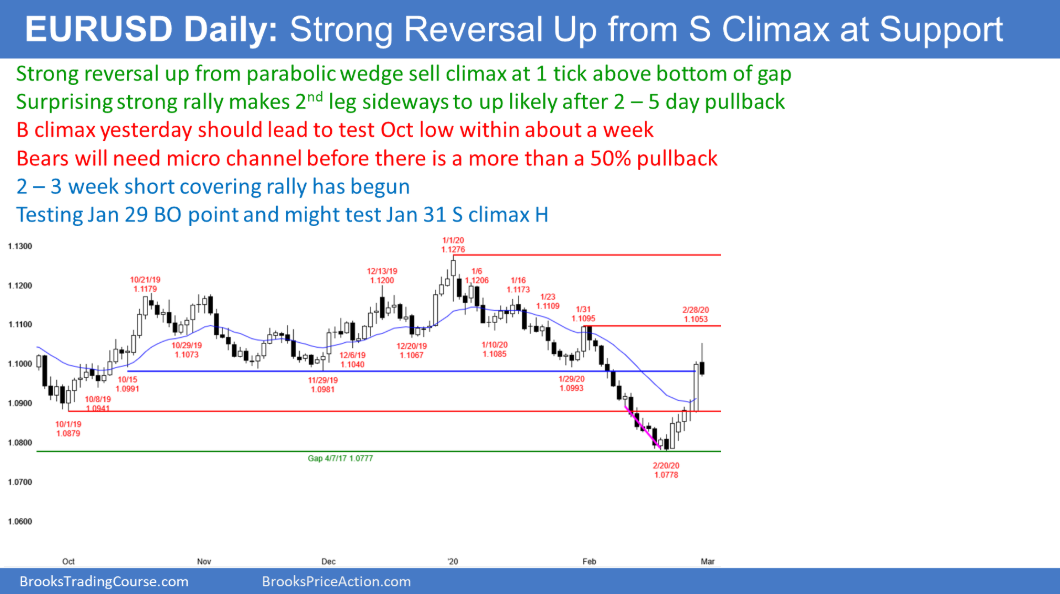

The daily chart of the EUR/USD Forex market had a bull Surprise Breakout yesterday. It is a buy climax and at the resistance of the bottom of the 2-month trading range.

The 6-day rally and yesterday were surprisingly strong. That typically means that traders will buy the 1st selloff. The bears usually will need at least a micro double top before they can get a new low.

There is obvious support below at the October low. It is almost exactly at yesterday’s low. Since yesterday was a buy climax, its low is a magnet. Also, that is around a 50% pullback. Traders should expect a test down to begin within a few days. There will then probably be a higher low and at least one more leg sideways to up.

Overnight EUR/USD Trading

The 5-minute chart rallied and then reversed down overnight. Today so far is a bear trend reversal day on the daily chart. It is at resistance and it comes after a buy climax. Traders should expect sideways to down trading for a few days.

The 80 pip overnight selloff has been in a tight bear channel. Day traders have only been selling.

However the momentum slowed over the past 2 hours. Also, the bears have already achieved their goal of creating a reversal day. Consequently they have less need to sell.

The day will probably start to go sideways around the open and yesterday’s close. The bears want the day to close near its low so that there will be a strong sell signal bar on the daily chart.

The bulls want the day to close above the open. Today would still be a sell signal bar on the daily chart, but it would be weaker. That would increase the chance of sideways trading early next week instead of having a test down beginning on Monday.