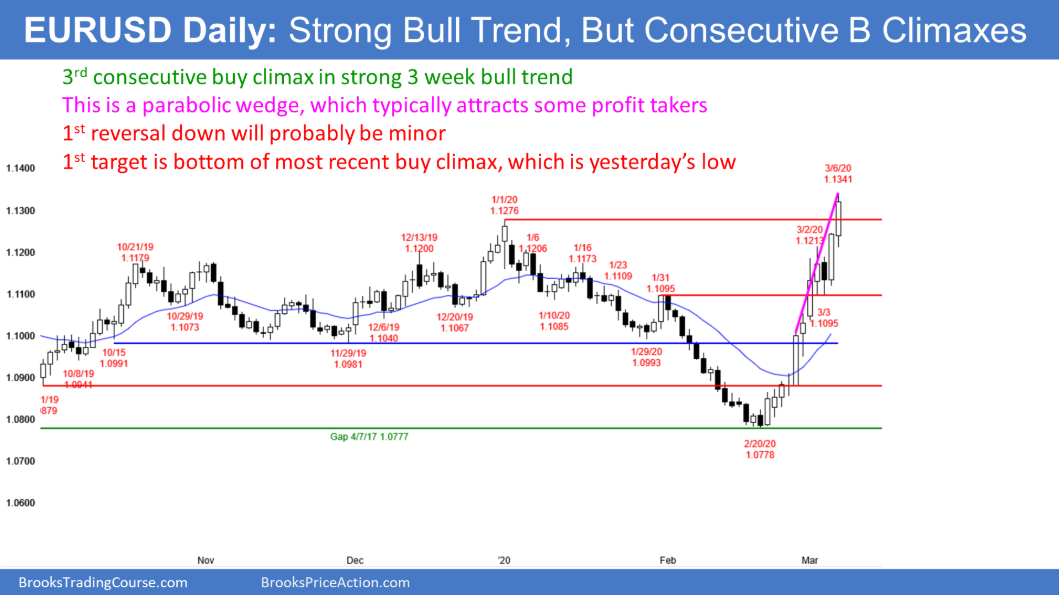

The daily chart of the EUR/USD Forex market has rallied strongly for 3 weeks. It is now in a bull trend. Traders will buy the selloff, even if it retraces half of the rally.

The rally has had 3 surges. That is a parabolic wedge buy climax. The stop for the bulls is now far below. That means the risk is big. Traders can reduce their risk by reducing their position size. A parabolic wedge buy climax typically attracts some profit takers. If the bulls take profits next week, the 1st target is the bottom of the most recent buy climax. That is yesterday’s low.

Can this trend continue up strongly like this next week? Probably not. There will probably be enough traders taking profits to create at least a small pullback within a few days.

Overnight EUR/USD Trading

The 5 minute chart of the EUR/USD Forex market rallied strongly again overnight. However, it has been in a 20-pip trading range for 3 hours. Also, the day’s range is about as big as the other 3 very big days in the 3 week rally. It therefore will probably not get much bigger. That reduces the chance of a big rally from here today. If there is a new high, the 3-hour trading range will probably be the Final Bull Flag. That means the rally will likely pull back into the trading range by the end of the day.

What about the bears today? They have not made money. When a bull trend is strong, it is better to only buy. In general, it is difficult to make money as a bear until there has been at least one 30 pip pullback. Most bears should wait. If there is a break above this 3 hour range and then a reversal down, the bears will sell for a Final Bull Flag reversal. But the odds of a big move down are small. Traders expect today to be mostly sideways for the remainder of the session.