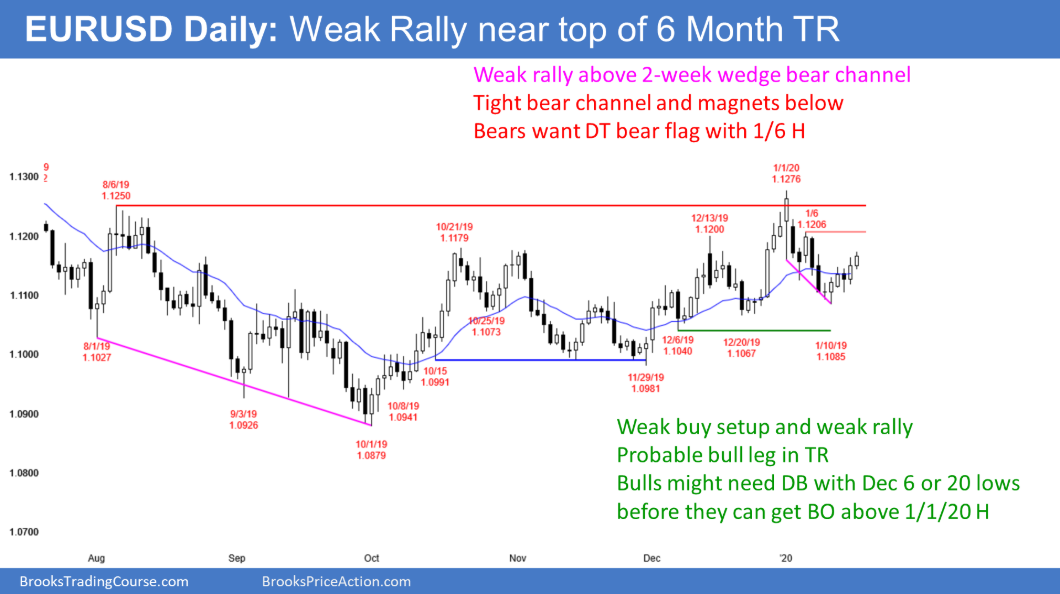

The daily chart of the EUR/USD Forex market has been rallying over the past week after a small weak wedge bull flag. Unless the rally accelerates soon, it will probably form a double top bear flag with the January 6 lower high.

If it turns down there, traders will see the rally as the right shoulder of a head and shoulders top. The left shoulder would be the December 13 high. The bears would then want a break below the December 20 low. That is the neck line. A measured move down would break below the November low.

While the bulls have been in control for 4 months, the rally is still only a leg in a 6 month trading range. They need consecutive closes above the January high before traders will conclude that a bull trend is underway on the daily chart.

Since trading ranges resist breaking out, it is more likely that this week’s rally is just a small leg near the top of the 6 month range. Traders expect it to fail around the January 6 or the January 1 high. They then expect a 2 – 3 week leg down. All legs up and down for almost 2 years have lasted only a few weeks.

Overnight EUR/USD Trading

The 5 minute chart of the EUR/USD Forex market broke above yesterday’s high overnight. However, it reversed down over the past hour.

Traders have been buying below the low of the prior day and selling above the high of the prior day for 2 weeks. This is a limit order market and a sign of trading range price action. It reduces the chance of a big trend day. Day traders will continue to scalp reversals on the 5-minute chart until there is a sustained breakout up or down. With the overnight bars being small and the overnight range being small, the odds are that today will be another trading range day.