Investing.com’s stocks of the week

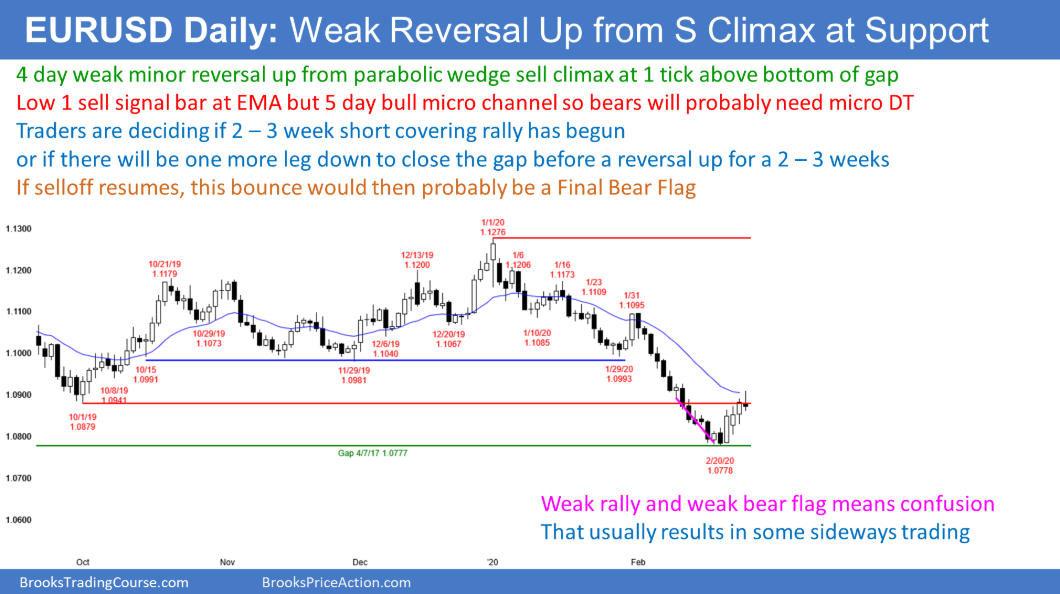

The daily chart of the EUR/USD market has rallied for 5 days after almost closing the gap from 2017. The rally had 3 small bull bars and it is stalling at the EMA and the October low resistance.

But 5 days without a pullback is a 5-day micro channel. The bears typically need at least a micro double top before they can resume the bear trend. Therefore, the EUR/USD will probably go sideways for at least a couple more days before the bears will be able to close that gap.

Traders expect a 2 – 3 week short covering rally after a climactic reversal down to major support. This rally so far is disappointing.

With the bear flag and the rally both being weak, there is confusion. That is a hallmark of a trading range. Consequently, the EUR/USD will probably be mostly sideways for at least a couple more days.

At that point, traders will have more information. They are deciding if the 150 – 200 pip short covering rally has begun.

The alternative is that this rally will be a bear flag. If so, a bear flag late in a bear trend is usually the Final Bear Flag before there is a bigger reversal up. In either case, traders expect at least a few weeks of sideways up trading now or soon.

Overnight EUR/USD Forex Trading

The 5-minute chart of the EUR/USD Forex market broke above the October low yesterday and above the 20 day EMA today. I have been saying that both were likely targets.

However, the EUR/USD reversed down from this resistance over the past couple hours. The bears will try to get today to close on its low and below the October low. If they are successful, today would be a reasonable sell signal bar on the daily chart.

But as I wrote above, the context is bad. The EUR/USD will probably be sideways for the rest of the week. This is true whether the bears create a sell signal bar today or if the bulls get a 4th consecutive bull bar on the daily chart.

Because 3 consecutive bull bars in a weak rally is excessive, the bears will probably be able to create a bear bar today. That means day traders should find it easier to make money selling rallies than buying selloffs.

But since the EUR/USD is exhausted, the 4-day rally will probably evolve into a trading range for a few days. Therefore day traders expect reversals and small moves up and down, even if today closes below the October low and around the low of the day.