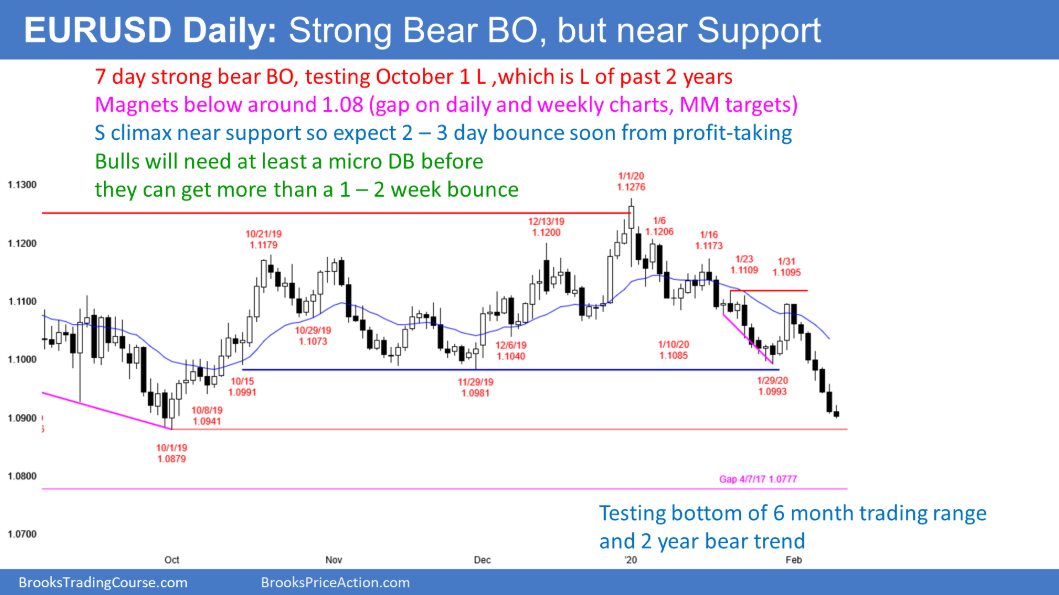

The daily chart of the EUR/USD market has been in a strong bear breakout for 7 days. It is just above the October low. That is the bottom of the 6-month trading range and of the 2-year bear trend.

The selling has been extreme and is it therefore climactic. Also, the EUR/USD is near support. That typically will attract some profit-taking. Consequently, there will probably be a 2 – 3 day bounce starting this week.

However, when a selloff is surprisingly strong like this, there is usually at least a small 2nd leg sideways to down. Therefore the 1st reversal up will likely not last more than a week or two. Traders will want to see at least a micro double bottom before they look for a 2 – 4 week reversal up.

It is important to remember what I have been saying for many months. There is a gap on the daily and weekly charts above the April 7, 2017 high of 1.0777. Since most gaps fill, this 2-year bear trend might not end until it closes that gap.

There is one other important point. Whether or not the sell continues down to below 1.08, every new low for 2 years reversed up for a few weeks within a couple weeks after making a new low. Therefore the October low is important support.

Overnight EUR/USD Trading

The 5-minute chart of the EUR/USD Forex market broke below 1.09 over the past hour. It is within 20 pips of the October low, which is support. Since the daily chart is in a sell climax that is now extreme, there will probably be a 2 – 3 day 100 pip bounce starting this week.

Day traders will start to look for a reversal up on the 5-minute and 60-minute charts to trade that bounce. Also, because the EUR/USD is overdone and near support, the bears will probably begin to take profits this week.

Can today break strongly below the October low and be another big bear trend day? Yes, but sideways to up is more likely. If it does, the bears will probably begin to take profits tomorrow.