Forex News and Events

Is USD correction almost over?

In its last statement the Federal Reserves reiterated its confidence in the US economy, adding that the recent slowdown was due to temporary factor. According to recent data, it would appear that those temporary factors may last longer than expected. April ADP private payroll report released yesterday indicates that private-sector companies added only 169k jobs last month (consensus 200k). In addition, the report reinforces concerns about US manufacturing industry - the sector erased 10k jobs – after the slump in industrial production in March (-0.6%m/m verse 0.1% expected).

The mix of encouraging economic improvements in Europe and disappointing US data has forced investors to reassess the level of EUR/USD. The euro is up more than 8% since its low of March 13th. Back in June 2014, a euro was worth 1.3990 dollar, the following months the single currency lost 25% as the Fed has ended QE and traders started to price in the next rate hike betting that the US economy will continue to expand at the same pace. It didn’t happen.

On the long-term we are still dollar bulls and we expect the US economy to accelerate significantly in Q3, pushing the greenback higher. However, US data will be closely monitored in the coming weeks and traders will be eager to buy dollar as soon as a good news will be released. We believe that EUR/USD correction is coming to an end and that the euro will need a real bad news from the US to break the strong 1.1450/1.1550 resistance area. If the single currency loses momentum, a support lies at 1.1050 (previous resistance, now support), the closest resistance lies at 1.1376.

Norges Bank to maintain its deposit rate? (by Yann Quelenn)

Today, the Norwegian Central Bank will announce its decision on sight deposit rate. At the last march Meeting, against all odds, Norges Bank decided to keep its rate at 1.25%. Last inflation figures increased in March mainly due to NOK depreciation but the Norway growth rate outlook has been corrected downwards because of the slowdown of the petroleum industry, very important in the country. Governor Olsen declared that if overall negative forecasts turn out to be in line with economic developments in the next couple of months, we could expect a deposit rate cut by May or June.

Although balanced. We anticipate that the Norges Bank will wait for before cutting its rate in order to get more Q1 data as the very important GDP figures. If the overall economy continues to weaken, this will make almost certain a rate cut at June’s meeting. However, the recent upsurge in oil prices will clearly be welcomed by policy makers. USDNOK is now trading between 7.4017 and 7.4460 with a clear downside trend since March. A resistance at 7.5189 may be on the target after the release.

Mexico CPI (by Peter Rosenstreich)

Traders will watching Mexico inflation data for further weakness. Markets are anticipating CPI to remain unchanged at 3.1% y/y, however we suspect that a softer 3.05% is more in line with the current disinflationary environment. Low oil prices, lack of energy investments and decelerating US economy has taken in their toll on Mexican inflation pressures. The Bank of Mexico recent decision to keep rates at 3.00% was balanced in our view. The dovish central bank clearly will be watching developments in MXN and confusion signals from the Fed with caution. The potential for Fed interest rates hikes to trigger a capital stamped out of MXN remains a critical concern. However, in Latam region where inflation expectations are running high (specifically BRL), the dovish Mexican central is an anomaly and MXN should underperform again regional peers.

Challenging Resistance

The Risk Today

Peter Rosenstreich

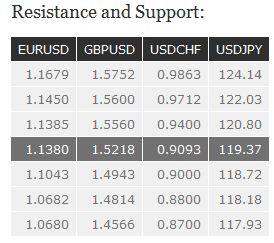

EUR/USD is bouncing close to the strong resistance at 1.1376 (26/02/2015 high). Hourly support can be found at 1.1334 (intraday low) and 1.1207 (06/05/2015 low). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high). In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support).

GBP/USD is showing limited short-term buying interest after break of declining trendline resistance at 1.5175. Hourly resistances can be found at 1.5262 (27/04/2015). Key support lies at 1.5100 (27/04/2015 low) and 1.5028 (24/04/2015 low). In the longer-term, the break of the strong support at 1.4814 opens the way for further medium-term weakness towards the strong support at 1.4231 (20/05/2010 low). Key resistance stands at 1.5552 (26/02/2015 high).

USD/JPY remains weak as long as prices remain below the key resistance at 120.10/20 (declining trendline). Hourly support stands at 119.20 (29/04/2015 high and intraday low) then 118.53. Another resistance is given by the recent high at 120.50 then 120.84 (13/04/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is favored. A key support can be found at 118.18 (16/02/2015 low), whereas a key resistance stands at 121.85 (see also the long-term declining channel).

USD/CHF remains under the selling pressure after breaking key support area defined by 0.9170 (30/01/2015 base) confirming an underlying downtrend. Next support can be located at 0.8986 (28/01/2015 low). Hourly resistances can be found at 0.9178 (intraday high) then 0.9413 (30/04/2015 high) and 0.9493 (27/04/2015 low). In the longer-term, the bullish momentum in USD/CHF has resumed after the decline linked to the removal of the EUR/CHF floor. A test of the strong resistance at 1.0240 is likely. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).