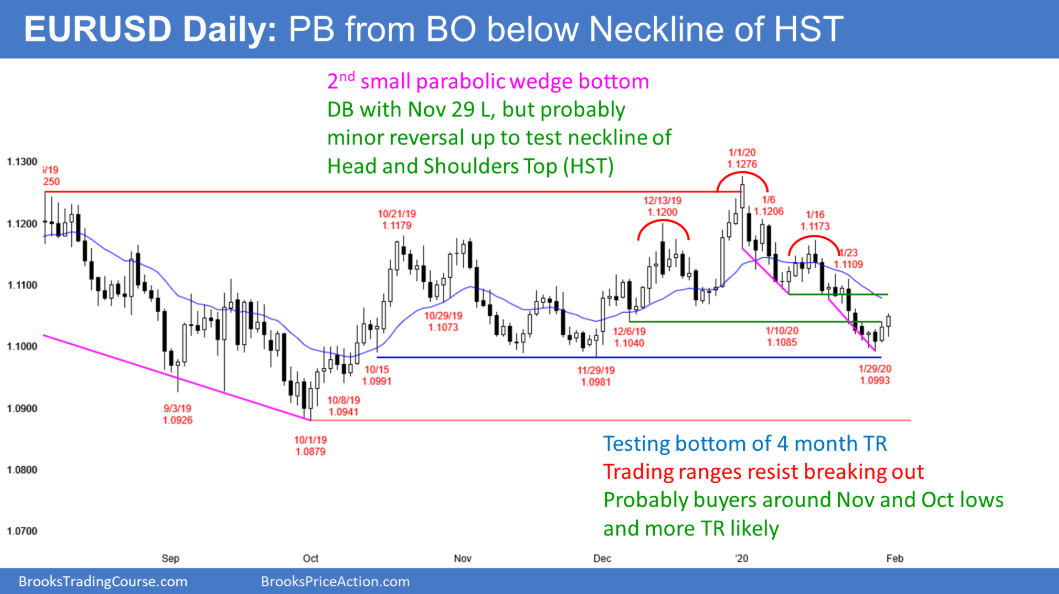

The daily chart of the EUR/USD Forex market is reversing up from the bottom of a 4-month trading range. There are consecutive parabolic wedge bottoms. That increases the chance of a reversal up soon.

However, the bear channel is tight. A tight bear channel typically needs at least a micro double bottom before a bull leg can begin. Consequently, this reversal will probably be minor.

It is a test of the neckline of the head and shoulders top. That means it is testing the lows that the selloff broke below. The most important is the January 10 low of 1.1085. Traders should expect the rally to end around 1.11 next week and for the bears to then get a test of this week’s lows. They see that every strong rally and selloff for 20 months reverse after a few weeks and are confident that this selloff will do the same.

Overnight EUR/USD Trading

The 5-minute chart of the EUR/USD market has rallied overnight. The 1.11 area around the January 10 low is a magnet above.

Can the EUR/USD reach it today? Probably not. This is because the bull trend over the past couple hours has only covered about 30 pips and most of the bars are small. That is not how a strong bull trend typically looks.

This price action increases the chance that the 5-minute chart will convert into a trading range today. But since there is a magnet above and the chart has rallied for 2 days, the odds favor sideways to higher prices.

At some point today, the bulls will probably stop buying at the market and switch to buying 20-pip pullbacks. If that happens, the bears will begin to look for scalps. Until then, it is better to only buy.