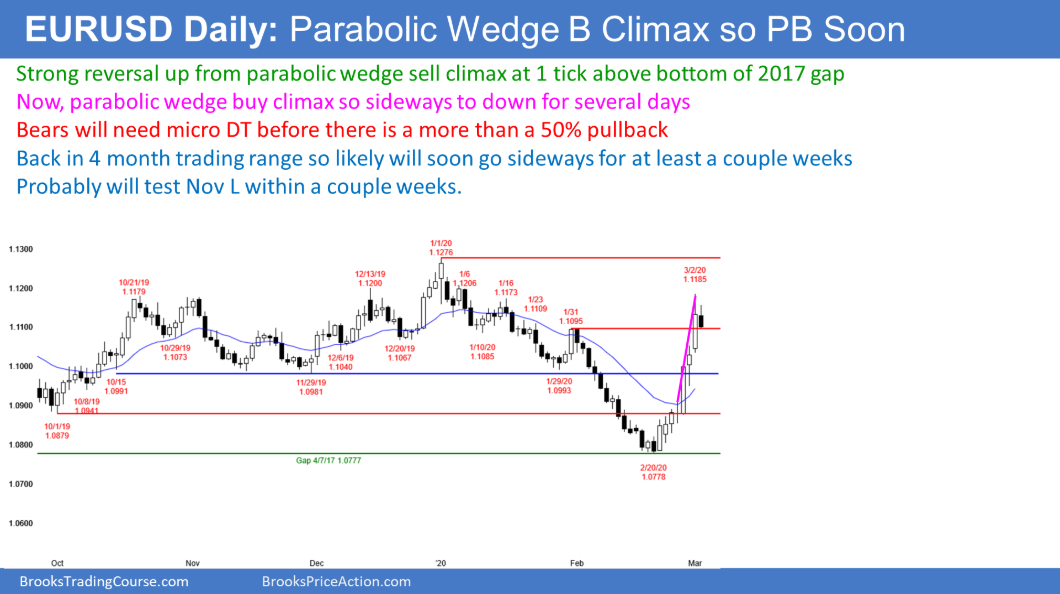

The daily chart of the EUR/USD had an exceptionally strong rally up from the 2017 gap. The rally has had 3 legs in a bull micro channel. This is a parabolic wedge buy climax, which typically attracts profit taking.

Traders should expect several days down to around the November low and a 50% pullback over the next week or so. However, the bears will probably need at least a micro double top before they have a reasonable chance of a test of the February low.

There may be one more brief push up before the profit taking begins. For example, if today’s high remains below yesterday’s high, which is likely, today will be a pullback. It would then be a High 1 bull flag buy signal bar for tomorrow. If it has a bear body, it would be a weak buy setup. There would probably be more sellers than buyers above its high. That reversal down would create a micro double top with yesterday’s high and could begin a 50% pullback.

Overnight EUR/USD Trading

The 5 minute chart of the EUR/USD Forex market drifted down in a bear trending trading range day so far today. The bulls would like a test of yesterday’s high. At a minimum, they want today to close above the open. Today would then have a bull body on the daily chart. That would make it a higher probability High 1 buy signal bar for tomorrow.

However, since yesterday might have begun some profit taking, there might not be much buying today. That reduces the chance of a strong bull day.

A strong rally typically needs a day or two of sideways trading before the bears can create a strong selloff. That therefore lowers the chance of a big bear day today.

A bear trending trading range means there was a trading range, a bear breakout, and another trading range. Most of the overnight trading was within trading ranges. That increases the chance of quiet trading today. Day traders are looking for reversals to scalp for 10 – 20 pips. A strong breakout up or down would be a surprise.