. Traders are betting that the 4-day bear trend will not get too far and that it is too early for the 2-week bull trend to resume. They are expecting reversals and a buying selloffs and selling rallies.

The overnight reversal was probably strong enough to that the overnight low will hold. However, it was not strong enough to make a big break above Friday’s high likely.

Traders expect a limit order market on the daily chart (reversals instead of breakouts). That usually results in lots of reversals on the 5-minute chart. The legs up and down for scalpers to make 20 – 30 pip scalps. Unless there is a surprise breakout up or down today, day traders will continue to scalp.